- Canada

- /

- Capital Markets

- /

- TSX:SII

Sprott (TSX:SII) Earnings Growth Tops Five-Year Trend, Reinforcing Quality Narrative

Reviewed by Simply Wall St

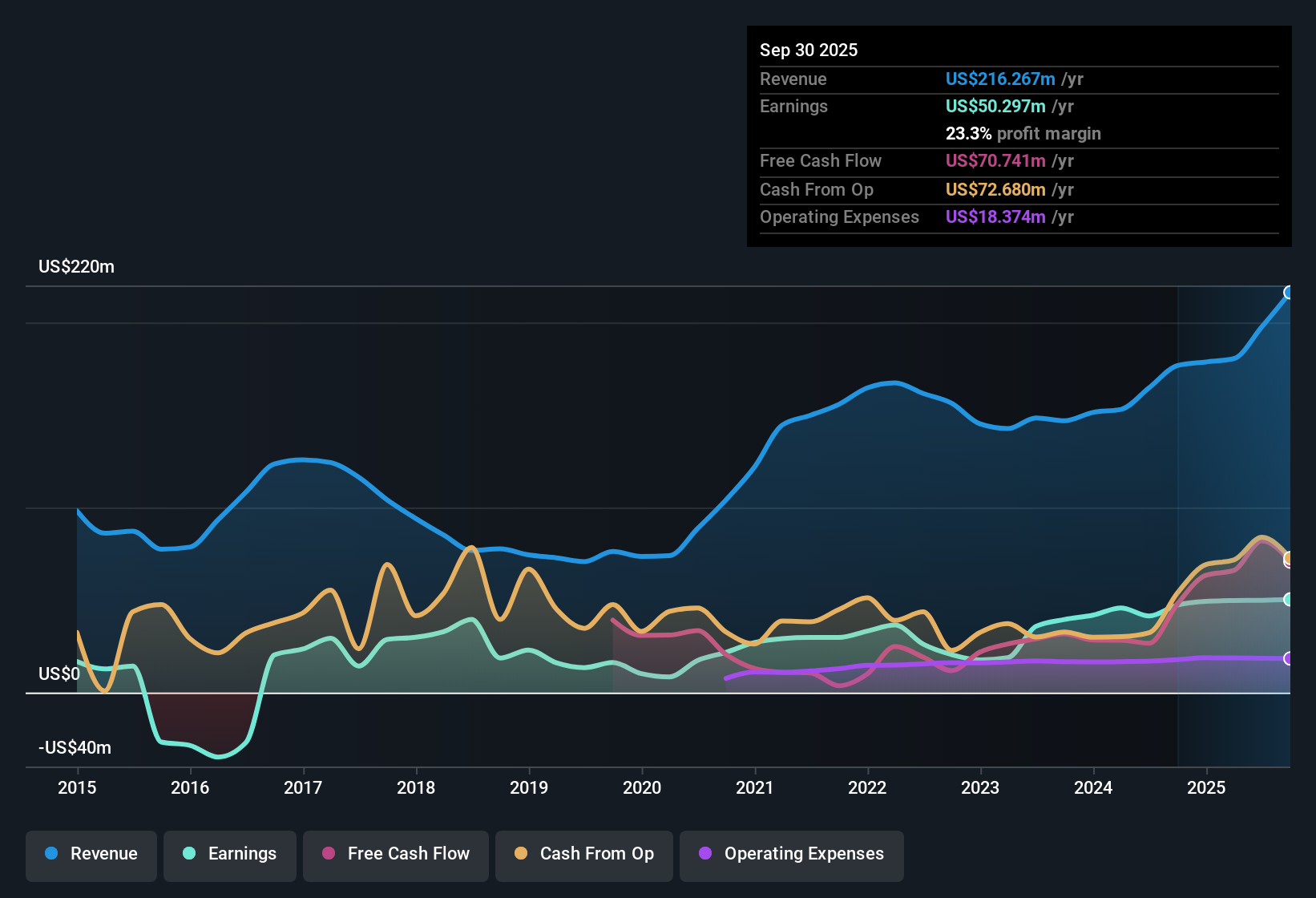

Sprott (TSX:SII) delivered consistent earnings and revenue performance in its latest results, with earnings climbing 20.5% year-over-year, which is well ahead of the company’s 5-year annual average of 16.1%. Revenue growth is forecast at 10.3% per year, outpacing the Canadian market’s expected 5.1%, while net profit margin edged higher to 25.2% compared to last year’s 25.1%. Despite the stock trading at a notable premium with a price-to-earnings ratio of 43.4x and shares changing hands well above fair value at CA$118.4, analysts recognize Sprott for its high quality earnings and positive record of growth.

See our full analysis for Sprott.The next step is to see how these headline numbers line up against the widely followed narratives for Sprott. Some perspectives may be validated by the data, while others could be called into question.

Curious how numbers become stories that shape markets? Explore Community Narratives

Net Profit Margin Holds Steady Above 25%

- Sprott’s net profit margin rose marginally to 25.2%, edging above last year’s 25.1% and indicating that the company continues to retain one of the strongest profitability profiles among Canadian capital markets firms.

- What is notable in the prevailing market view is that this consistent margin strength, paired with sustained revenue gains, heavily supports the idea that Sprott’s specialized focus on alternative asset management is paying off for both clients and shareholders.

- With margins remaining solidly above 25%, the numbers reinforce a key bullish argument that Sprott’s niche exposure, especially in precious metals and real assets, helps shield profitability from typical fee compression risks.

- Despite industry competition and sector trends, Sprott’s stable margins suggest its differentiated approach continues to attract flows and validate investor confidence in its strategy.

Growth Forecasts Surpass Market Averages

- Revenue is projected to increase by 10.3% per year for Sprott, effectively doubling the broader Canadian market’s 5.1% annual growth outlook.

- The prevailing view highlights that this optimistic forecast anchors bullish confidence, as Sprott’s growth prospects outpace the industry, even without any major flagged risks or headwinds.

- Analysts’ continued positive expectations for both profit and revenue are repeatedly cited, showing that Sprott’s growth runway appears meaningfully above sector norms.

- With this superior growth profile, Sprott maintains its reputation as one of the region’s high-quality earnings generators, further easing concerns about downside risks typically associated with asset managers.

Valuation Premium Far Above Fair Value

- Sprott’s shares trade at CA$118.40, nearly triple its DCF fair value of CA$39.50 and at a price-to-earnings multiple of 43.4x, which far exceeds both the Canadian capital markets industry average (9.6x) and peer levels (16.1x).

- This sharp premium creates a tension in the prevailing perspective, as even strong growth and stable margins may not fully justify such a high valuation relative to industry standards.

- Investors need to weigh if Sprott’s scarcity and resilience warrant paying several times sector multiples or if price is running ahead of fundamentals.

- The clear gap to DCF fair value is a reminder that even admired quality can carry valuation risks once momentum stretches too far.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Sprott's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

Explore Alternatives

Despite Sprott’s impressive growth and profitability, its shares currently trade at a substantial premium to both fair value and industry averages. This poses valuation risks for investors.

If you want to focus on companies trading closer to their underlying worth, check out these 843 undervalued stocks based on cash flows to spot opportunities with stronger value upside and less pricing risk.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:SII

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives