- Canada

- /

- Energy Services

- /

- TSX:ESI

Ensign Energy Services Inc.'s (TSE:ESI) Shares Not Telling The Full Story

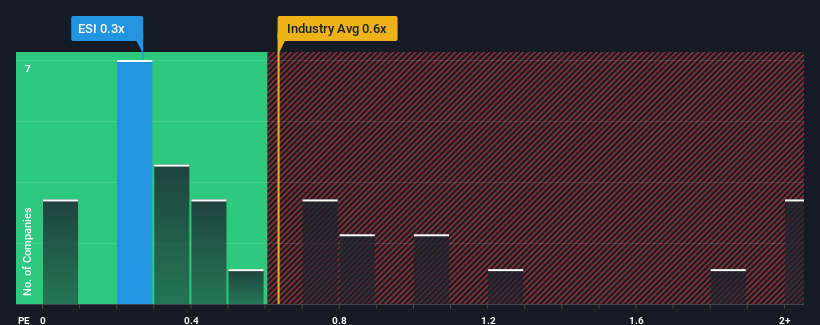

With a median price-to-sales (or "P/S") ratio of close to 0.6x in the Energy Services industry in Canada, you could be forgiven for feeling indifferent about Ensign Energy Services Inc.'s (TSE:ESI) P/S ratio of 0.3x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

View our latest analysis for Ensign Energy Services

How Has Ensign Energy Services Performed Recently?

Recent times haven't been great for Ensign Energy Services as its revenue has been rising slower than most other companies. One possibility is that the P/S ratio is moderate because investors think this lacklustre revenue performance will turn around. However, if this isn't the case, investors might get caught out paying too much for the stock.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Ensign Energy Services.What Are Revenue Growth Metrics Telling Us About The P/S?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Ensign Energy Services' to be considered reasonable.

If we review the last year of revenue, the company posted a result that saw barely any deviation from a year ago. Still, the latest three year period has seen an excellent 125% overall rise in revenue, in spite of its uninspiring short-term performance. Therefore, it's fair to say the revenue growth recently has been great for the company, but investors will want to ask why it has slowed to such an extent.

Looking ahead now, revenue is anticipated to slump, contracting by 2.0% during the coming year according to the five analysts following the company. This is still shaping up to be materially better than the broader industry which is also set to decline 9.9%.

With this information, it's perhaps curious but not a major surprise that Ensign Energy Services is trading at a fairly similar P/S in comparison. Even though the company may outperform the industry, shrinking revenues are unlikely to lead to a stable P/S long-term. Even just maintaining these prices could be difficult to achieve as the weak outlook is already weighing down the shares.

What We Can Learn From Ensign Energy Services' P/S?

It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

It looks to us like Ensign Energy Services currently trades on a lower than expected P/S since its revenue forecast is not as bad as the struggling industry. Even though it's revenue prospects are better than the wider industry, we assume there are several risk factors might be placing downward pressure on the P/S, bringing it in line with the industry average. One major risk is whether its revenue trajectory can keep outperforming under these tough industry conditions. However, if you agree with the analysts' forecasts, you may be able to pick up the stock at an attractive price.

And what about other risks? Every company has them, and we've spotted 2 warning signs for Ensign Energy Services (of which 1 makes us a bit uncomfortable!) you should know about.

If these risks are making you reconsider your opinion on Ensign Energy Services, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Ensign Energy Services might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:ESI

Ensign Energy Services

Provides oilfield services to the oil and natural gas industries in Canada, the United States, and internationally.

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives