- Canada

- /

- Energy Services

- /

- TSX:PHX

PHX Energy (TSX:PHX) Margin Drops to 7.6% as One-Off Gain Distorts Profit Outlook

Reviewed by Simply Wall St

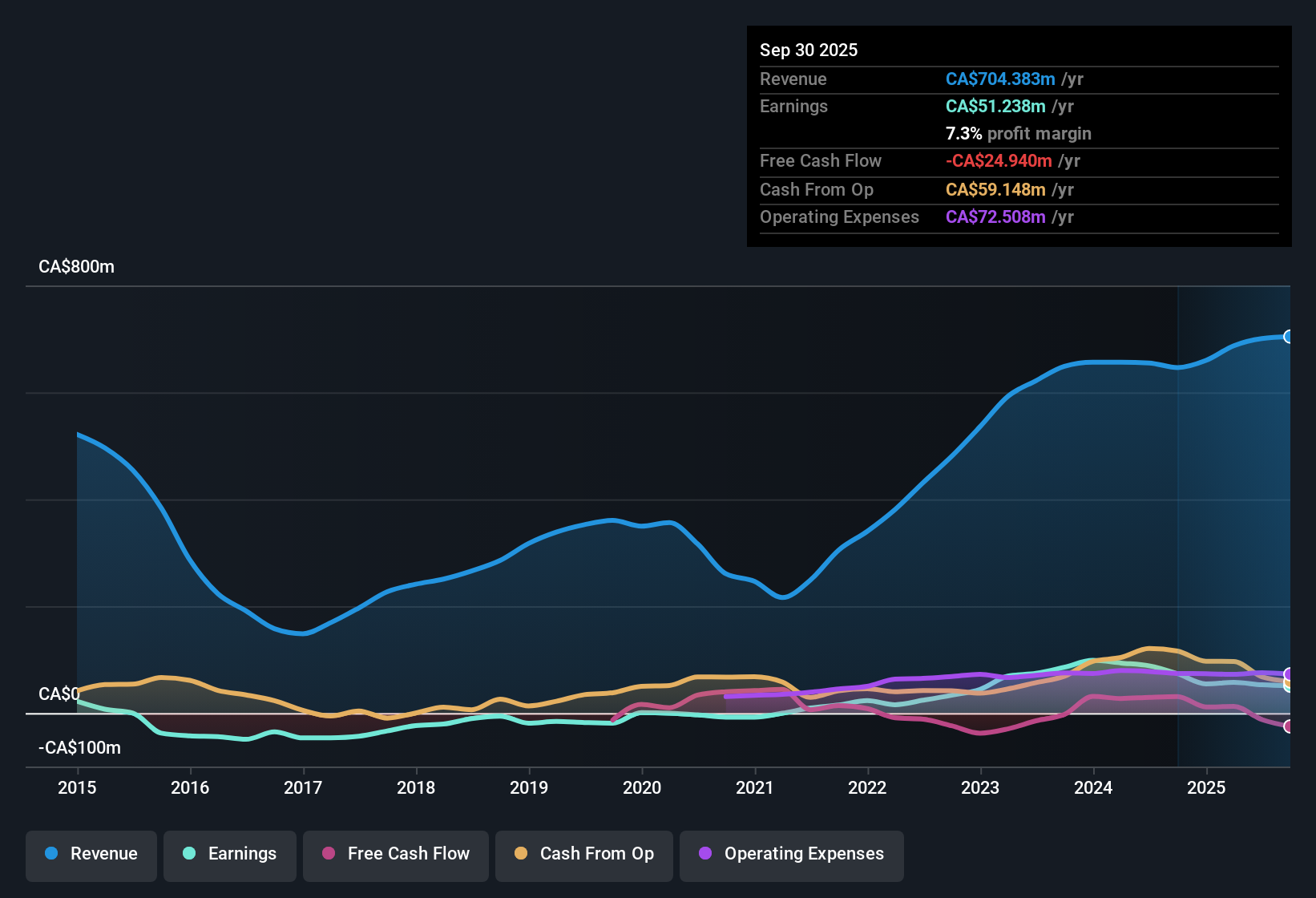

PHX Energy Services (TSX:PHX) reported a net profit margin of 7.6%, down from last year’s 13.5%. A notable one-off gain of CA$25.9 million shaped this period’s results. Revenues are projected to grow at 2.3% per year, which is slower than the Canadian market average of 5.1%. However, earnings are set to rise at an impressive 30.8% annually, far outpacing the market’s 12.1% forecast. In a market where value and growth rarely align, PHX’s combination of strong expected earnings growth and below-industry valuation multiples stands out. Nevertheless, margin pressure and one-time gains remain in focus for investors.

See our full analysis for PHX Energy Services.The real test is how these numbers stack up against the prevailing market narratives. Some perspectives will be confirmed, while others might need a rethink.

Curious how numbers become stories that shape markets? Explore Community Narratives

One-Off Gain of CA$25.9 Million Distorts Underlying Profitability

- PHX Energy Services booked a sizeable one-time gain of CA$25.9 million in its latest period, a non-recurring item that inflates net income and masks the true operational profit margin.

- Profit quality discussion highlights how headline profit margin looks better due to this boost:

- net margin stands at 7.6% compared to the prior year’s 13.5%,

- and critics note that recurring profitability trends are less favorable without the one-off gain. Investors should be cautious about assuming this level of earnings can be repeated.

P/E Ratio at 6.1x Signals Deep Discount to Peers

- PHX trades at a price-to-earnings multiple of just 6.1x, well below both the industry average of 14.8x and the peer group’s 13.8x. This suggests the market is assigning a lower value to its future earnings stream.

- The valuation disconnect attracts attention because:

- projected annual earnings growth of 30.8% is notably stronger than the Canadian market’s 12.1% average,

- and prevailing analysis contends that the low valuation may not be justified given PHX’s strong earnings outlook, unless ongoing margin pressure or low revenue growth affect future results.

Five-Year Turnaround: 41.4% Average Annual Earnings Growth

- Since returning to profitability, PHX has delivered an average annual earnings growth rate of 41.4% over the past five years, reflecting substantial improvement in the bottom line despite recent margin headwinds.

- This turnaround is noteworthy since:

- value-focused investors highlight the company’s below-peer multiples as a potential opportunity,

- while the latest margin erosion and the impact of non-recurring gains temper enthusiasm for projecting past growth forward without considering underlying volatility.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on PHX Energy Services's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

PHX’s recent results reveal that while earnings growth is robust, margin pressures and reliance on one-off gains raise questions about the consistency of future profits.

If stable, recurring profitability matters most to you, check out stable growth stocks screener (2074 results) for companies with a proven track record of steady performance across ups and downs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:PHX

PHX Energy Services

Provides horizontal and directional drilling services, rents performance drilling motors, and sells motor equipment and parts to oil and natural gas exploration and development companies in Canada, the United States, Albania, the Middle East regions, and internationally.

Very undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives