- Canada

- /

- Oil and Gas

- /

- TSX:HWX

Assessing Headwater Exploration (TSX:HWX) Valuation After Latest Earnings Reveal Softer Sales and Net Income

Reviewed by Simply Wall St

Headwater Exploration (TSX:HWX) has just released its third-quarter earnings results, marking a slight year-over-year dip in sales, revenue, and net income. Investors are watching closely because these updates often guide both sentiment and valuation for the stock.

See our latest analysis for Headwater Exploration.

Headwater Exploration’s latest earnings report, while reflecting modest declines in sales and net income, has not derailed its share price momentum. The stock is still up 8.75% year-to-date and boasts a strong total shareholder return of nearly 16% over the past year. This shows investors remain optimistic about its long-term fundamentals despite recent short-term volatility.

If you’re interested in expanding your watchlist beyond the usual options, now is a compelling moment to discover fast growing stocks with high insider ownership.

With the latest earnings now in, investors are left wondering whether the recent dip is a sign of undervaluation or if Headwater Exploration’s price already reflects its growth prospects, leaving little room for upside.

Price-to-Earnings of 9.4x: Is it justified?

Headwater Exploration’s stock is trading at a price-to-earnings (P/E) ratio of 9.4x, noticeably below both peer and industry averages. This signals the market currently values its earnings at a discount.

The P/E ratio measures how much investors are willing to pay for a dollar of earnings and is a key metric for oil and gas companies, whose profits can fluctuate materially with commodity cycles. A lower P/E may reveal the market expects slower earnings growth or heightened volatility ahead.

Compared to the Canadian Oil and Gas industry average P/E of 12.4x and the broader peer average of 12.1x, Headwater Exploration’s ratio stands out as relatively cheap. It is also almost aligned with its estimated fair price-to-earnings ratio of 9.6x. This suggests minimal mispricing and that future market movements could bring the current valuation closer to this benchmark.

Explore the SWS fair ratio for Headwater Exploration

Result: Price-to-Earnings of 9.4x (UNDERVALUED)

However, persistent declines in net income and muted revenue growth could signal underlying challenges. These factors may limit further share price appreciation.

Find out about the key risks to this Headwater Exploration narrative.

Another View: What Does Our DCF Model Suggest?

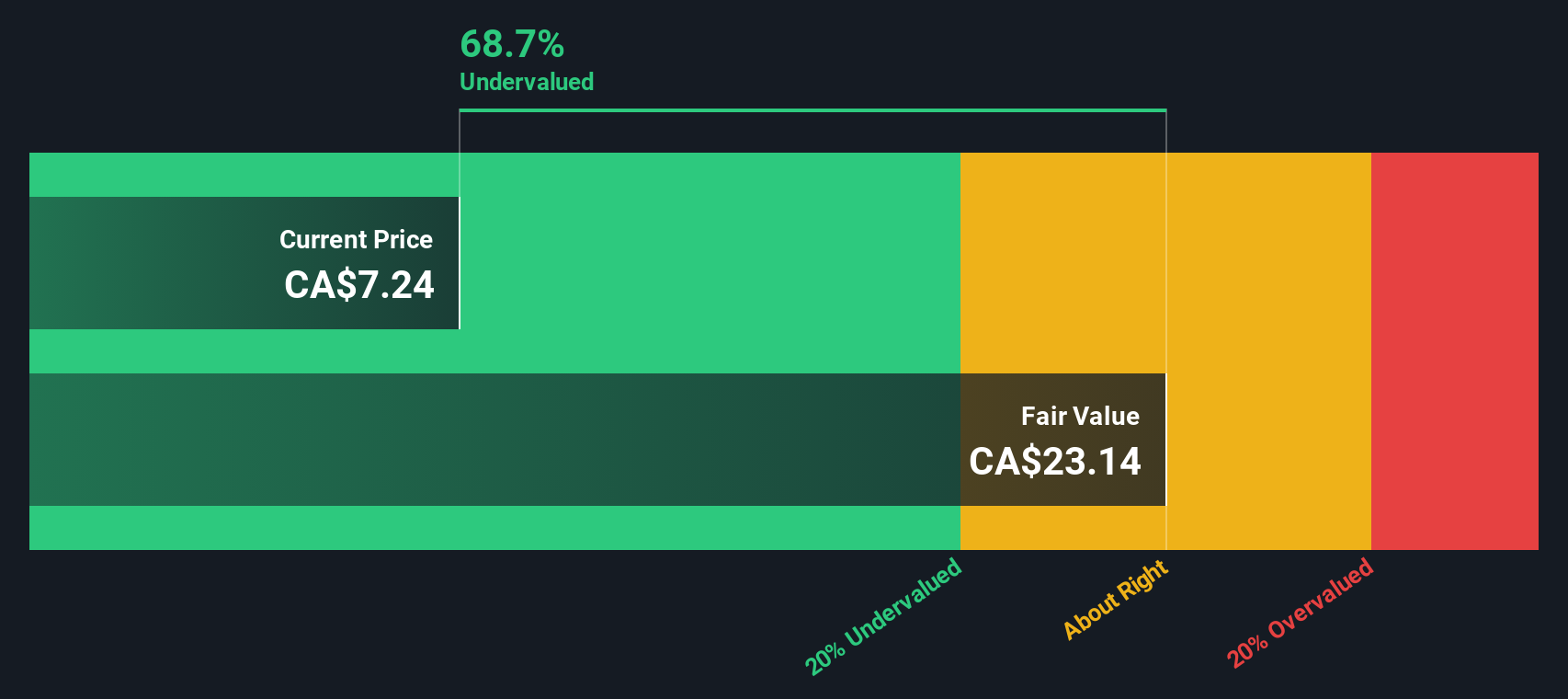

While Headwater Exploration’s low price-to-earnings ratio suggests it may be undervalued, our SWS DCF model paints an even stronger picture. The DCF approach estimates the stock is trading at a massive 68% discount to its calculated fair value. That is a big difference. Are investors missing something, or is the market seeing risks our model does not?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Headwater Exploration for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 847 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Headwater Exploration Narrative

If you see these results differently or want to dig into the numbers firsthand, you can easily create your own analysis in just a few minutes. Do it your way

A great starting point for your Headwater Exploration research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Smart Investment Moves?

Don’t just stop at one opportunity. There are plenty of promising stocks waiting for savvy investors like you. The next winner could be just a click away, so make your move today.

- Capture reliable income streams and shield your portfolio from volatility when you choose these 21 dividend stocks with yields > 3% offering yields above 3%.

- Get ahead of megatrends by targeting these 26 AI penny stocks that are shaping the future of the artificial intelligence market.

- Position yourself for growth with these 847 undervalued stocks based on cash flows trading below their intrinsic value based on strong cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Headwater Exploration might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:HWX

Headwater Exploration

Engages in the exploration, development, and production of petroleum and natural gas resources in Canada.

Flawless balance sheet and undervalued.

Market Insights

Community Narratives