- Canada

- /

- Oil and Gas

- /

- TSX:ELEF

Investors bid Silver Elephant Mining (TSE:ELEF) up CA$2.4m despite increasing losses YoY, taking five-year CAGR to 49%

This week we saw the Silver Elephant Mining Corp. (TSE:ELEF) share price climb by 16%. While a drop like that is definitely a body blow, money isn't as important as health and happiness.

Although the past week has been more reassuring for shareholders, they're still in the red over the last five years, so let's see if the underlying business has been responsible for the decline.

See our latest analysis for Silver Elephant Mining

With zero revenue generated over twelve months, we don't think that Silver Elephant Mining has proved its business plan yet. This state of affairs suggests that venture capitalists won't provide funds on attractive terms. So it seems that the investors focused more on what could be, than paying attention to the current revenues (or lack thereof). It seems likely some shareholders believe that Silver Elephant Mining will discover or develop fossil fuel before too long.

We think companies that have neither significant revenues nor profits are pretty high risk. There was already a significant chance that they would need more money for business development, and indeed they recently put themselves at the mercy of capital markets and raised equity. So the share price itself impacts the value of the shares (as it determines the cost of capital). While some such companies do very well over the long term, others become hyped up by promoters before eventually falling back down to earth, and going bankrupt (or being recapitalized). Some Silver Elephant Mining investors have already had a taste of the bitterness stocks like this can leave in the mouth.

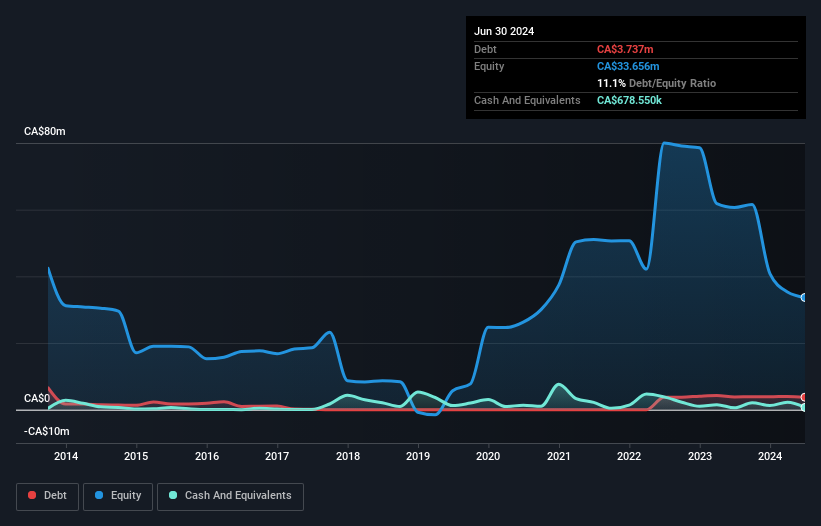

Silver Elephant Mining had liabilities exceeding cash when it last reported, according to our data. That made it extremely high risk, in our view. But with the share price diving 14% per year, over 5 years , it's probably fair to say that some shareholders no longer believe the company will succeed or they are worried about dilution with the recent cash injection. You can see in the image below, how Silver Elephant Mining's cash levels have changed over time (click to see the values).

Of course, the truth is that it is hard to value companies without much revenue or profit. Given that situation, would you be concerned if it turned out insiders were relentlessly selling stock? It would bother me, that's for sure. It costs nothing but a moment of your time to see if we are picking up on any insider selling.

What About The Total Shareholder Return (TSR)?

We've already covered Silver Elephant Mining's share price action, but we should also mention its total shareholder return (TSR). The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. We note that Silver Elephant Mining's TSR, at 641% is higher than its share price return of -89%. When you consider it hasn't been paying a dividend, this data suggests shareholders have benefitted from a spin-off, or had the opportunity to acquire attractively priced shares in a discounted capital raising.

A Different Perspective

We're pleased to report that Silver Elephant Mining shareholders have received a total shareholder return of 59% over one year. That gain is better than the annual TSR over five years, which is 49%. Therefore it seems like sentiment around the company has been positive lately. Someone with an optimistic perspective could view the recent improvement in TSR as indicating that the business itself is getting better with time. It's always interesting to track share price performance over the longer term. But to understand Silver Elephant Mining better, we need to consider many other factors. Case in point: We've spotted 4 warning signs for Silver Elephant Mining you should be aware of, and 2 of them are a bit concerning.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: many of them are unnoticed AND have attractive valuation).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Canadian exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:ELEF

Silver Elephant Mining

A mineral exploration stage company, engages in the acquisition, exploration, and development of mineral properties in the United States, Canada, Bolivia, and Mongolia.

Moderate with mediocre balance sheet.