- Canada

- /

- Capital Markets

- /

- TSX:BN

Brookfield’s $100 Billion AI Infrastructure Push Might Change The Case For Investing In Brookfield (TSX:BN)

Reviewed by Sasha Jovanovic

- Brookfield Corporation recently announced the launch of a global $100 billion artificial intelligence infrastructure investment program in partnership with Nvidia and the Kuwait Investment Authority, anchored by the Brookfield Artificial Intelligence Infrastructure Fund and targeting $10 billion of equity commitments.

- This initiative expands Brookfield's operations into the fast-growing AI infrastructure sector, with plans to develop data centers, dedicated power solutions, compute capacity, and AI services across multiple markets.

- We'll explore what Brookfield's move into large-scale AI infrastructure means for its future earnings outlook and market positioning.

We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Brookfield Investment Narrative Recap

To be a Brookfield shareholder, you need to believe in the company’s ability to scale its infrastructure and asset management platforms globally, focusing on growth in new sectors like AI while managing exposure to shifting market conditions. While the new $100 billion AI infrastructure program is a significant step for long-term positioning, its immediate impact on Brookfield’s short-term earnings catalysts or exposure to market risks is limited, given execution risk in new initiatives remains the key challenge.

Among recent developments, Brookfield’s announcement to redeem C$850 million of medium-term notes underscores its focus on managing liabilities and preserving financial flexibility. This move supports Brookfield’s ability to fund growth projects and maintain capital strength, but does not directly influence the pace at which asset monetization or revenue realization materializes, the current short-term catalyst for earnings growth.

Yet, in contrast to these large-scale ambitions, execution risk in unfamiliar markets remains a factor that investors should be aware of...

Read the full narrative on Brookfield (it's free!)

Brookfield's outlook points to $8.5 billion in revenue and $7.2 billion in earnings by 2028. This assumes a 54.2% annual revenue decline and a $6.7 billion increase in earnings from the current $473 million.

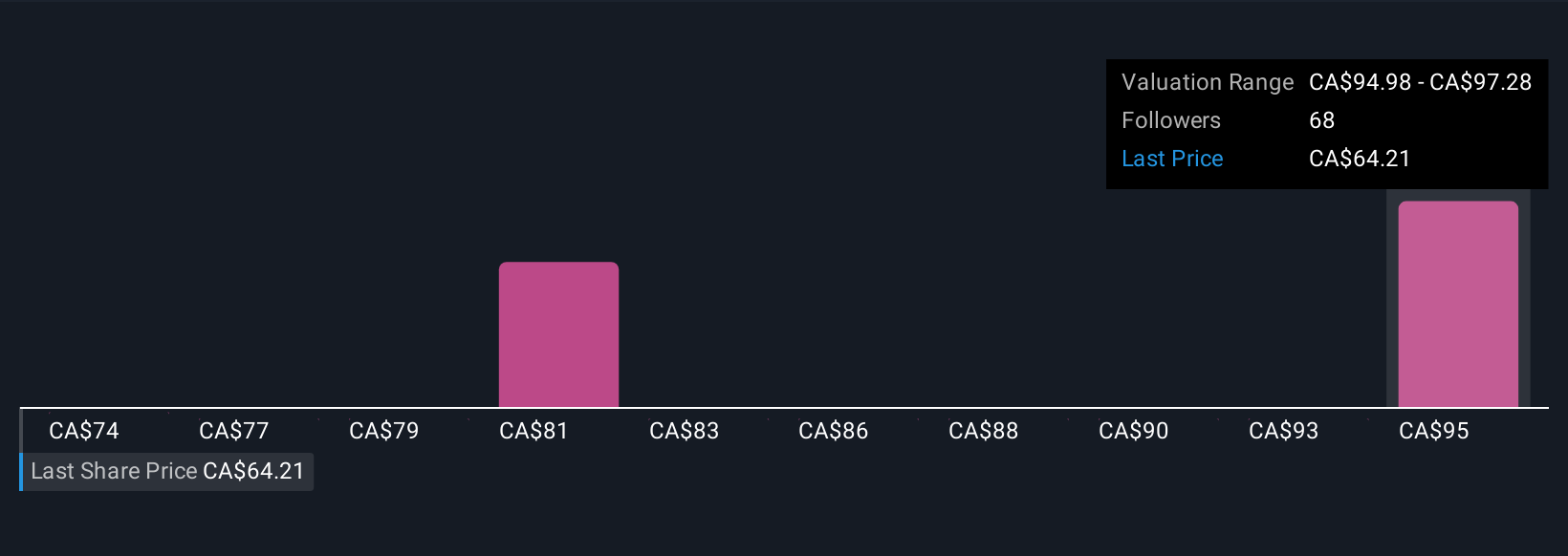

Uncover how Brookfield's forecasts yield a CA$97.28 fair value, a 54% upside to its current price.

Exploring Other Perspectives

The Simply Wall St Community’s four fair value estimates for Brookfield range from C$74.25 to C$97.28, showing a wide spread of investor expectations. With execution risk in new markets still top of mind, these diverse viewpoints encourage you to consider multiple outlooks for Brookfield’s future performance.

Explore 4 other fair value estimates on Brookfield - why the stock might be worth as much as 54% more than the current price!

Build Your Own Brookfield Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Brookfield research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

- Our free Brookfield research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Brookfield's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Brookfield might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:BN

Brookfield

A multi-asset manager focused on real estate, credit, renewable power and transition, infrastructure, venture capital, and private equity including growth capital and emerging growth investments.

Proven track record with low risk.

Similar Companies

Market Insights

Community Narratives