- Canada

- /

- Oil and Gas

- /

- TSXV:SYH

3 TSX Penny Stocks With Market Caps Over CA$30M To Watch

Reviewed by Simply Wall St

The TSX is experiencing a strong year, with gains exceeding 17%, reflecting a broader trend of market optimism fueled by economic growth, favorable central bank policies, and rising corporate profits. Amidst this positive backdrop, penny stocks remain an intriguing area for investors seeking affordability and potential growth. Although the term 'penny stocks' might seem outdated, these smaller or newer companies can offer significant opportunities when they possess solid financials and a clear path to expansion.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Financial Health Rating |

| PetroTal (TSX:TAL) | CA$0.68 | CA$620.88M | ★★★★★★ |

| Findev (TSXV:FDI) | CA$0.41 | CA$11.75M | ★★★★★☆ |

| Winshear Gold (TSXV:WINS) | CA$0.165 | CA$4.4M | ★★★★★★ |

| Mandalay Resources (TSX:MND) | CA$3.24 | CA$297.04M | ★★★★★★ |

| Pulse Seismic (TSX:PSD) | CA$2.29 | CA$119.71M | ★★★★★★ |

| Amerigo Resources (TSX:ARG) | CA$1.80 | CA$303.41M | ★★★★★☆ |

| Foraco International (TSX:FAR) | CA$2.40 | CA$221.84M | ★★★★★☆ |

| East West Petroleum (TSXV:EW) | CA$0.035 | CA$3.17M | ★★★★★★ |

| Newport Exploration (TSXV:NWX) | CA$0.115 | CA$12.14M | ★★★★★★ |

| NamSys (TSXV:CTZ) | CA$1.11 | CA$30.89M | ★★★★★★ |

Click here to see the full list of 947 stocks from our TSX Penny Stocks screener.

We'll examine a selection from our screener results.

Sama Resources (TSXV:SME)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Sama Resources Inc. is involved in the exploration and development of mineral properties in West Africa, with a market cap of CA$31.91 million.

Operations: Currently, there are no reported revenue segments for Sama Resources Inc.

Market Cap: CA$31.91M

Sama Resources Inc., with a market cap of CA$31.91 million, remains pre-revenue with no significant revenue streams reported. Despite being unprofitable, the company has reduced its losses significantly over the past five years by 47.1% annually. Recent earnings showed a net income of CA$5.23 million for the first half of 2024, an improvement from last year’s CA$0.32 million, although earnings per share remain low at CA$0.024. The company benefits from having no debt and experienced management and board teams with average tenures exceeding ten years, suggesting solid leadership stability amidst its financial challenges.

- Jump into the full analysis health report here for a deeper understanding of Sama Resources.

- Gain insights into Sama Resources' past trends and performance with our report on the company's historical track record.

Skyharbour Resources (TSXV:SYH)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Skyharbour Resources Ltd. is involved in the acquisition, exploration, and evaluation of uranium mineral properties with a market cap of CA$89.44 million.

Operations: Skyharbour Resources Ltd. does not have reported revenue segments as it focuses on the acquisition, exploration, and evaluation of uranium mineral properties.

