- Canada

- /

- Capital Markets

- /

- TSX:BN

Brookfield's AI Infrastructure Push and Tech Partnerships Could Be a Game Changer for Brookfield (TSX:BN)

Reviewed by Sasha Jovanovic

- In its recent communications, Brookfield Corporation outlined an ambitious plan to achieve 25% annualized growth in distributable earnings per share through 2030, underpinned by targeted investments in AI infrastructure and long-term contracts with leading technology firms like Google and Microsoft.

- This approach combines robust free cash flow projections, substantial excess cash for buybacks and mergers, and a de-risked push into AI infrastructure, signaling Brookfield's commitment to advancing high-growth sectors while maintaining financial flexibility.

- We'll consider how Brookfield's expansion into AI infrastructure through long-term technology partnerships may reshape its investment narrative outlook.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

Brookfield Investment Narrative Recap

To be a Brookfield shareholder, you need to believe in the company’s ability to compound intrinsic value through diverse, opportunistic investments, across infrastructure, real assets, and now, scaled AI data centers, while maintaining ample free cash flow. The plan for 25% distributable earnings growth, driven by AI partnerships, supports the company’s near-term momentum but doesn’t meaningfully change the biggest short-term risk: heavy reliance on favorable market conditions for asset monetization.

Among Brookfield’s recent actions, its partnership to develop AI infrastructure is the most relevant to this news. Backed by long-term contracts with large technology firms, this move ties directly into potential catalysts for earnings growth, reinforcing management’s stated aim to harness high-quality, recurring revenue streams.

Yet, in contrast, investors should be aware that a shift toward less accommodative market conditions could...

Read the full narrative on Brookfield (it's free!)

Brookfield's outlook anticipates $8.5 billion in revenue and $7.2 billion in earnings by 2028. This scenario requires a 54.2% annual revenue decline and a dramatic $6.7 billion increase in earnings from the current $473.0 million.

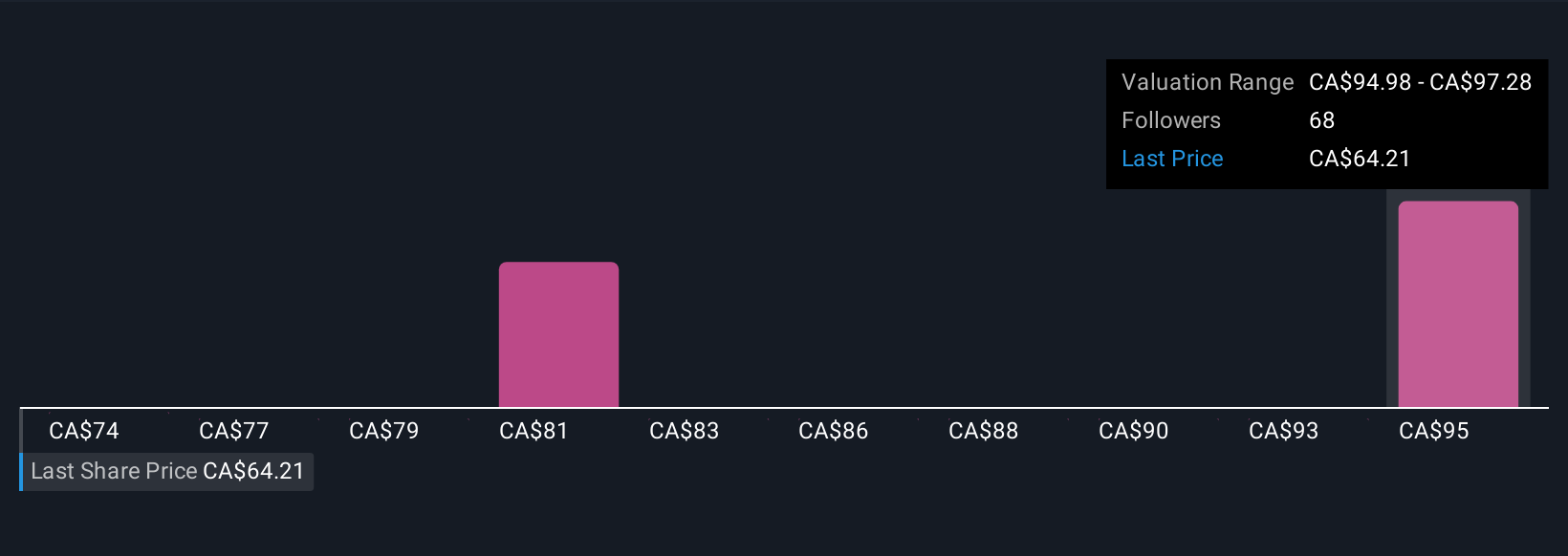

Uncover how Brookfield's forecasts yield a CA$97.28 fair value, a 51% upside to its current price.

Exploring Other Perspectives

Four members of the Simply Wall St Community estimate Brookfield’s fair value between US$74.25 and US$97.28 per share, well above current consensus targets. With AI infrastructure partnerships in focus, opinions on Brookfield’s future potential remain divided, consider exploring these perspectives for wider context.

Explore 4 other fair value estimates on Brookfield - why the stock might be worth as much as 51% more than the current price!

Build Your Own Brookfield Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Brookfield research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

- Our free Brookfield research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Brookfield's overall financial health at a glance.

Ready For A Different Approach?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- We've found 22 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Brookfield might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:BN

Brookfield

An alternative asset manager and real estate investment manager firm focuses on real estate, renewable power, infrastructure and venture capital and private equity assets.

Fair value with low risk.

Similar Companies

Market Insights

Community Narratives