- Canada

- /

- Oil and Gas

- /

- TSX:HWX

Headwater Exploration (TSX:HWX) Profit Margin Drops, Challenging Case for Ongoing Value Narrative

Reviewed by Simply Wall St

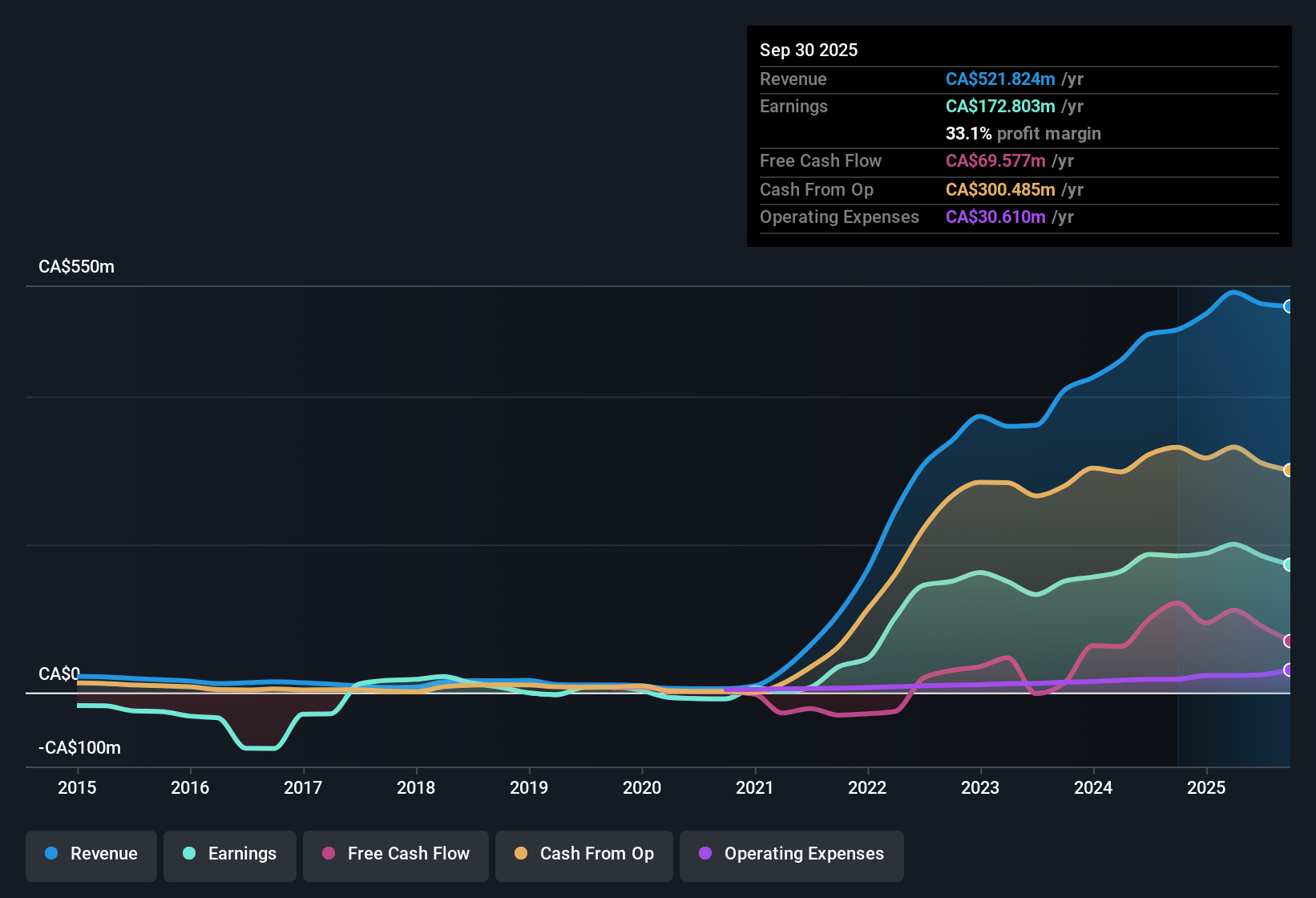

Headwater Exploration (TSX:HWX) posted a net profit margin of 35.1%, down from last year’s 38.5%. Both its earnings and revenue are projected to decline annually by 14.9% and 5.5% over the next three years. The company’s earnings fell year-over-year despite a strong five-year streak of profitability. Shares now trade at a price-to-earnings ratio of 9.4x, below both the industry and peer averages. For value-focused investors, HWX’s share price of CA$7.3 is notably under an estimated fair value, which hints at attractive relative value even as the company faces a tougher outlook for growth.

See our full analysis for Headwater Exploration.Next up, we’ll put these headline results in context by checking them against the key market narratives and community perspectives to see which story stands out.

Curious how numbers become stories that shape markets? Explore Community Narratives

DCF Fair Value Highlights Huge Discount

- Headwater shares trade at CA$7.30, well below both analyst price targets (CA$9.08) and a DCF fair value of CA$20.82. This paints a picture of sizable undervaluation against traditional valuation models.

- Prevailing market view highlights that this persistent discount to fair value is unusual for a company with high quality earnings, but points to annual earnings declines of 14.9% expected for the next three years.

- While headline profitability remains strong, projected revenue and earnings drops could explain the market's caution and limited re-rating despite the low price-to-earnings ratio.

- The discrepancy between discounted cash flow valuation and share price underscores a tension. Bulls see a bargain, but ongoing declines set a skeptical market mood.

Five-Year Profit Growth Reverses Course

- Following years of robust annual earnings growth at 38.7%, the latest results mark a reversal as both revenue and net profits slipped in the last year, breaking Headwater’s winning streak.

- Prevailing market view points out that the drop in profit margins to 35.1% can shake confidence in the company’s ability to maintain past momentum, especially alongside expected revenue declines.

- The combination of slightly lower margins and the first year of shrinking earnings signals an inflection point that many investors will be watching closely.

- This slowdown stands in contrast to Headwater’s reputation for outgrowing its sector, fueling anxiety about whether this marks a one-off dip or the start of a new trend.

Dividend Sustainability in the Spotlight

- While substantial profitability has enabled Headwater’s dividend payments, the ongoing concerns over revenue and earnings declines have raised new questions about the ongoing sustainability of these payouts.

- Prevailing market view emphasizes that dividend risk now looms larger in investor calculus, since shrinking profits can pressure the company’s ability to sustain or increase returns to shareholders.

- With forecasts calling for continued top and bottom line contraction, management may need to balance capital returns with investment in growth to preserve long-term strength.

- Investors focused on yield should keep a close eye on future guidance, as any hint of dividend reduction could quickly alter market sentiment.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Headwater Exploration's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Headwater’s recent reversal from steady profit growth to sliding earnings and an uncertain outlook signals greater risk for investors seeking reliable performance.

If you want more consistency, use our stable growth stocks screener (2110 results) to discover companies that have demonstrated stable revenue and earnings growth through ups and downs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Headwater Exploration might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:HWX

Headwater Exploration

Engages in the exploration, development, and production of petroleum and natural gas resources in Canada.

Flawless balance sheet and undervalued.

Market Insights

Community Narratives