- Canada

- /

- Commercial Services

- /

- TSX:EFN

Should You Be Adding Element Fleet Management (TSE:EFN) To Your Watchlist Today?

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in Element Fleet Management (TSE:EFN). While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

View our latest analysis for Element Fleet Management

Element Fleet Management's Earnings Per Share Are Growing

If you believe that markets are even vaguely efficient, then over the long term you'd expect a company's share price to follow its earnings per share (EPS) outcomes. So it makes sense that experienced investors pay close attention to company EPS when undertaking investment research. Impressively, Element Fleet Management has grown EPS by 25% per year, compound, in the last three years. As a general rule, we'd say that if a company can keep up that sort of growth, shareholders will be beaming.

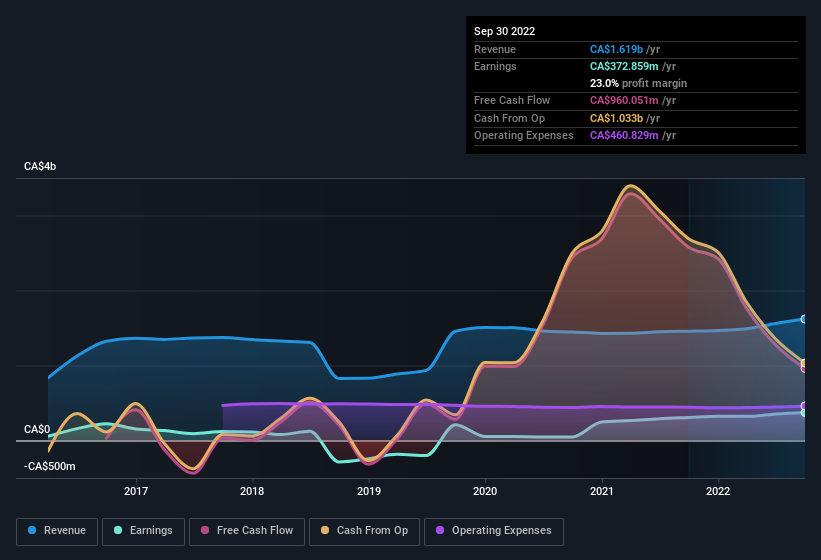

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. It's noted that Element Fleet Management's revenue from operations was lower than its revenue in the last twelve months, so that could distort our analysis of its margins. Element Fleet Management maintained stable EBIT margins over the last year, all while growing revenue 11% to CA$1.6b. That's progress.

You can take a look at the company's revenue and earnings growth trend, in the chart below. To see the actual numbers, click on the chart.

Of course the knack is to find stocks that have their best days in the future, not in the past. You could base your opinion on past performance, of course, but you may also want to check this interactive graph of professional analyst EPS forecasts for Element Fleet Management.

Are Element Fleet Management Insiders Aligned With All Shareholders?

Insider interest in a company always sparks a bit of intrigue and many investors are on the lookout for companies where insiders are putting their money where their mouth is. Because often, the purchase of stock is a sign that the buyer views it as undervalued. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

We haven't seen any insiders selling Element Fleet Management shares, in the last year. With that in mind, it's heartening that Frank Ruperto, the Executive VP & CFO of the company, paid CA$61k for shares at around CA$12.12 each. It seems that at least one insider is prepared to show the market there is potential within Element Fleet Management.

Should You Add Element Fleet Management To Your Watchlist?

For growth investors, Element Fleet Management's raw rate of earnings growth is a beacon in the night. Not only is that growth rate rather juicy, but the insider buying adds fuel to the fire. In essence, your time will not be wasted checking out Element Fleet Management in more detail. What about risks? Every company has them, and we've spotted 2 warning signs for Element Fleet Management (of which 1 can't be ignored!) you should know about.

Keen growth investors love to see insider buying. Thankfully, Element Fleet Management isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Element Fleet Management might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:EFN

Element Fleet Management

Operates as a fleet management company primarily in Canada, Mexico, Australia, and New Zealand.

Undervalued low.