- Canada

- /

- Oil and Gas

- /

- TSX:MEG

MEG Energy (TSX:MEG): Assessing Valuation After Recent Share Price Strength

Reviewed by Simply Wall St

See our latest analysis for MEG Energy.

Momentum has been building for MEG Energy as the share price has climbed steadily this year, with a year-to-date share price return of 23.72%. While recent weeks have seen renewed attention, the one-year total shareholder return of 19.90% signals that gains are not just short-term blips but part of a longer, constructive trend for investors.

If MEG’s strong run has you wondering where else opportunity is brewing, now’s a great time to discover fast growing stocks with high insider ownership

The real question now is whether MEG Energy's impressive gains have left the stock undervalued, or if investors have already factored in all the growth ahead. Is there still a buying opportunity, or is the market fully pricing in future prospects?

Most Popular Narrative: Fairly Valued

With the consensus fair value of CA$29.90 almost matching the latest close of CA$29.68, the market appears in sync with analyst assumptions. Yet, a closer look at their narrative reveals some notable drivers influencing this equilibrium.

Disciplined capital allocation, including resumed share buybacks, dividend growth, and rapid debt reduction, enables greater free cash flow to be returned to shareholders and enhances per-share earnings growth over time.

Want to unravel the math behind this consensus view? The secret sauce here is a blend of rising output, narrowing margins, and an earnings forecast that stands out even among seasoned energy analysts. The stakes and the surprises are hidden in the full narrative. Go deeper and see what numbers really justify this price.

Result: Fair Value of $29.90 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks such as MEG's dependence on a single project or regulatory shifts could quickly impact revenue reliability and challenge the fair value outlook.

Find out about the key risks to this MEG Energy narrative.

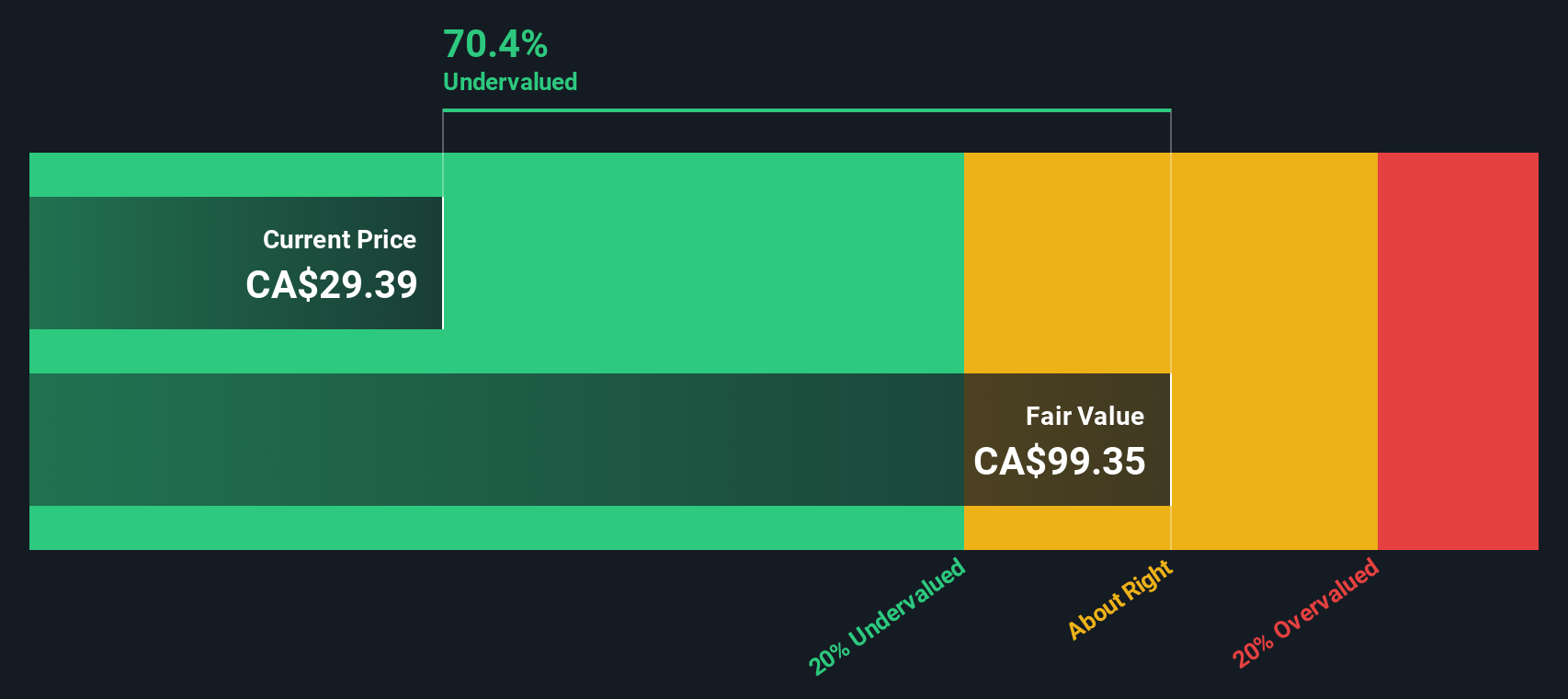

Another View: Our DCF Model Tells a Different Story

While analysts see MEG Energy as fairly valued based on current share price and future earnings estimates, our DCF model offers a different perspective. The SWS DCF model values MEG at CA$16.94, which is below the market price. This could suggest the stock is overvalued if more conservative growth expectations occur. Which approach will prove right as market sentiment shifts?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out MEG Energy for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 840 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own MEG Energy Narrative

If you see the story differently or want to test your own perspective, it only takes a few minutes to craft your own view from the data. Do it your way.

A great starting point for your MEG Energy research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Don't limit yourself to just one stock when there’s a world of opportunity at your fingertips. Let the Simply Wall Street Screener guide you to powerful trends and hidden gems you could easily miss out on.

- Capitalize on market inefficiencies by targeting these 840 undervalued stocks based on cash flows that offer real value based on cash flow fundamentals.

- Seize the surge in healthcare innovation by searching for these 33 healthcare AI stocks that are set to transform patient care through breakthrough technology.

- Boost your income strategy with these 22 dividend stocks with yields > 3% that deliver above-average yields and the potential for long-term growth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:MEG

MEG Energy

An energy company, focuses on in situ thermal oil production in its Christina Lake Project in the southern Athabasca oil region of Alberta, Canada.

Excellent balance sheet with acceptable track record.

Similar Companies

Market Insights

Community Narratives