- Canada

- /

- Oil and Gas

- /

- TSX:EFR

Will Energy Fuels' (TSX:EFR) Bold Financing Shift Its Risk Profile Amid Rising Uranium Sales?

Reviewed by Sasha Jovanovic

- Energy Fuels Inc. recently reported its third quarter 2025 results, showing a substantial increase in uranium sales to US$17.71 million but with continued net losses, and advanced its rare earth and project development efforts with increased financial flexibility following a US$700 million convertible notes offering.

- A unique aspect from the past quarter is the combination of higher sales volume and major project milestones, despite persistent challenges reflected in rising net losses and ongoing investments across critical mineral initiatives in both North America and Australia.

- We’ll examine how the large convertible notes offering and increased uranium sales may influence Energy Fuels’ investment outlook and risk profile.

The latest GPUs need a type of rare earth metal called Dysprosium and there are only 35 companies in the world exploring or producing it. Find the list for free.

Energy Fuels Investment Narrative Recap

To own shares of Energy Fuels, you need to see value in its efforts to build a leading North American uranium and rare earth producer, banking on continued policy, contract, and financing support. The Q3 2025 results, the sales jump and US$700 million convertible notes boost, may help support project advancement, but rising net losses and ongoing capital needs remain the central short-term risk. The recent financing helps address funding for critical mineral growth, so its impact on near-term project progress is meaningful.

Among recent announcements, the approval of government support and conditional financing for the Donald Project in Australia is particularly relevant to short-term catalysts, as it could accelerate the scale and timeline for rare earth production. This development ties directly to the company’s need to achieve secure, diverse feedstock to meet margin improvement and revenue goals in the rare earths business.

In contrast, investors should pay close attention to how much future project advancement ultimately depends on securing additional offtake and government support, since...

Read the full narrative on Energy Fuels (it's free!)

Energy Fuels' outlook projects $553.4 million in revenue and $237.8 million in earnings by 2028. This implies a 104.1% annual revenue growth rate and an increase in earnings of $330.9 million from the current level of -$93.1 million.

Uncover how Energy Fuels' forecasts yield a CA$27.10 fair value, a 23% upside to its current price.

Exploring Other Perspectives

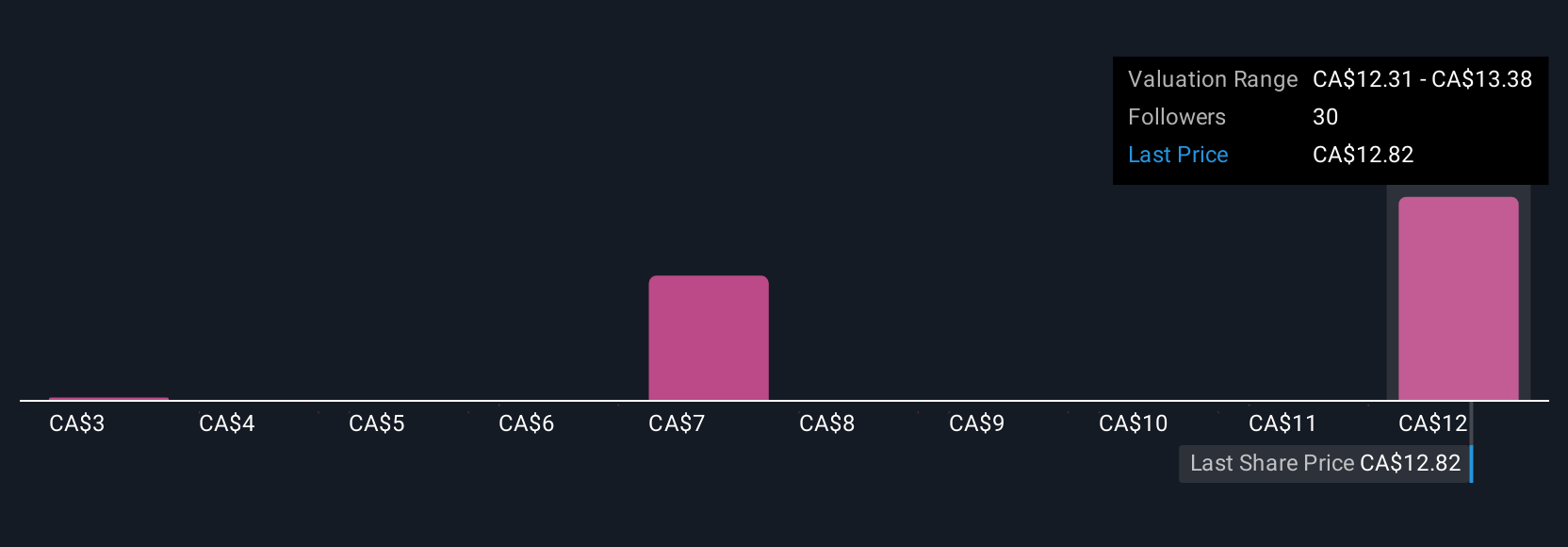

The Simply Wall St Community has shared 11 fair value estimates for Energy Fuels ranging from US$2.57 to US$35.85 per share. As you consider these diverse perspectives, remember that heavy ongoing capital requirements and risks tied to project financing could affect the company's ability to realize future production growth or profitability.

Explore 11 other fair value estimates on Energy Fuels - why the stock might be worth as much as 63% more than the current price!

Build Your Own Energy Fuels Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Energy Fuels research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

- Our free Energy Fuels research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Energy Fuels' overall financial health at a glance.

Looking For Alternative Opportunities?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Energy Fuels might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:EFR

Energy Fuels

Engages in the exploration, recovery, recycling, exploration, operation, development, permitting, evaluation, and sale of uranium mineral properties in the United States.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives