- Canada

- /

- Oil and Gas

- /

- TSX:DML

Denison Mines (TSX:DML): Evaluating Valuation After Nuclear Power Investment Boosts Uranium Sector Momentum

Reviewed by Simply Wall St

Denison Mines (TSX:DML) gained fresh attention after the US government revealed an $80 billion investment to jumpstart nuclear power development. The announcement, which featured major sector players, has fueled optimism around uranium demand.

See our latest analysis for Denison Mines.

Denison Mines has seized momentum in line with the broader surge in uranium stocks, driven by excitement over the US government's $80 billion push for nuclear power and fresh industry partnerships. After a strong jump on the news, Denison’s 1-year total shareholder return stands at 54.3 percent, with its share price up 51.7 percent year-to-date. Over the longer term, the stock’s multi-year returns signal that investors are increasingly confident in the sector’s growth story and Denison’s role within it.

If this renewed excitement around uranium has you curious, now is a good time to discover fast growing stocks with high insider ownership.

But after such a dramatic run, the big question is whether Denison Mines shares still offer value for investors or if the market is already reflecting the company’s future growth potential. Is there truly a buying opportunity, or has optimism been fully priced in?

Price-to-Book Ratio of 7.6x: Is it justified?

At a price-to-book ratio of 7.6x, Denison Mines trades at a premium to both its direct peers and the broader Canadian Oil and Gas industry. The last close was CA$4.52, highlighting just how stretched this valuation appears compared to the company’s book value.

The price-to-book ratio compares a company's market price to its net asset value per share. This is an important metric for asset-heavy sectors such as mining and energy. For Denison, this multiple suggests investors are paying significantly more than the company’s reported assets would typically indicate.

Relative to the peer group average of 5x and the industry average of 1.6x, Denison’s premium is considerable. The market appears to be pricing in aggressive growth or future milestones that are not yet reflected in the balance sheet.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Book Ratio of 7.6x (OVERVALUED)

However, Denison's heavy premium could be challenged if uranium prices soften or if the company struggles to deliver on projected growth.

Find out about the key risks to this Denison Mines narrative.

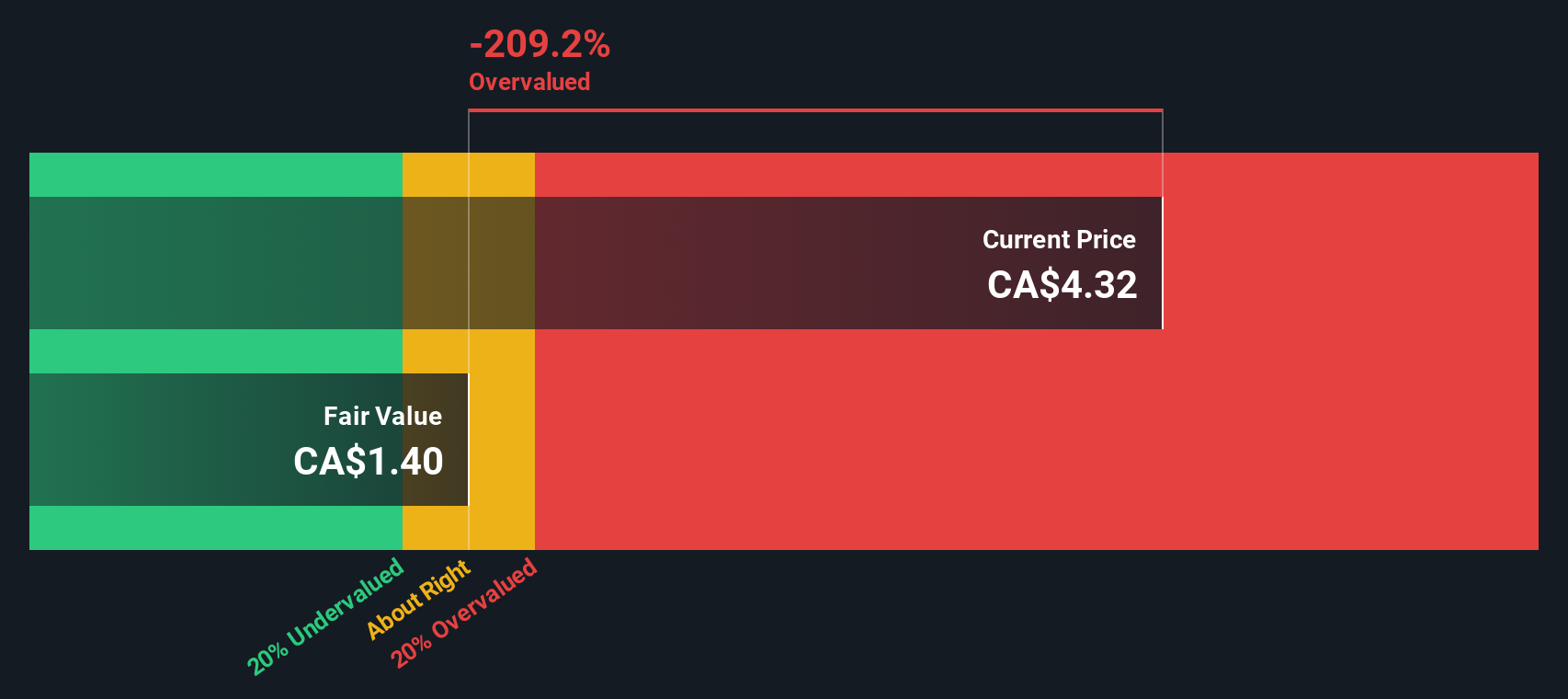

Another View: Our DCF Model Says Overvalued

While the price-to-book approach suggests Denison Mines is richly valued, our SWS DCF model supports this concern. The DCF estimate places fair value at just CA$1.40, which is well below today’s CA$4.52 share price. This could imply the market is ahead of the fundamentals. Could optimistic forecasts be overstating the company’s true worth?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Denison Mines for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 834 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Denison Mines Narrative

If you think the numbers tell a different story or want to research Denison Mines for yourself, you can craft a custom narrative in just a few minutes. Do it your way

A great starting point for your Denison Mines research is our analysis highlighting 1 key reward and 4 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don’t limit your portfolio to just one opportunity when the market is bursting with fresh potential. Every week, smart investors like you are finding overlooked gems and dynamic sectors set to outperform. Now’s your chance to act before others catch on. Here’s where to start:

- Capture steady income growth and navigate market shifts through these 24 dividend stocks with yields > 3%, spotlighting companies with robust yields above 3%.

- Ride the AI wave for long-term performance by scanning these 26 AI penny stocks shaping industries with transformational technology.

- Seize early-mover advantage by targeting these 3574 penny stocks with strong financials that deliver strong fundamentals rarely found in this segment.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:DML

Denison Mines

Engages in the acquisition, exploration, and development of uranium bearing properties in Canada.

Excellent balance sheet with slight risk.

Similar Companies

Market Insights

Community Narratives