Baytex Energy Corp. (TSE:BTE) is about to trade ex-dividend in the next four days. The ex-dividend date occurs one day before the record date which is the day on which shareholders need to be on the company's books in order to receive a dividend. It is important to be aware of the ex-dividend date because any trade on the stock needs to have been settled on or before the record date. This means that investors who purchase Baytex Energy's shares on or after the 14th of June will not receive the dividend, which will be paid on the 2nd of July.

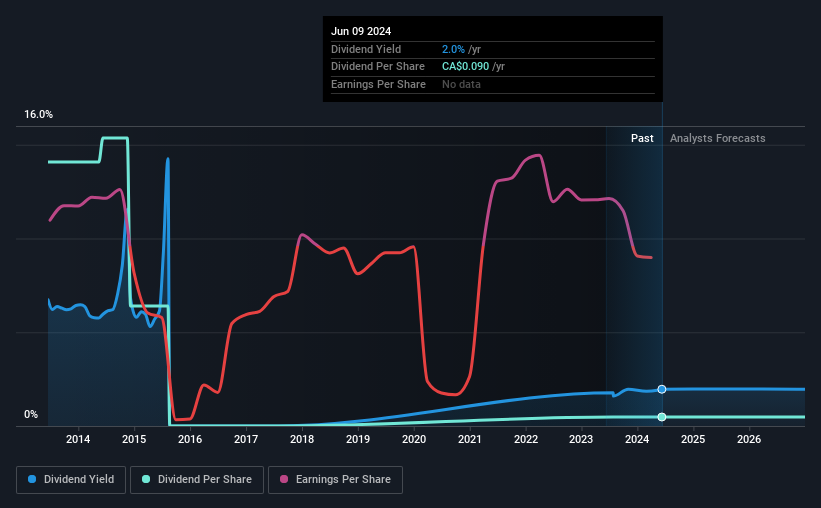

The company's next dividend payment will be CA$0.0225 per share. Last year, in total, the company distributed CA$0.09 to shareholders. Calculating the last year's worth of payments shows that Baytex Energy has a trailing yield of 2.0% on the current share price of CA$4.59. We love seeing companies pay a dividend, but it's also important to be sure that laying the golden eggs isn't going to kill our golden goose! We need to see whether the dividend is covered by earnings and if it's growing.

See our latest analysis for Baytex Energy

Dividends are usually paid out of company profits, so if a company pays out more than it earned then its dividend is usually at greater risk of being cut. Baytex Energy lost money last year, so the fact that it's paying a dividend is certainly disconcerting. There might be a good reason for this, but we'd want to look into it further before getting comfortable. With the recent loss, it's important to check if the business generated enough cash to pay its dividend. If Baytex Energy didn't generate enough cash to pay the dividend, then it must have either paid from cash in the bank or by borrowing money, neither of which is sustainable in the long term. Fortunately, it paid out only 25% of its free cash flow in the past year.

Click here to see the company's payout ratio, plus analyst estimates of its future dividends.

Have Earnings And Dividends Been Growing?

Stocks in companies that generate sustainable earnings growth often make the best dividend prospects, as it is easier to lift the dividend when earnings are rising. Investors love dividends, so if earnings fall and the dividend is reduced, expect a stock to be sold off heavily at the same time. Baytex Energy was unprofitable last year, but at least the general trend suggests its earnings have been improving over the past five years. Even so, an unprofitable company whose business does not quickly recover is usually not a good candidate for dividend investors.

Many investors will assess a company's dividend performance by evaluating how much the dividend payments have changed over time. Baytex Energy's dividend payments per share have declined at 29% per year on average over the past 10 years, which is uninspiring.

We update our analysis on Baytex Energy every 24 hours, so you can always get the latest insights on its financial health, here.

To Sum It Up

Has Baytex Energy got what it takes to maintain its dividend payments? We're a bit uncomfortable with it paying a dividend while being loss-making. However, we note that the dividend was covered by cash flow. Overall we're not hugely bearish on the stock, but there are likely better dividend investments out there.

While it's tempting to invest in Baytex Energy for the dividends alone, you should always be mindful of the risks involved. For example, Baytex Energy has 3 warning signs (and 1 which makes us a bit uncomfortable) we think you should know about.

A common investing mistake is buying the first interesting stock you see. Here you can find a full list of high-yield dividend stocks.

Valuation is complex, but we're here to simplify it.

Discover if Baytex Energy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:BTE

Baytex Energy

An energy company, engages in the acquisition, development, and production of crude oil and natural gas in the Western Canadian Sedimentary Basin and in the Eagle Ford, the United States.

Very undervalued with moderate growth potential.