Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. We note that McCoy Global Inc. (TSE:MCB) does have debt on its balance sheet. But the more important question is: how much risk is that debt creating?

When Is Debt A Problem?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. When we think about a company's use of debt, we first look at cash and debt together.

View our latest analysis for McCoy Global

What Is McCoy Global's Net Debt?

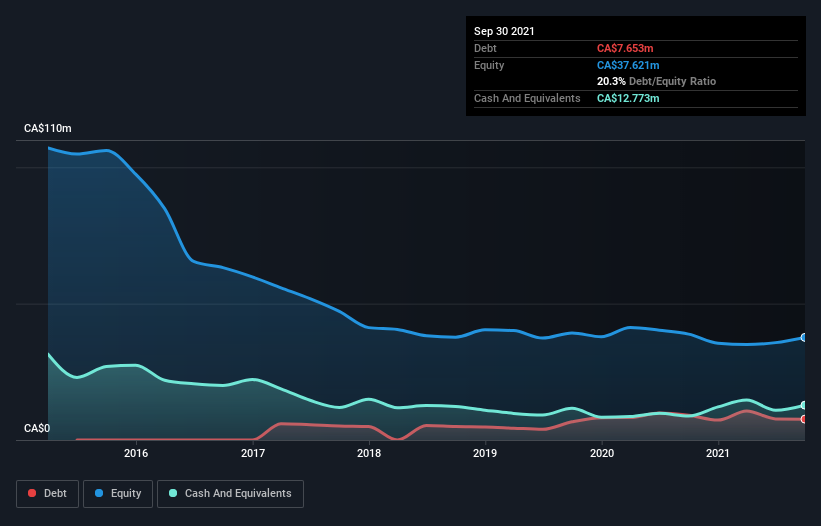

As you can see below, McCoy Global had CA$7.65m of debt at September 2021, down from CA$9.07m a year prior. However, it does have CA$12.8m in cash offsetting this, leading to net cash of CA$5.12m.

A Look At McCoy Global's Liabilities

According to the last reported balance sheet, McCoy Global had liabilities of CA$8.29m due within 12 months, and liabilities of CA$9.98m due beyond 12 months. Offsetting this, it had CA$12.8m in cash and CA$4.88m in receivables that were due within 12 months. So it has liabilities totalling CA$615.0k more than its cash and near-term receivables, combined.

Given McCoy Global has a market capitalization of CA$24.6m, it's hard to believe these liabilities pose much threat. However, we do think it is worth keeping an eye on its balance sheet strength, as it may change over time. While it does have liabilities worth noting, McCoy Global also has more cash than debt, so we're pretty confident it can manage its debt safely. There's no doubt that we learn most about debt from the balance sheet. But you can't view debt in total isolation; since McCoy Global will need earnings to service that debt. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

In the last year McCoy Global had a loss before interest and tax, and actually shrunk its revenue by 21%, to CA$33m. To be frank that doesn't bode well.

So How Risky Is McCoy Global?

Although McCoy Global had an earnings before interest and tax (EBIT) loss over the last twelve months, it generated positive free cash flow of CA$2.8m. So although it is loss-making, it doesn't seem to have too much near-term balance sheet risk, keeping in mind the net cash. Until we see some positive EBIT, we're a bit cautious of the stock, not least because of the rather modest revenue growth. When analysing debt levels, the balance sheet is the obvious place to start. However, not all investment risk resides within the balance sheet - far from it. These risks can be hard to spot. Every company has them, and we've spotted 2 warning signs for McCoy Global you should know about.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:MCB

McCoy Global

Provides equipment and technologies designed to support tubular running operations that enhance wellbore integrity and assist with collecting data for the energy industry in the United States, Latin America, the Middle East, Africa, Europe, the Asia Pacific, and Canada.

Flawless balance sheet and fair value.

Market Insights

Community Narratives