Market Cap: CA$89.44M

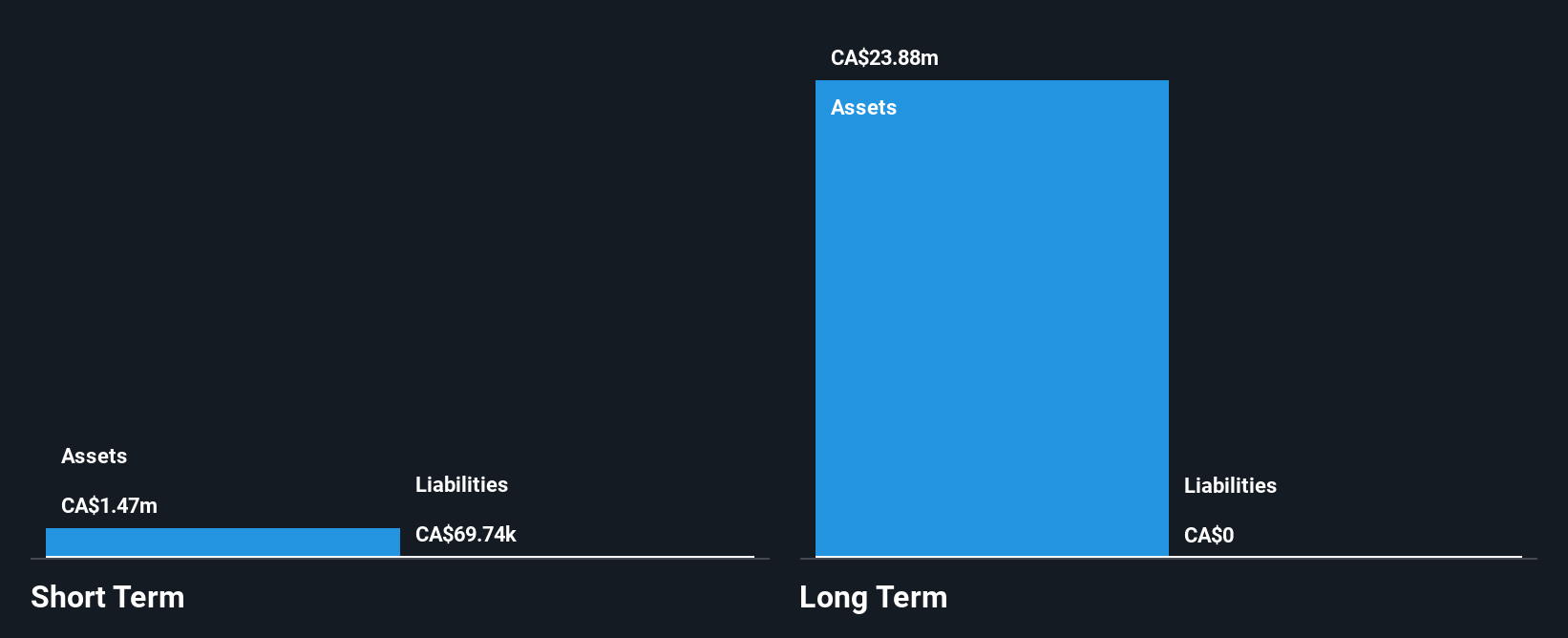

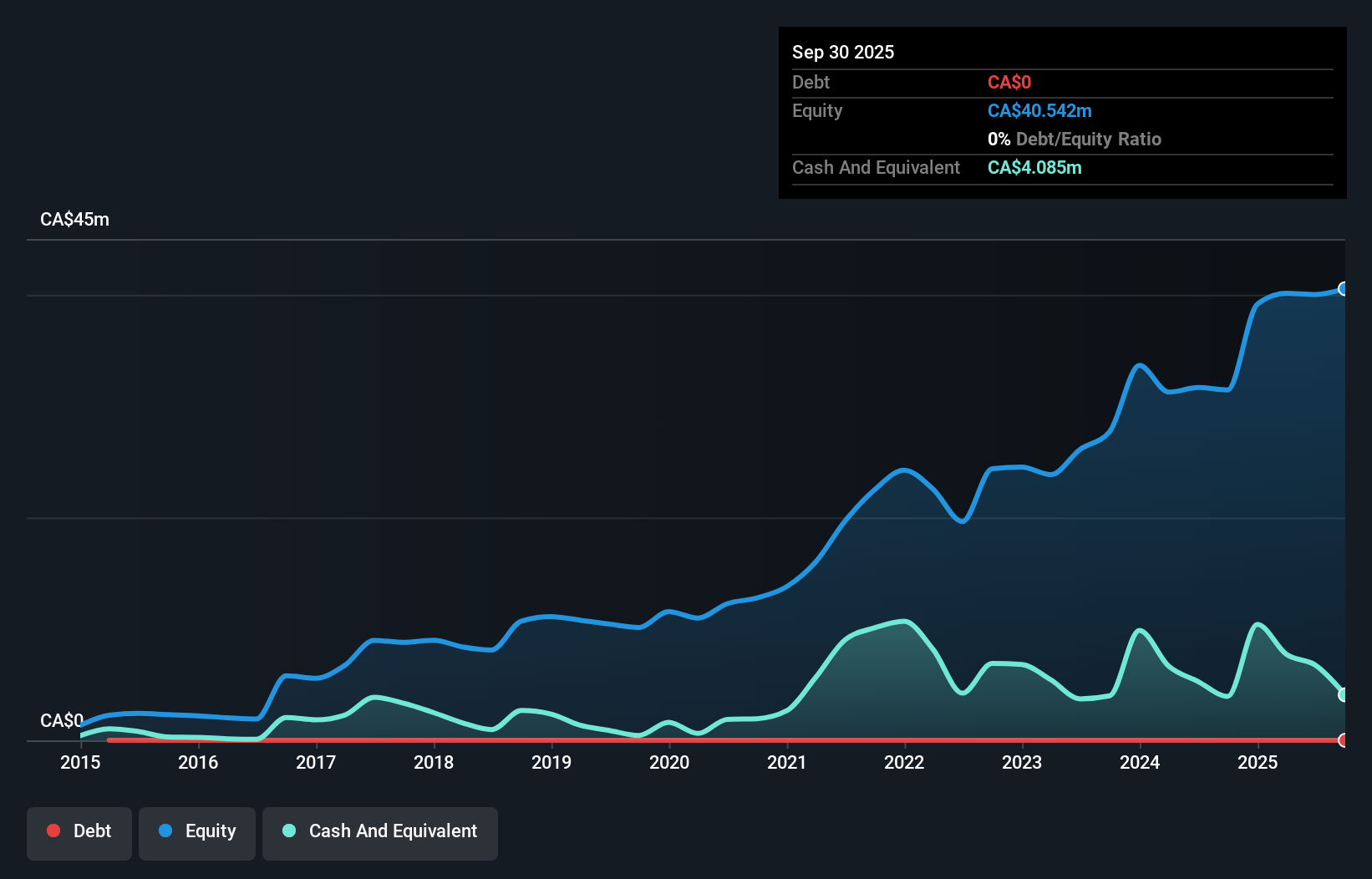

Skyharbour Resources Ltd., with a market cap of CA$89.44 million, is pre-revenue and focused on uranium exploration in Canada. The company has entered into several earn-in option agreements, potentially bringing over CA$38 million in partner-funded exploration expenditures. Despite being unprofitable and having less than a year of cash runway, Skyharbour remains debt-free with short-term assets exceeding liabilities. Recent developments include an option agreement with UraEx Resources for its South Dufferin and Bolt Uranium Projects, alongside ongoing drilling at the Moore Project aimed at expanding high-grade uranium zones, highlighting its strategic focus on resource development.

- Take a closer look at Skyharbour Resources' potential here in our financial health report.

- Evaluate Skyharbour Resources' historical performance by accessing our past performance report.

Westaim (TSXV:WED)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: The Westaim Corporation is a private equity firm that engages in direct and indirect investments through various financial arrangements, with a market cap of CA$603.69 million.

