- Canada

- /

- Oil and Gas

- /

- TSX:AAV

Advantage Energy (TSX:AAV): Evaluating Valuation Following Recent Share Price Movement

Reviewed by Simply Wall St

Advantage Energy (TSX:AAV) has caught investor attention lately after its shares moved higher by nearly 2.4% in the latest session. With recent price shifts and ongoing volatility across energy markets, investors may be weighing the company’s long-term value potential.

See our latest analysis for Advantage Energy.

Advantage Energy’s share price has seen some ups and downs this year. While recent days brought another spike, the stock’s momentum is modest compared to its standout 27% total shareholder return over the past twelve months. Investors appear to be weighing both the company’s strong multi-year performance and the shifting sentiment in energy markets.

If you’re curious about where opportunity may strike next in energy and resources, you might want to see what’s on the move with fast growing stocks with high insider ownership

But with the stock still trading at a notable discount to analyst targets and boasting strong revenue and income growth, the big question is whether investors are overlooking hidden value or if the market has already considered future gains.

Most Popular Narrative: 21.4% Undervalued

Advantage Energy’s fair value, according to the most watched narrative, stands well above the last closing price. This sets expectations high against the backdrop of strong growth trends and a discounted share price.

Expansion and optimization of Advantage’s Charlie Lake and processing assets, demonstrated by outperformance versus budget curves and improved operating netback, support higher production volumes and operating leverage. These factors should contribute to higher corporate cash flow and net margins over the long term.

Wondering what fuels this head-turning price target? The narrative blends bullish operational forecasts with margin boosts and a dramatic profit surge. Discover which pivotal strategic levers and financial turning points drive this ambitious valuation. Dive in for the quantitative secrets behind the optimism.

Result: Fair Value of $14.16 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent infrastructure bottlenecks or a sharp shift toward renewables could quickly weaken Advantage Energy’s long-term prospects and valuation outlook.

Find out about the key risks to this Advantage Energy narrative.

Another View: The Multiples Perspective

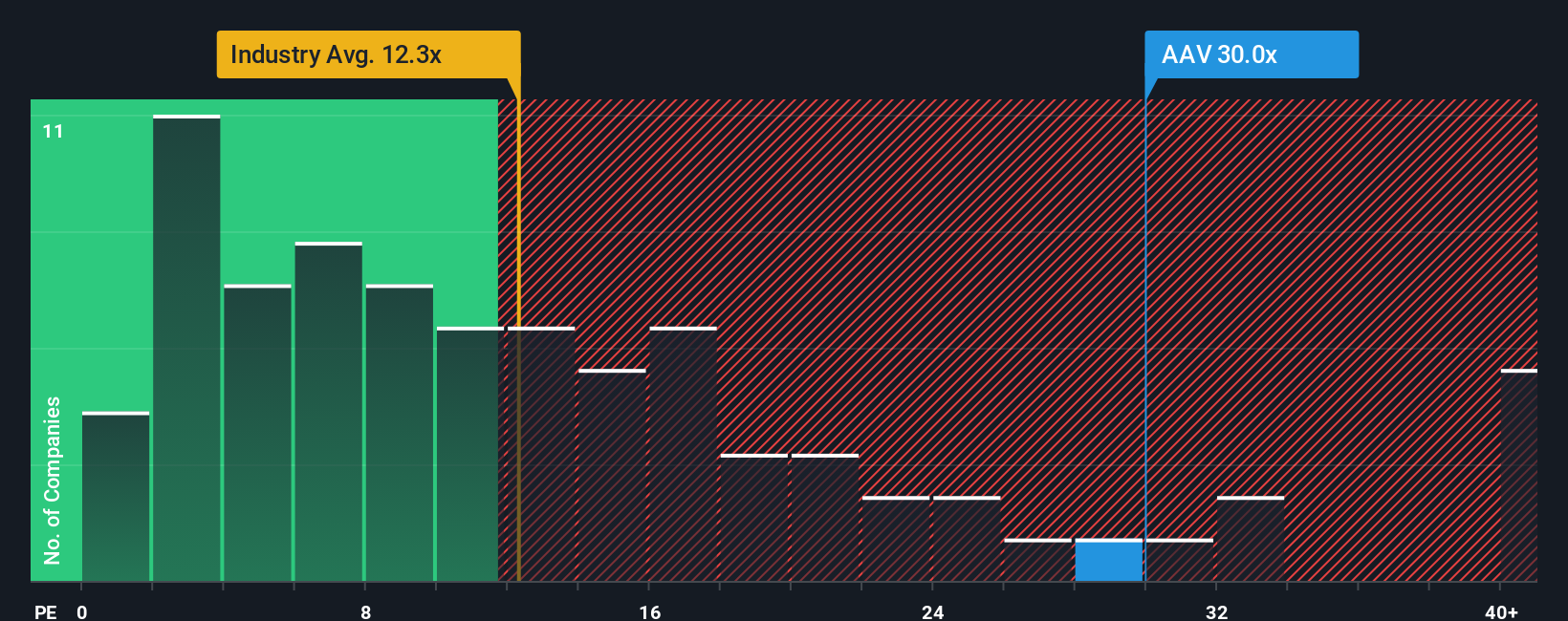

While the fair value estimate points to undervaluation, a look at Advantage Energy’s current price-to-earnings ratio paints a different picture. Trading at 30.7x earnings, the stock stands well above both the Canadian industry average of 12.3x and its fair ratio of 22.9x. This suggests investors are paying a premium, which may leave less room for upside.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Advantage Energy Narrative

If you’re keen to dig deeper or have your own viewpoint on Advantage Energy, you can build your own narrative using the latest data in just a few minutes. Do it your way

A great starting point for your Advantage Energy research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Don’t stop with just one opportunity. The smartest investors are always one step ahead by tracking fresh opportunities across different trends using the Simply Wall Street Screener.

- Position yourself for powerful returns by tapping into these 835 undervalued stocks based on cash flows driven by robust cash flows and overlooked growth.

- Boost your portfolio's income stream when you browse these 22 dividend stocks with yields > 3% featuring stocks that consistently reward shareholders with yields above 3%.

- Get a jump on tomorrow's breakthroughs as you explore these 28 quantum computing stocks that are pioneering the future of computing and redefining what is possible.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:AAV

Advantage Energy

Engages in the acquisition, exploitation, development, and production natural gas, crude oil, and natural gas liquids (NGLs) in the Province of Alberta, Canada.

High growth potential with solid track record.

Market Insights

Community Narratives