Dundee Precious Metals And 2 More Undervalued Small Caps With Insider Actions In Canada

Reviewed by Simply Wall St

As central banks like the Bank of Canada adjust interest rates in response to evolving economic indicators, the landscape for investments, particularly in small-cap stocks, is also shifting. In this context, identifying undervalued small caps such as Dundee Precious Metals becomes crucial, especially when these selections are backed by significant insider actions suggesting confidence from those who know the companies best.

Top 10 Undervalued Small Caps With Insider Buying In Canada

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Nexus Industrial REIT | 2.4x | 3.0x | 20.77% | ★★★★★★ |

| Dundee Precious Metals | 8.4x | 2.9x | 45.21% | ★★★★★☆ |

| Primaris Real Estate Investment Trust | 11.2x | 2.9x | 36.95% | ★★★★★☆ |

| Calfrac Well Services | 2.3x | 0.2x | 6.77% | ★★★★☆☆ |

| Guardian Capital Group | 10.6x | 4.1x | 31.39% | ★★★★☆☆ |

| Sagicor Financial | 1.2x | 0.4x | -93.83% | ★★★★☆☆ |

| Trican Well Service | 8.3x | 1.0x | -15.83% | ★★★☆☆☆ |

| Westshore Terminals Investment | 14.3x | 3.8x | 2.22% | ★★★☆☆☆ |

| Russel Metals | 8.7x | 0.5x | -1.38% | ★★★☆☆☆ |

| Freehold Royalties | 15.3x | 6.6x | 49.17% | ★★★☆☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

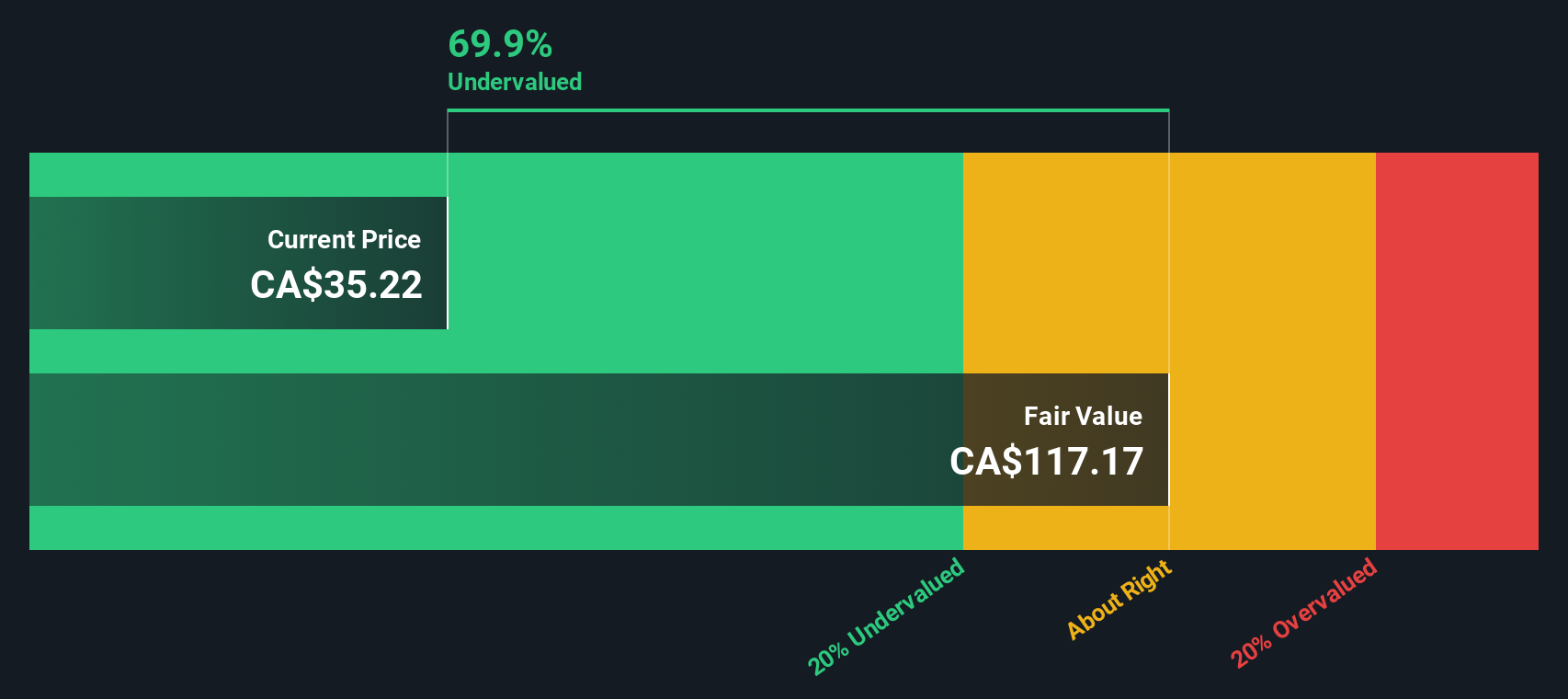

Dundee Precious Metals (TSX:DPM)

Simply Wall St Value Rating: ★★★★★☆

Overview: Dundee Precious Metals is a gold and copper mining company with operations at Ada Tepe and Chelopech, boasting a market capitalization of approximately $1.08 billion.

Operations: Ada Tepe and Chelopech generated revenues of $243.33 million and $274.18 million respectively, contributing to a gross profit margin that peaked at 55.29% in the latest quarter. The company's net income margin also showed significant growth, reaching up to 55.32% in the same period.

PE: 8.4x

Dundee Precious Metals, a notable player in the metals sector, recently underscored its growth potential by reaffirming its robust 2024 production guidance and declaring a consistent quarterly dividend. With insider confidence highlighted by recent strategic executive appointments, the company is poised for further development. Particularly compelling is their Coka Rakita project in Serbia, expected to significantly boost production with favorable cost metrics, reflecting strong operational capabilities and regional synergies. This project not only promises high-grade gold output but also leverages existing infrastructure and Dundee's seasoned expertise in underground mining.

- Dive into the specifics of Dundee Precious Metals here with our thorough valuation report.

Understand Dundee Precious Metals' track record by examining our Past report.

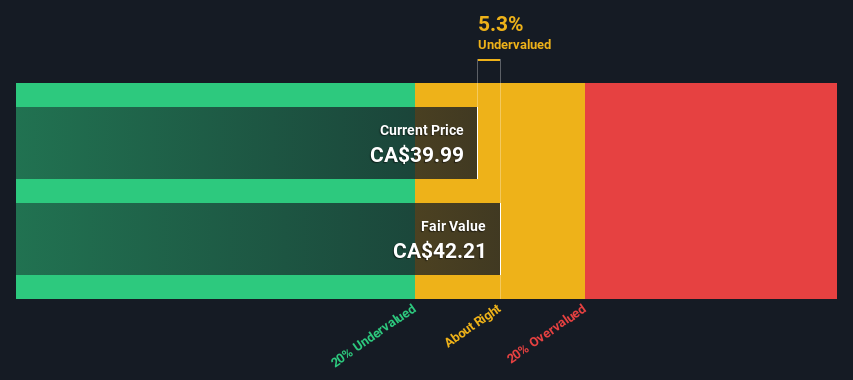

Guardian Capital Group (TSX:GCG.A)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Guardian Capital Group is a financial services company specializing in investment management and corporate activities, with a market capitalization of approximately CA$0.71 billion.

Operations: The company generates significant revenue from its Investment Management and Wealth Management services, totaling CA$198.91 million, complemented by CA$51.50 million from Corporate Activities and Investments. Over recent periods, it has experienced a gross profit margin ranging between 48% to 53%, reflecting its cost management in relation to revenue generation activities.

PE: 10.6x

Guardian Capital Group, reflecting a strategic confidence through recent insider purchases, has seen insiders acquiring shares, signaling strong belief in the company's prospects. Despite a challenging backdrop with a 15.7% annual decline in earnings over the past five years, they reported a robust first quarter in 2024 with revenues rising to CAD 62.5 million from CAD 54.49 million year-over-year. Additionally, their commitment to shareholder value is evident from the repurchase of 94,000 shares for CAD 4.15 million within the first quarter of this year alone. This blend of insider activity and financial maneuvers positions Guardian as an intriguing entity within Canada's investment landscape.

- Take a closer look at Guardian Capital Group's potential here in our valuation report.

Explore historical data to track Guardian Capital Group's performance over time in our Past section.

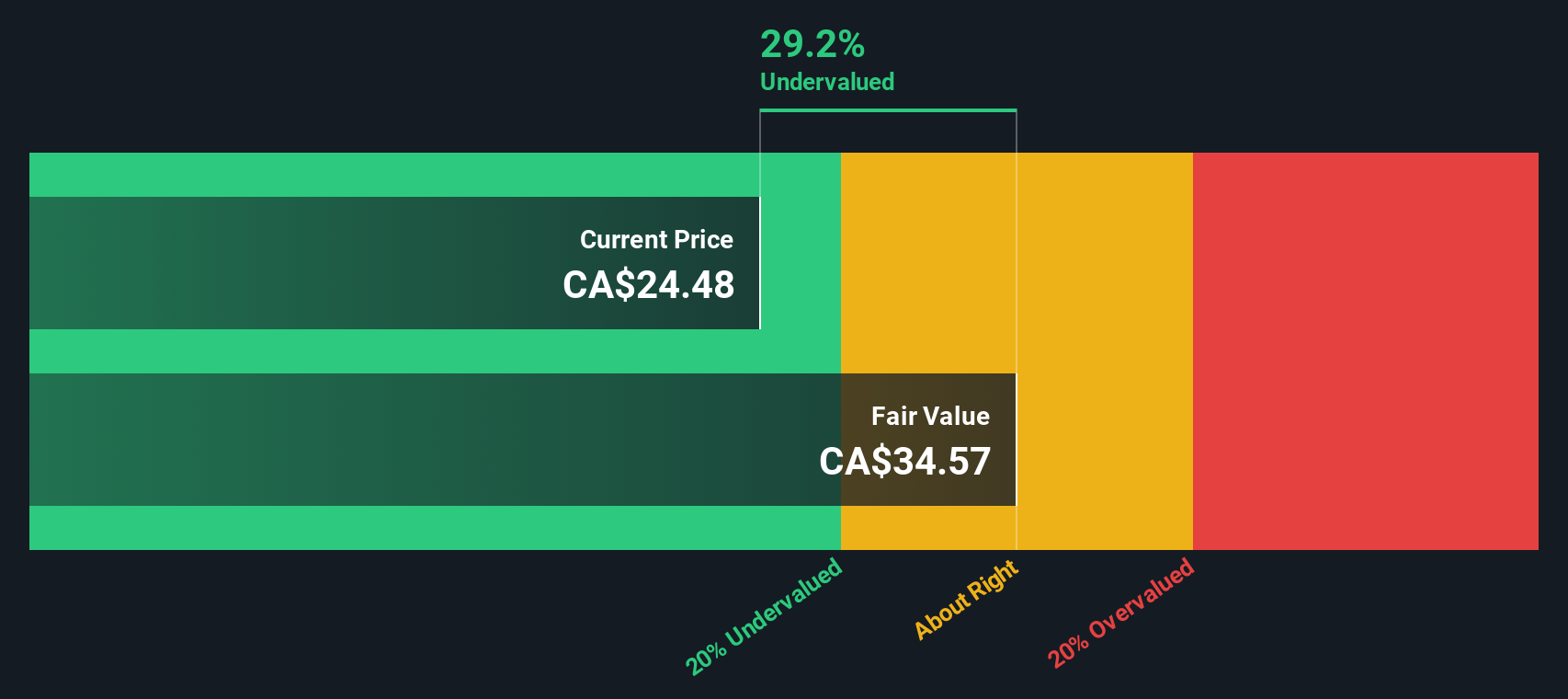

Softchoice (TSX:SFTC)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Softchoice is a technology company specializing in IT solutions and services, with a market capitalization of approximately $1.2 billion.

Operations: Direct Marketing generated $777.35 million in revenue, with a notable gross profit margin increase to 41.82% by mid-2024, reflecting an upward trend from 23.91% at the end of 2018. This segment has seen a consistent rise in gross profitability over recent periods, indicating improved operational efficiency or pricing strategies.

PE: 20.1x

Softchoice, a lesser-known player in the Canadian market, recently showcased its agility by presenting at the CIBC Technology & Innovation Conference. Despite a challenging quarter with sales dropping to US$169.76 million and a net loss of US$1.03 million, insider confidence remains strong; they recently increased their dividend by 18%. This decision reflects an optimistic outlook on future cash flows and profitability, suggesting that current market prices may not fully reflect the company's intrinsic value.

- Navigate through the intricacies of Softchoice with our comprehensive valuation report here.

Review our historical performance report to gain insights into Softchoice's's past performance.

Seize The Opportunity

- Delve into our full catalog of 34 Undervalued TSX Small Caps With Insider Buying here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:SFTC

Softchoice

Designs, procures, implements, and manages information technology (IT) solutions in Canada and the United States.

Undervalued with proven track record.