Operations: Westaim has not reported any specific revenue segments.

Market Cap: CA$603.69M

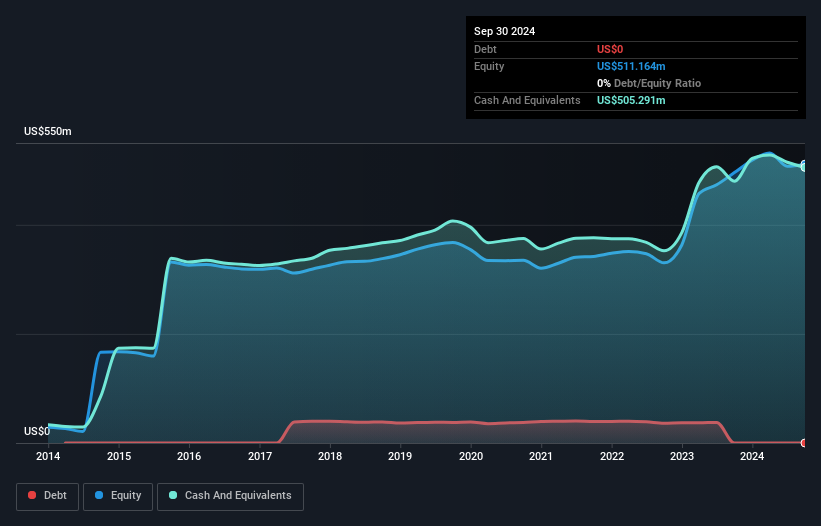

Westaim Corporation, with a market cap of CA$603.69 million, is debt-free and has short-term assets significantly exceeding its liabilities. Despite experiencing negative earnings growth over the past year and declining profit margins from 91.7% to 61.8%, Westaim's earnings have grown significantly over the past five years at an impressive rate. Recent developments include a proposed private placement expected to raise CAD 343.83 million, involving significant equity interest changes, and a potential share repurchase program valued up to CAD 100 million, reflecting strategic financial maneuvers aimed at enhancing shareholder value amidst fluctuating profitability metrics.

- Dive into the specifics of Westaim here with our thorough balance sheet health report.

- Gain insights into Westaim's historical outcomes by reviewing our past performance report.

Seize The Opportunity

- Navigate through the entire inventory of 947 TSX Penny Stocks here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:SYH

Skyharbour Resources

Engages in acquisition, exploration, and evaluation of uranium mineral properties.

Moderate with adequate balance sheet.