- Canada

- /

- Capital Markets

- /

- TSX:FIH.U

Should Fairfax India Holdings’ Third-Quarter Volatility Prompt a Strategic Reassessment for TSX:FIH.U Investors?

Reviewed by Sasha Jovanovic

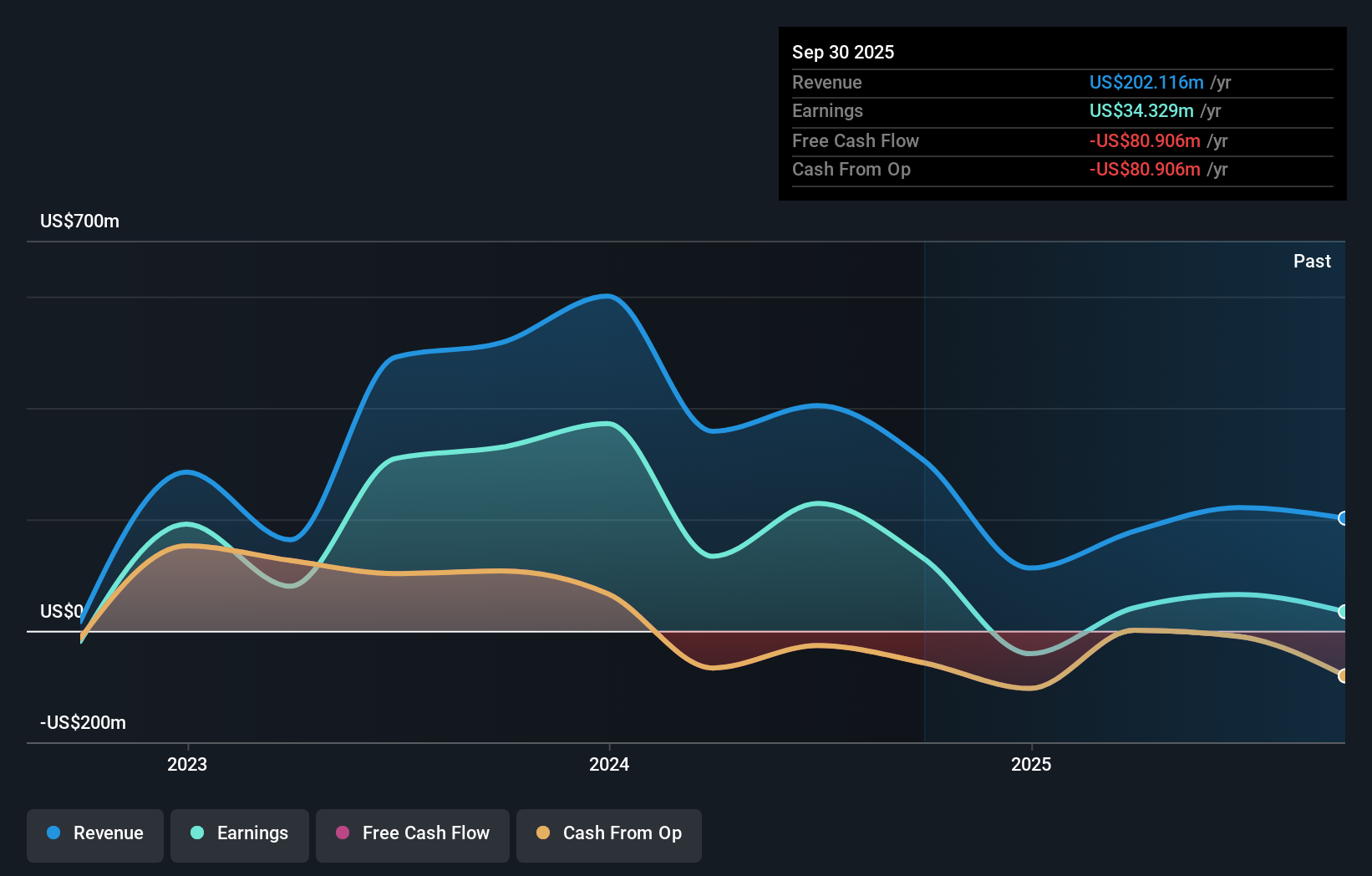

- Fairfax India Holdings reported its third quarter 2025 results, revealing revenue of US$49.03 million and net income of US$3.22 million, both materially lower than the same period last year.

- While quarterly profit dropped significantly, strong nine-month net income highlights meaningful year-to-date performance improvement from a net loss the prior year.

- We'll examine how Fairfax India Holdings' unexpected third-quarter earnings volatility shapes its current investment narrative and outlook.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

What Is Fairfax India Holdings' Investment Narrative?

To believe in Fairfax India Holdings as a shareholder, you need to buy into the story of resilient long-term value from unique India-focused investments, despite considerable short-term bumps. The stunning drop in third-quarter revenue and net income punctuates just how volatile this holding company’s earnings profile can be, mostly due to its concentrated portfolio and reliance on large one-off gains or losses. That being said, the latest earnings miss may moderately impact some short-term expectation resets, but given the nine-month net income rebound from a prior-year loss, the broad investment thesis is still more about compounding over time than quarter-to-quarter swings. Still, this news does make catalysts like improving net profit margins and executing on new leadership or capital allocation strategies feel more urgent, while exacerbating familiar risks like expensive valuation and lack of earnings momentum. For now, this quarter is a cautionary note, not a knockout blow to the investment case.

But on the risk side, valuation concerns now seem harder to ignore given recent volatility. Fairfax India Holdings' share price has been on the slide but might be dropping deeper into value territory. Find out whether it's a bargain at this price.Exploring Other Perspectives

Explore another fair value estimate on Fairfax India Holdings - why the stock might be worth as much as $8.06!

Build Your Own Fairfax India Holdings Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Fairfax India Holdings research is our analysis highlighting 2 important warning signs that could impact your investment decision.

- Our free Fairfax India Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Fairfax India Holdings' overall financial health at a glance.

Want Some Alternatives?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:FIH.U

Fairfax India Holdings

Operates as an investment holding company in India.

Adequate balance sheet with very low risk.

Market Insights

Community Narratives