- Canada

- /

- Oil and Gas

- /

- TSX:IPCO

Can Early Progress at Blackrod Offset International Petroleum’s (TSX:IPCO) Weaker Quarterly Profits?

Reviewed by Sasha Jovanovic

- International Petroleum Corporation recently reported third quarter 2025 results, highlighting average net production of approximately 45,900 barrels of oil equivalent per day and the Blackrod Phase 1 project running ahead of schedule, despite quarterly sales of US$171.19 million and net income of US$3.8 million coming in below last year's figures.

- Progress at Blackrod and ongoing share buybacks helped offset weaker financial performance, while successful bond refinancing improved financial flexibility and supported investor sentiment.

- We’ll examine how Blackrod’s accelerated development timeline and production outperformance may reshape International Petroleum’s investment narrative.

Find companies with promising cash flow potential yet trading below their fair value.

International Petroleum Investment Narrative Recap

To be a shareholder in International Petroleum, you need to believe in the company’s ability to accelerate Blackrod Phase 1 and transform production, despite near-term earnings weakness. This quarter’s solid operational progress is significant for the main investment catalyst, timely Blackrod ramp-up, while financial softness makes execution risk more visible, but the news doesn’t materially change the short-term risk picture.

Among recent announcements, IPC’s completion of its substantial share buyback program stands out. By reducing the common share count by 6.2% and committing over CA$148.8 million since late 2024, management has reinforced capital allocation discipline, even as Blackrod outperformance remains the leading catalyst for future cash flow.

However, investors should also keep in mind that, despite project execution running ahead of schedule, reliance on Blackrod still leaves the company exposed if…

Read the full narrative on International Petroleum (it's free!)

International Petroleum's narrative projects $1.2 billion revenue and $218.6 million earnings by 2028. This requires 18.7% yearly revenue growth and a $165.2 million earnings increase from $53.4 million today.

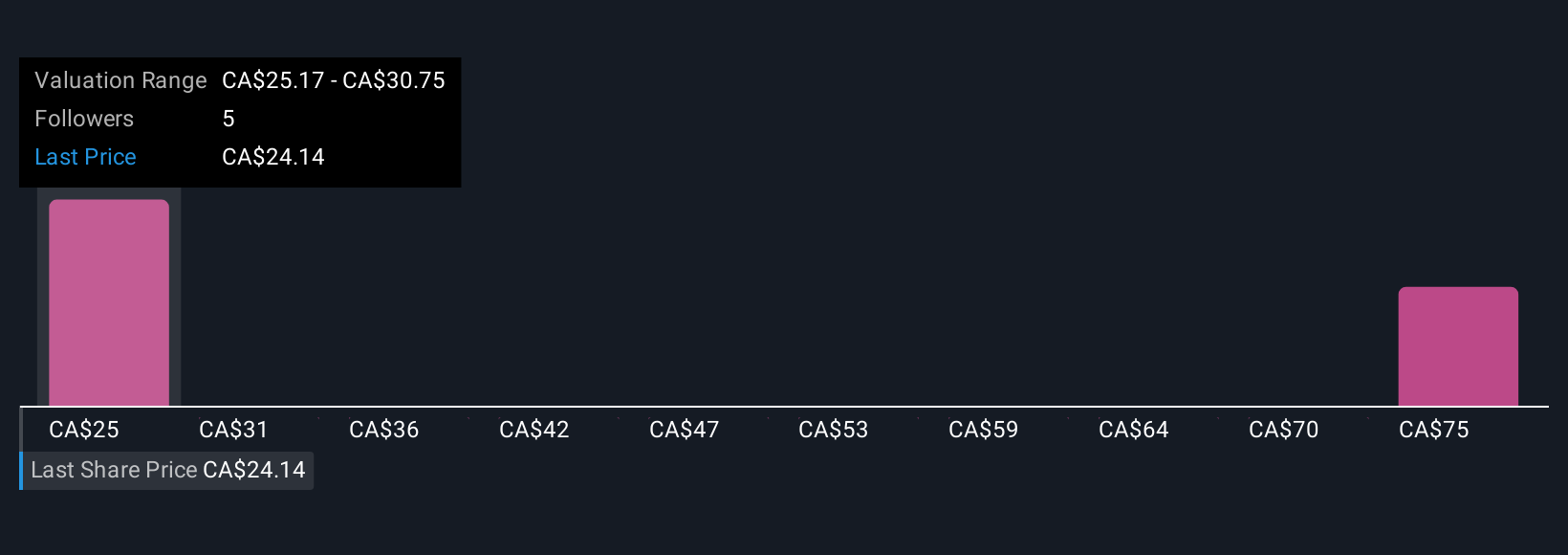

Uncover how International Petroleum's forecasts yield a CA$25.17 fair value, in line with its current price.

Exploring Other Perspectives

Three individual fair value estimates from the Simply Wall St Community range from CA$25.17 to CA$93.39 per share. While opinions differ widely, balance sheet risks tied to Blackrod’s capital intensity may influence how you weigh these perspectives against future earnings expectations.

Explore 3 other fair value estimates on International Petroleum - why the stock might be worth over 3x more than the current price!

Build Your Own International Petroleum Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your International Petroleum research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free International Petroleum research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate International Petroleum's overall financial health at a glance.

No Opportunity In International Petroleum?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:IPCO

International Petroleum

Explores for, develops, and produces oil and gas.

Reasonable growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives