- Canada

- /

- Oil and Gas

- /

- TSX:BTE

Baytex Energy (TSX:BTE): Evaluating Valuation After Latest Earnings, Dividend, and Production Update

Reviewed by Simply Wall St

Baytex Energy (TSX:BTE) released its third quarter results, highlighting a dip in both revenue and net income from the previous year. The company also reaffirmed its 2025 production targets and approved its next quarterly dividend, giving investors fresh details on its direction.

See our latest analysis for Baytex Energy.

Baytex Energy’s share price has surged an impressive 35% over the past 90 days, indicating renewed momentum as investors respond to its steady production targets and reliable dividend. Despite short-term volatility, the long-term outlook remains mixed, with a one-year total shareholder return of -4.9% and a five-year total return of over 550% for those who maintained their positions through different market cycles.

If you’re watching how energy stocks rebound on new outlooks, this could be a great time to broaden your horizons and discover fast growing stocks with high insider ownership

With a recent surge in share price but declining earnings and production, investors face a crucial question: is Baytex Energy undervalued at these levels, or is the market already pricing in all of its future growth?

Most Popular Narrative: 5.3% Undervalued

With Baytex Energy's fair value estimated at CA$3.95, analysts see about 5% upside from the recent close of CA$3.74, despite muted growth signals and margin pressures.

Baytex Energy's continuous improvement in drilling and completion efficiencies, particularly in the Eagle Ford and Pembina Duvernay plays, is expected to lead to improved capital costs and better production performance, which will likely impact revenue and net margins positively.

Want to know the secret formula behind this price target? The fair value builds on projected operational gains, evolving margins, and bold long-term performance assumptions. The full narrative reveals the surprising forecasts driving this call. Are you curious?

Result: Fair Value of $3.95 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent oil price volatility and uncertainty around tariffs on Canadian exports could quickly disrupt Baytex Energy’s projected earnings and fair value outlook.

Find out about the key risks to this Baytex Energy narrative.

Another View: What Do the Ratios Say?

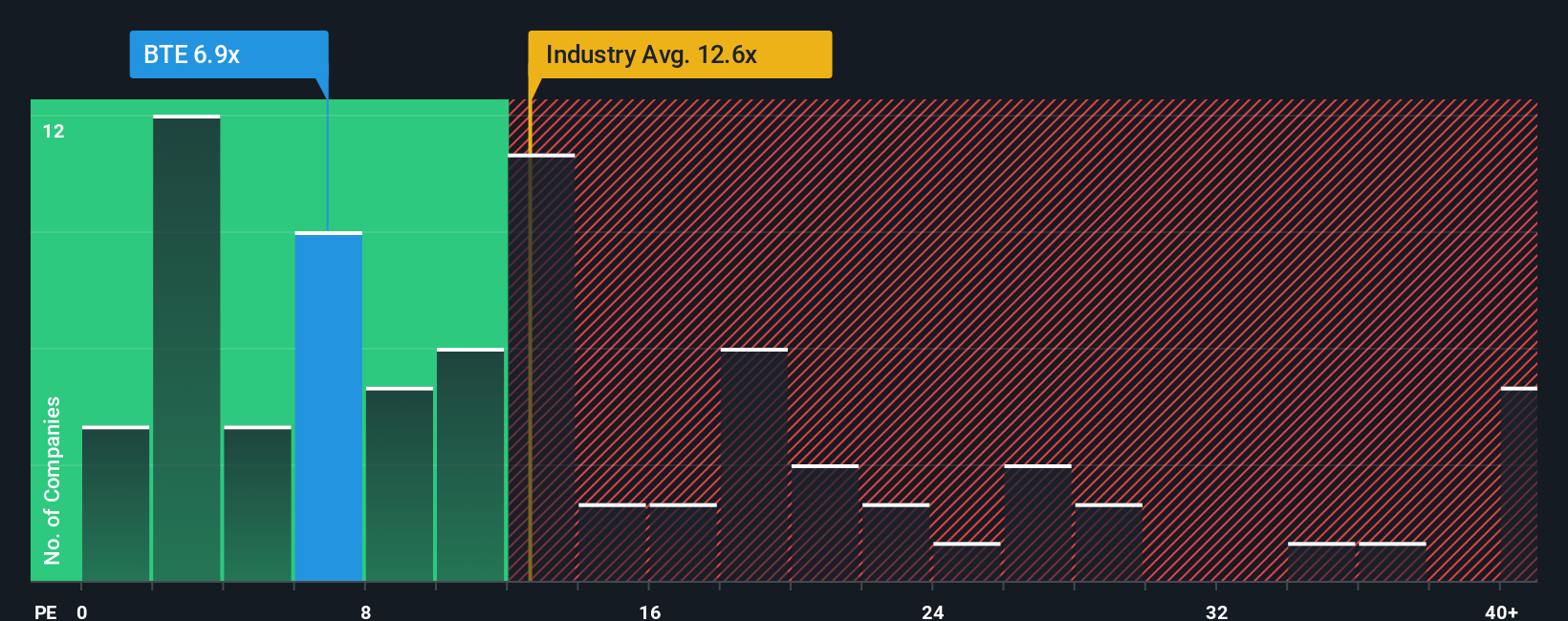

While analysts see Baytex Energy as undervalued with room to run, the latest price-to-earnings ratio of 13.4x actually sits below the Canadian market average of 16.4x and the industry average of 14x. However, it remains well above its own fair ratio of just 4.4x. This creates an interesting tension, as investors must weigh whether the stock's valuation truly offers upside or if the market is already cautious due to earnings risks.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Baytex Energy Narrative

If you see things differently or want to dig into the data firsthand, you can put together your own take on Baytex Energy in just a few minutes. Do it your way

A great starting point for your Baytex Energy research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors know that opportunities rarely knock twice. Take charge of your portfolio by tapping into these unique screens and get ahead of the next big trend.

- Tap new possibilities and find value by targeting companies trading below their intrinsic worth through these 855 undervalued stocks based on cash flows.

- Unlock income potential by selecting stocks with generous yields when you check out these 15 dividend stocks with yields > 3%.

- Fuel your portfolio's growth by following innovators at the forefront of machine learning and automation using these 25 AI penny stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Baytex Energy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:BTE

Baytex Energy

An energy company, engages in the acquisition, development, and production of crude oil and natural gas in the Western Canadian Sedimentary Basin and in the Eagle Ford, the United States.

Acceptable track record second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives