- Canada

- /

- Energy Services

- /

- TSX:PD

Precision Drilling (TSX:PD) Net Margin Falls to 5.7%, Testing Bullish Valuation Narratives

Reviewed by Simply Wall St

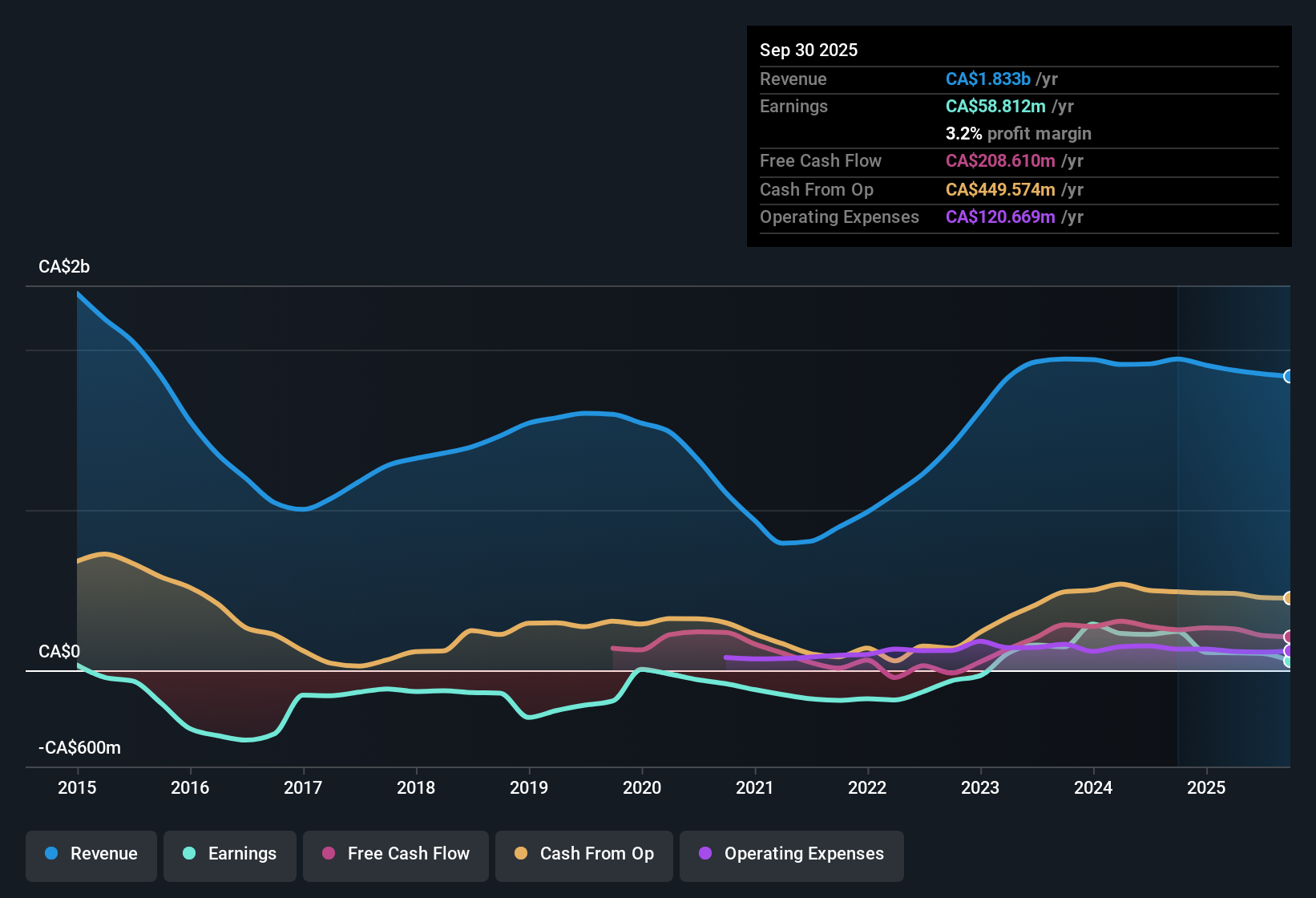

Precision Drilling (TSX:PD) reported earnings that continue to trend upward, with profits growing at an impressive 60.6% annual rate over the past five years and a current annual earnings growth forecast of 13.1%. Both are comfortably ahead of Canadian market averages. While profit margins dipped to 5.7% from last year's 11.7%, the stock trades at a compelling 10.4x P/E, lower than both industry and peer benchmarks. For investors, attractive relative valuation and positive growth forecasts may help offset the recent margin pressure.

See our full analysis for Precision Drilling.Next, we will see how these results compare with the key narratives investors use to make sense of Precision Drilling, setting up where consensus stands and where the numbers might tell a different story.

See what the community is saying about Precision Drilling

Margin Outlook Hinges on Technology Upgrades

- Analysts expect profit margins to improve from 5.7% today to 7.3% over the next three years, reflecting anticipated benefits from ongoing investments in automation, digitalization, and emissions-reducing rigs.

- According to the analysts' consensus view, investments in Alpha automation and EverGreen emissions solutions are seen as crucial for driving margin expansion and differentiating Precision Drilling as demand for high-spec rigs rises.

- Consensus narrative notes that recent and expected customer demand for upgraded rigs supports the path to higher day rates and improved earnings stability.

- Still, achieving the forecasted margin expansion depends on successful contract coverage and the adoption of newer technologies, as underscored in the analyst commentary.

Consensus sees margin growth as the key battleground. Will tech upgrades and rig demand outpace ongoing cost pressures? 📊 Read the full Precision Drilling Consensus Narrative.

Debt Reduction and Share Buybacks Drive Flexibility

- Management targets a leverage ratio under 1x by 2027, down from a $644 million debt load at an average 6.9% interest cost, while analysts expect shares outstanding to fall 5.53% annually as buybacks accelerate.

- In analysts' consensus view, these moves toward lower debt and reduced share count are designed to increase future capital returns and earnings per share.

- Reaching the leverage goal could improve Precision Drilling's flexibility to return value, such as through dividends or more aggressive share repurchases.

- However, rising interest expense and substantial capital needs for rig upgrades mean that freeing up capital may be gradual rather than immediate, tempering short-term upside.

Discounted Valuation Versus Analyst Target

- With a share price of $82.26 and a P/E ratio of 10.4x, Precision Drilling trades at a notable discount to the analyst target of $101.71, while also sitting below peer and industry P/E averages.

- Per the analysts' consensus narrative, the current valuation is supported by earnings quality and ongoing profit growth, but future upside relies on delivering to ambitious earnings and margin forecasts.

- Analysts note there is significant disagreement, with the lowest estimates for 2028 earnings less robust, suggesting that the discount offers opportunity if Precision meets expectations, but also risk if growth falls short.

- Ultimately, the share price gap could narrow only if projected margin and earnings growth materialize alongside continued balance sheet progress.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Precision Drilling on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Spot something unique in the data? It takes just minutes to build and share your perspective. Do it your way

A great starting point for your Precision Drilling research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

Despite positive earnings momentum, Precision Drilling’s high debt, rising interest costs, and large capital needs could limit financial flexibility in the near term.

If you would rather prioritize financial strength, check out solid balance sheet and fundamentals stocks screener (1984 results) for companies with stronger balance sheets built to weather uncertainty.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:PD

Precision Drilling

A drilling company, provides onshore drilling, completion, and production services to exploration and production companies in the oil and natural gas and geothermal industries in the United States, Canada, and internationally.

Adequate balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives