ECN Capital Corp. (TSE:ECN) has announced that it will pay a dividend of CA$0.03 per share on the 30th of June. The dividend yield is 1.3% based on this payment, which is a little bit low compared to the other companies in the industry.

Check out our latest analysis for ECN Capital

ECN Capital's Payment Has Solid Earnings Coverage

Even a low dividend yield can be attractive if it is sustained for years on end. Before this announcement, ECN Capital was paying out 295% of what it was earning, and not generating any free cash flows either. This high of a dividend payment could start to put pressure on the balance sheet in the future.

According to analysts, EPS should be several times higher next year. Assuming the dividend continues along recent trends, we estimate that the payout ratio could reach 54%, which is in a comfortable range for us.

ECN Capital Is Still Building Its Track Record

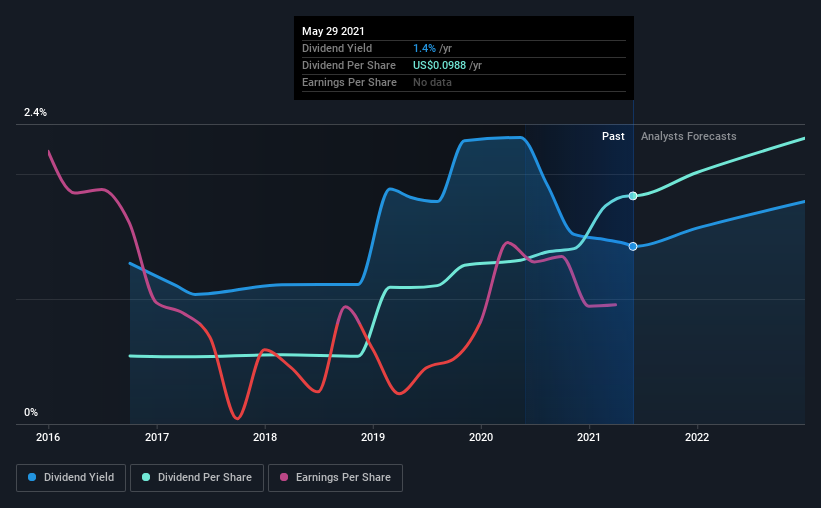

It is great to see that ECN Capital has been paying a stable dividend for a number of years now, however we want to be a bit cautious about whether this will remain true through a full economic cycle. Since 2016, the dividend has gone from US$0.029 to US$0.099. This means that it has been growing its distributions at 27% per annum over that time. ECN Capital has been growing its dividend quite rapidly, which is exciting. However, the short payment history makes us question whether this performance will persist across a full market cycle.

Dividend Growth Potential Is Shaky

The company's investors will be pleased to have been receiving dividend income for some time. Unfortunately things aren't as good as they seem. ECN Capital's earnings per share has shrunk at 32% a year over the past five years. This steep decline can indicate that the business is going through a tough time, which could constrain its ability to pay a larger dividend each year in the future. Over the next year, however, earnings are actually predicted to rise, but we would still be cautious until a track record of earnings growth can be built.

ECN Capital's Dividend Doesn't Look Great

Overall, this isn't a great candidate as an income investment, even though the dividend was stable this year. The company seems to be stretching itself a bit to make such big payments, but it doesn't appear they can be consistent over time. Overall, the dividend is not reliable enough to make this a good income stock.

It's important to note that companies having a consistent dividend policy will generate greater investor confidence than those having an erratic one. Meanwhile, despite the importance of dividend payments, they are not the only factors our readers should know when assessing a company. Case in point: We've spotted 4 warning signs for ECN Capital (of which 1 is potentially serious!) you should know about. If you are a dividend investor, you might also want to look at our curated list of high performing dividend stock.

When trading stocks or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if ECN Capital might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TSX:ECN

ECN Capital

ECN Capital Corp. originates, manages, and advises on credit assets on behalf of its partners in North America.

Exceptional growth potential and slightly overvalued.

Similar Companies

Market Insights

Community Narratives