- Canada

- /

- Oil and Gas

- /

- TSX:CNQ

Is Canadian Natural Resources a Hidden Opportunity After Strong Cash Flow Headlines in 2025?

Reviewed by Bailey Pemberton

- Curious whether Canadian Natural Resources might be a value gem hiding in plain sight? Let’s take a closer look at why investors are increasingly interested in this stock right now.

- The share price has mostly treaded water this year, dipping 0.6% year-to-date, but has delivered hefty gains of 25.8% over three years and a massive 341.7% over five years. This hints at both past growth potential and possible shifts in market outlook.

- Recent headlines have spotlighted Canadian Natural Resources’ strong operational performance and robust cash flows, stirring up conversation about its ability to weather industry volatility. There has also been buzz around the company’s continued investments in environmentally responsible production, which is drawing interest from more cautious, sustainability-focused investors.

- On our fundamental value checks, the company earns a 5 out of 6 score, suggesting it may be meaningfully undervalued. Next, we will walk through how that score is determined and compare traditional valuation measures. At the end of this article, we will introduce an even deeper way to think about value.

Approach 1: Canadian Natural Resources Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's intrinsic value by projecting its future cash flows and discounting them back to today's value. This approach helps investors assess what a business is truly worth based on its ability to generate cash in the years ahead.

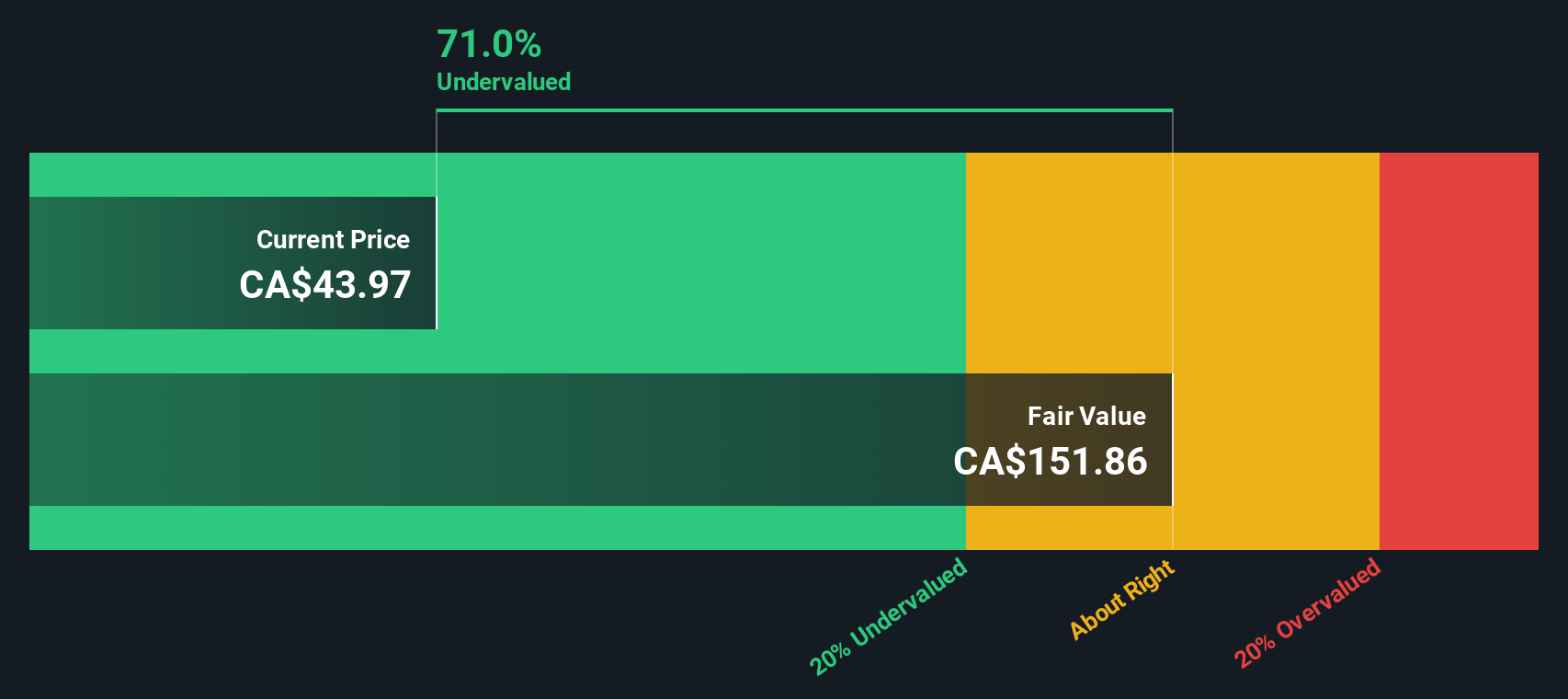

For Canadian Natural Resources, analysts report current Free Cash Flow (FCF) at CA$8.4 Billion. Forecasts suggest steady growth, with FCF projected to reach approximately CA$11.5 Billion by 2029. Estimates beyond this period are extrapolated using longer-term growth assumptions, providing a forward-looking view up to 10 years.

Based on this methodology and the company's underlying performance, the estimated intrinsic value is CA$151.80 per share. According to the DCF model, the stock is trading at a 70.4% discount to its intrinsic value, which indicates Canadian Natural Resources appears substantially undervalued based on these cash flow projections.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Canadian Natural Resources is undervalued by 70.4%. Track this in your watchlist or portfolio, or discover 842 more undervalued stocks based on cash flows.

Approach 2: Canadian Natural Resources Price vs Earnings

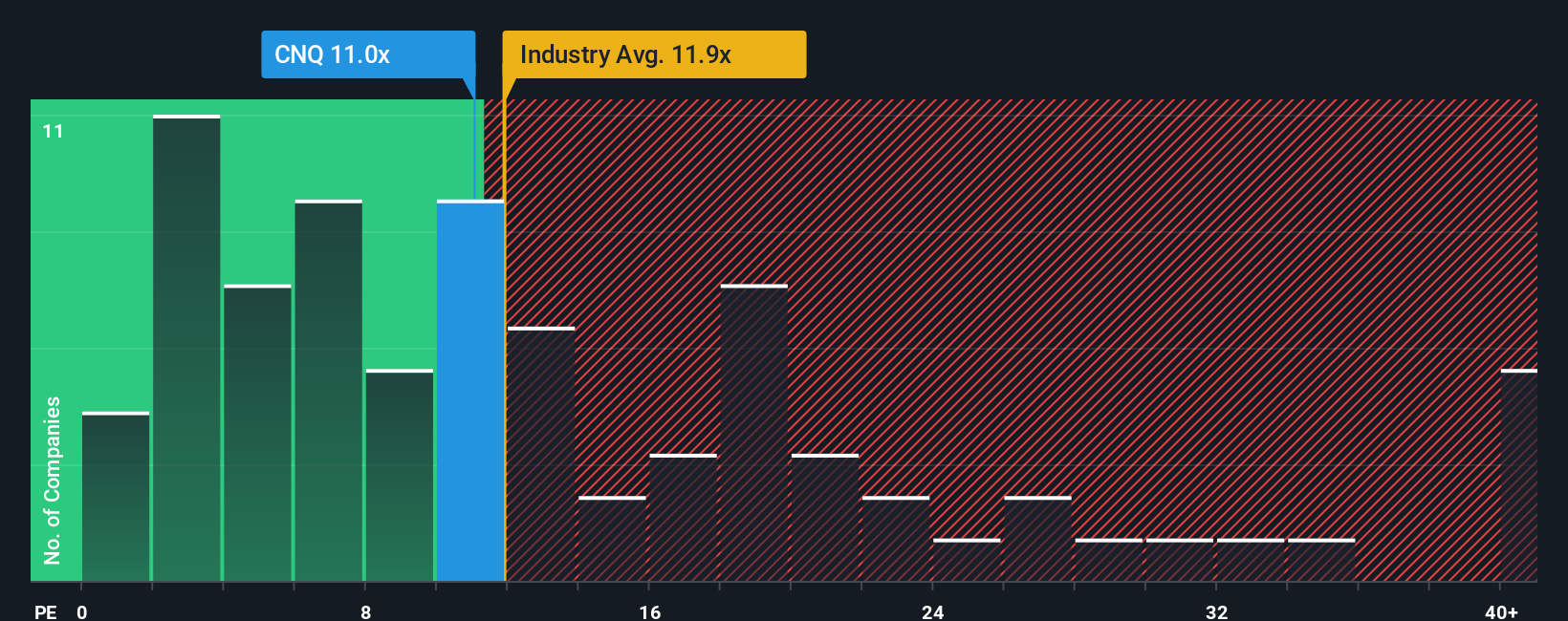

The Price-to-Earnings (PE) ratio is widely used for valuing profitable companies like Canadian Natural Resources, as it relates a company’s market price to its earning power. For established, consistently profitable businesses, it gives a quick snapshot of how much investors are willing to pay per dollar of earnings.

Growth prospects and risk appetite influence what a typical, or “fair,” PE ratio should be. Higher expected earnings growth often justifies a higher PE, while increased risk tends to pull it lower. Comparing these numbers with relevant benchmarks can shed light on whether a stock is trading at a premium or a discount.

Right now, Canadian Natural Resources trades at an 11.27x PE ratio. This is below both the average for its Oil and Gas peers (13.10x) and the industry average (12.52x), which might suggest it is undervalued on a surface-level comparison. However, it is also important to consider the unique financial characteristics of the company.

