- Canada

- /

- Energy Services

- /

- TSX:ESI

Revenues Not Telling The Story For Ensign Energy Services Inc. (TSE:ESI) After Shares Rise 27%

Ensign Energy Services Inc. (TSE:ESI) shareholders would be excited to see that the share price has had a great month, posting a 27% gain and recovering from prior weakness. Taking a wider view, although not as strong as the last month, the full year gain of 13% is also fairly reasonable.

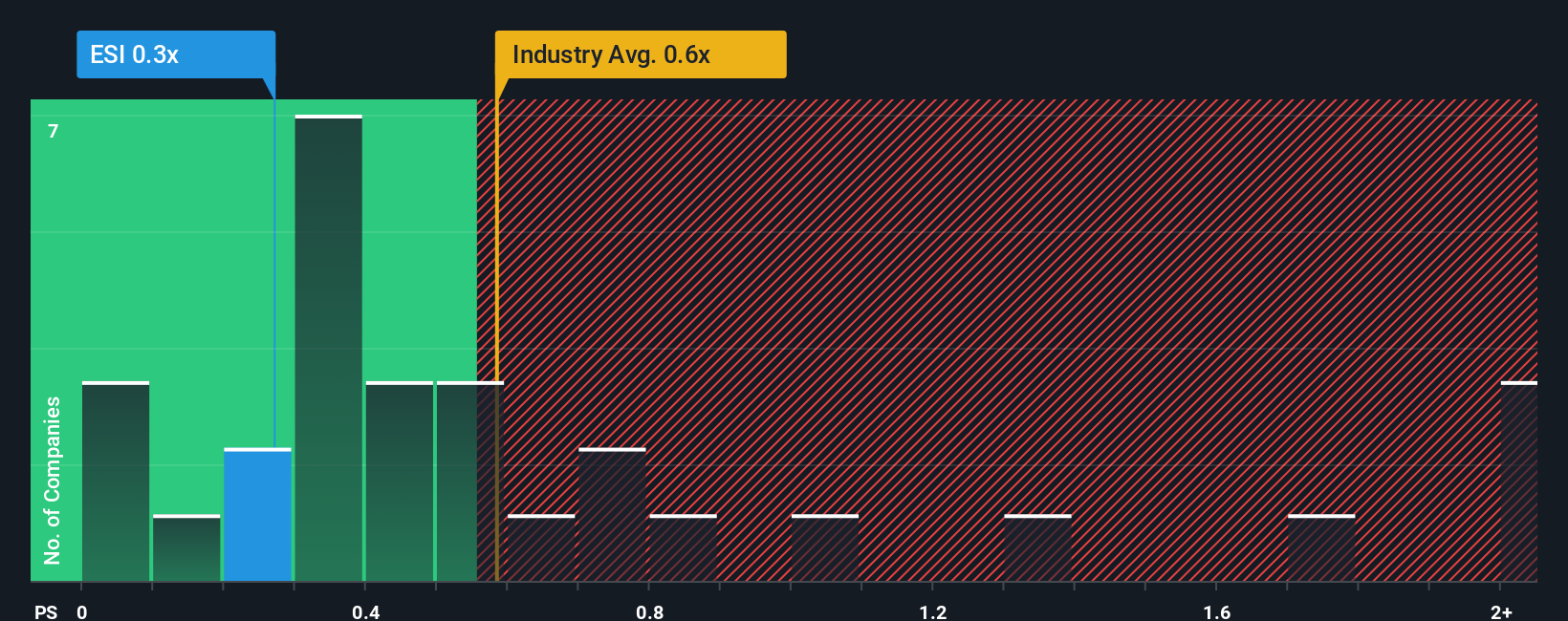

Although its price has surged higher, there still wouldn't be many who think Ensign Energy Services' price-to-sales (or "P/S") ratio of 0.3x is worth a mention when the median P/S in Canada's Energy Services industry is similar at about 0.6x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

View our latest analysis for Ensign Energy Services

How Ensign Energy Services Has Been Performing

While the industry has experienced revenue growth lately, Ensign Energy Services' revenue has gone into reverse gear, which is not great. One possibility is that the P/S ratio is moderate because investors think this poor revenue performance will turn around. If not, then existing shareholders may be a little nervous about the viability of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Ensign Energy Services will help you uncover what's on the horizon.How Is Ensign Energy Services' Revenue Growth Trending?

The only time you'd be comfortable seeing a P/S like Ensign Energy Services' is when the company's growth is tracking the industry closely.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 2.9%. However, a few very strong years before that means that it was still able to grow revenue by an impressive 52% in total over the last three years. Accordingly, while they would have preferred to keep the run going, shareholders would definitely welcome the medium-term rates of revenue growth.

Shifting to the future, estimates from the six analysts covering the company suggest revenue growth is heading into negative territory, declining 1.9% over the next year. With the industry predicted to deliver 21% growth, that's a disappointing outcome.

With this information, we find it concerning that Ensign Energy Services is trading at a fairly similar P/S compared to the industry. Apparently many investors in the company reject the analyst cohort's pessimism and aren't willing to let go of their stock right now. There's a good chance these shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the negative growth outlook.

The Final Word

Ensign Energy Services' stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Our check of Ensign Energy Services' analyst forecasts revealed that its outlook for shrinking revenue isn't bringing down its P/S as much as we would have predicted. When we see a gloomy outlook like this, our immediate thoughts are that the share price is at risk of declining, negatively impacting P/S. If the poor revenue outlook tells us one thing, it's that these current price levels could be unsustainable.

A lot of potential risks can sit within a company's balance sheet. Take a look at our free balance sheet analysis for Ensign Energy Services with six simple checks on some of these key factors.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Ensign Energy Services might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:ESI

Ensign Energy Services

Provides oilfield services to the oil and natural gas industries in Canada, the United States, and internationally.

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives