- Canada

- /

- Oil and Gas

- /

- TSX:HWX

A Fresh Look at Headwater Exploration (TSX:HWX) Valuation Following Lower Q3 Results and Maintained Dividend

Reviewed by Simply Wall St

Headwater Exploration (TSX:HWX) just released its third quarter results, showing lower sales, revenue, and net income compared to last year. Despite these declines, the company maintained its quarterly cash dividend for shareholders.

See our latest analysis for Headwater Exploration.

Despite reporting lower quarterly profits, Headwater Exploration’s share price has gained 11% year-to-date, as investors look past near-term results and focus on its long-term track record. The energy producer’s 14% total shareholder return over the past year, along with a remarkable 430% over five years, show momentum is still in its favor.

If steady growth with proven resilience appeals to you, it might be a good time to broaden your investing outlook and discover fast growing stocks with high insider ownership

The key question for investors now is whether these near-term dips have left Headwater’s stock undervalued, or if the market is already factoring in a rebound in growth. Could there be a buying opportunity here, or is future strength already priced in?

Price-to-Earnings of 10.4x: Is it justified?

Headwater Exploration is trading at a price-to-earnings ratio of 10.4x, which is lower than both its industry peers and the broader market average. At a last close of CA$7.50, the company appears attractively valued compared to similar oil and gas producers.

The price-to-earnings (P/E) ratio measures how much investors are willing to pay for each dollar of company earnings. For companies like Headwater, operating in the energy sector, this figure helps gauge whether the market believes in the stability and future growth of current profits.

This below-average P/E suggests that investors may be underestimating Headwater's future earnings potential or reflecting caution due to expected near-term declines. However, a lower ratio can give new investors a margin of safety if profitability stabilizes or improves.

Compared to the Canadian Oil and Gas industry average P/E of 12.2x, Headwater stands out as a value pick on this metric. The figure is also well below the peer group average of 18.8x, indicating that market expectations are even more tempered. While it trades slightly above its estimated fair price-to-earnings ratio (8.9x), any improvement in earnings outlook could prompt a re-rating toward this fair level.

Explore the SWS fair ratio for Headwater Exploration

Result: Price-to-Earnings of 10.4x (UNDERVALUED)

However, a slowdown in revenue growth and weaker net income trends could dampen sentiment, particularly if energy prices continue to face pressure in the quarters ahead.

Find out about the key risks to this Headwater Exploration narrative.

Another View: Discounted Cash Flow Model Signals Upside

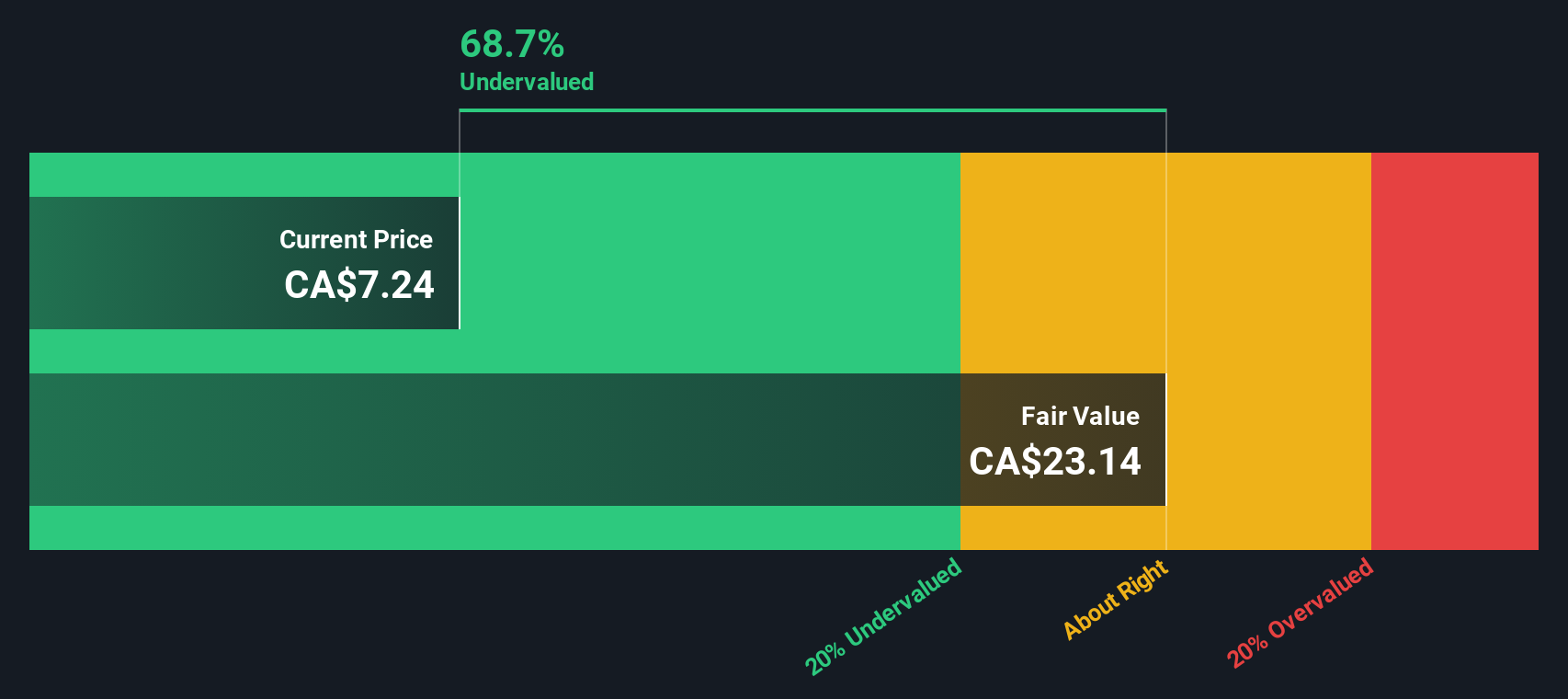

While the price-to-earnings ratio points to Headwater Exploration being undervalued relative to peers, our DCF model suggests an even bigger gap between market price and intrinsic value. Headwater’s current share price trades at a steep discount to its calculated fair value, which challenges the assumptions made by multiples alone. Could the DCF model be pricing in strengths that the market is missing?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Headwater Exploration for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 841 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Headwater Exploration Narrative

If you want to see the story differently or trust your own due diligence, you can easily build your own Headwater Exploration outlook in just a few minutes with Do it your way.

A great starting point for your Headwater Exploration research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Expand your horizons and stay ahead of the market by checking out unique stock picks tailored for growth, innovation, and steady returns. Don’t let these opportunities pass you by. Start your next investing move now.

- Capture consistent income with reliable options from these 20 dividend stocks with yields > 3% that showcase robust yields and a history of steady payouts.

- Join the AI revolution by pursuing smart companies on the cutting edge. Explore these 25 AI penny stocks blending technology and intelligence for the next wave of growth.

- Position yourself for the future with these 81 cryptocurrency and blockchain stocks that leverage blockchain breakthroughs and are riding the momentum of digital innovation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Headwater Exploration might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:HWX

Headwater Exploration

Engages in the exploration, development, and production of petroleum and natural gas resources in Canada.

Flawless balance sheet and undervalued.

Market Insights

Community Narratives