Simply Wall St’s proprietary “Fair Ratio” provides a more nuanced view. It incorporates the company’s growth outlook, profit margins, size, industry, and risk factors, giving a tailored benchmark. In this case, the Fair Ratio is 14.98x. This is clearly higher than both the company’s current PE and the industry average, meaning the market is pricing Canadian Natural Resources below its fair value based on its fundamentals.

Comparing these figures side by side, the stock appears attractively valued versus its own Fair Ratio benchmark.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1410 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Canadian Natural Resources Narrative

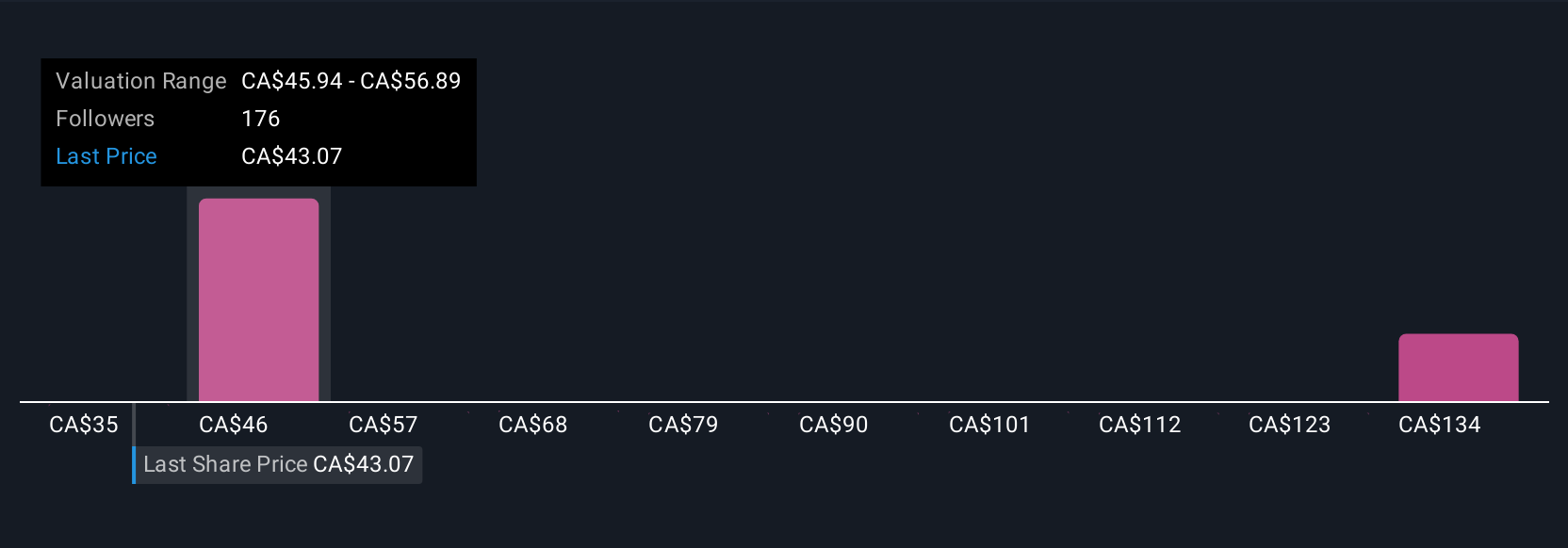

Earlier we mentioned there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is simply the story behind the numbers—your view of where the company is headed and why. Narratives connect what you believe about Canadian Natural Resources’ future to a financial forecast, which then leads to your own fair value for the stock.

This approach makes valuation more accessible and intuitive. On Simply Wall St’s Community page, millions of investors use Narratives to explain their perspectives, tie together future assumptions about revenue, earnings, and margins, and see how their expected fair value compares to today’s price. It becomes much easier to decide when a stock is undervalued enough to buy, or rich enough to consider selling.

The best part is, Narratives update automatically as new information, such as earnings releases or breaking news, changes the outlook. For example, analysts covering Canadian Natural Resources currently set price targets ranging from a bullish CA$62.00 to a more cautious CA$45.00 per share, based on differing assumptions about growth, margins, and market conditions. Narratives let you compare your story and valuation directly against other investors, so you can invest with clarity and confidence.

Do you think there's more to the story for Canadian Natural Resources? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:CNQ

Canadian Natural Resources

Engages in the acquisition, exploration, development, production, marketing, and sale of crude oil, natural gas, and natural gas liquids (NGLs) in Western Canada, the United Kingdom sector of the North Sea, and Offshore Africa.

Established dividend payer and good value.

Similar Companies

Market Insights

Community Narratives