Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. We note that BNK Petroleum Inc. (TSE:BKX) does have debt on its balance sheet. But is this debt a concern to shareholders?

When Is Debt Dangerous?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. The first step when considering a company's debt levels is to consider its cash and debt together.

View our latest analysis for BNK Petroleum

What Is BNK Petroleum's Debt?

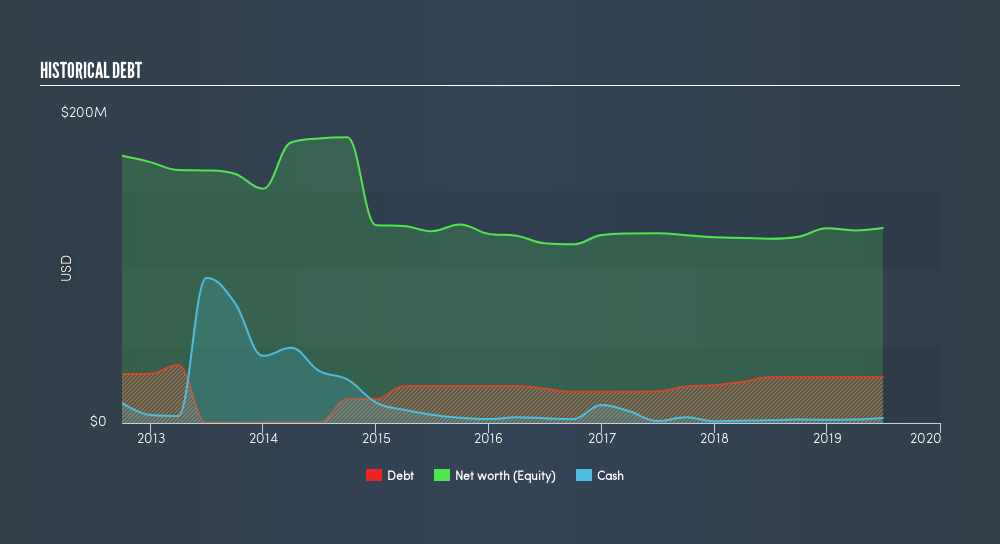

The chart below, which you can click on for greater detail, shows that BNK Petroleum had US$29.6m in debt in June 2019; about the same as the year before. However, it does have US$3.31m in cash offsetting this, leading to net debt of about US$26.3m.

A Look At BNK Petroleum's Liabilities

We can see from the most recent balance sheet that BNK Petroleum had liabilities of US$6.21m falling due within a year, and liabilities of US$30.8m due beyond that. On the other hand, it had cash of US$3.31m and US$2.30m worth of receivables due within a year. So its liabilities total US$31.4m more than the combination of its cash and short-term receivables.

This is a mountain of leverage relative to its market capitalization of US$32.3m. Should its lenders demand that it shore up the balance sheet, shareholders would likely face severe dilution.

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

BNK Petroleum has net debt worth 1.7 times EBITDA, which isn't too much, but its interest cover looks a bit on the low side, with EBIT at only 4.2 times the interest expense. While that doesn't worry us too much, it does suggest the interest payments are somewhat of a burden. We also note that BNK Petroleum improved its EBIT from a last year's loss to a positive US$8.9m. There's no doubt that we learn most about debt from the balance sheet. But it is BNK Petroleum's earnings that will influence how the balance sheet holds up in the future. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. So it is important to check how much of its earnings before interest and tax (EBIT) converts to actual free cash flow. In the last year, BNK Petroleum created free cash flow amounting to 7.9% of its EBIT, an uninspiring performance. For us, cash conversion that low sparks a little paranoia about is ability to extinguish debt.

Our View

On the face of it, BNK Petroleum's level of total liabilities left us tentative about the stock, and its conversion of EBIT to free cash flow was no more enticing than the one empty restaurant on the busiest night of the year. But at least its net debt to EBITDA is not so bad. Looking at the bigger picture, it seems clear to us that BNK Petroleum's use of debt is creating risks for the company. If all goes well, that should boost returns, but on the flip side, the risk of permanent capital loss is elevated by the debt. Over time, share prices tend to follow earnings per share, so if you're interested in BNK Petroleum, you may well want to click here to check an interactive graph of its earnings per share history.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About TSX:KEI

Kolibri Global Energy

Engages in the exploration and exploitation of oil, gas, and clean and sustainable energy reserves in the United States.

Undervalued with reasonable growth potential.

Market Insights

Community Narratives