- Canada

- /

- Capital Markets

- /

- TSX:BAM

Does Brookfield’s Latest Investment Partnership Mean Its Stock Still Has Room to Climb in 2025?

Reviewed by Bailey Pemberton

- Curious if Brookfield Asset Management is a sleeper value or a stock that has already run too far? If you have ever wondered whether now is the right time to get in, you are not alone.

- Shares are currently at $75.99 after dipping 1.1% in the last week, with a 5.8% slide over the past month. However, they remain in the green for the year with a 1.8% gain.

- Market sentiment recently shifted after news of Brookfield's latest investment partnership and ongoing expansion efforts in infrastructure and alternative assets. These moves have caught the market's attention and increased speculation about both future growth and potential risks in a changing environment.

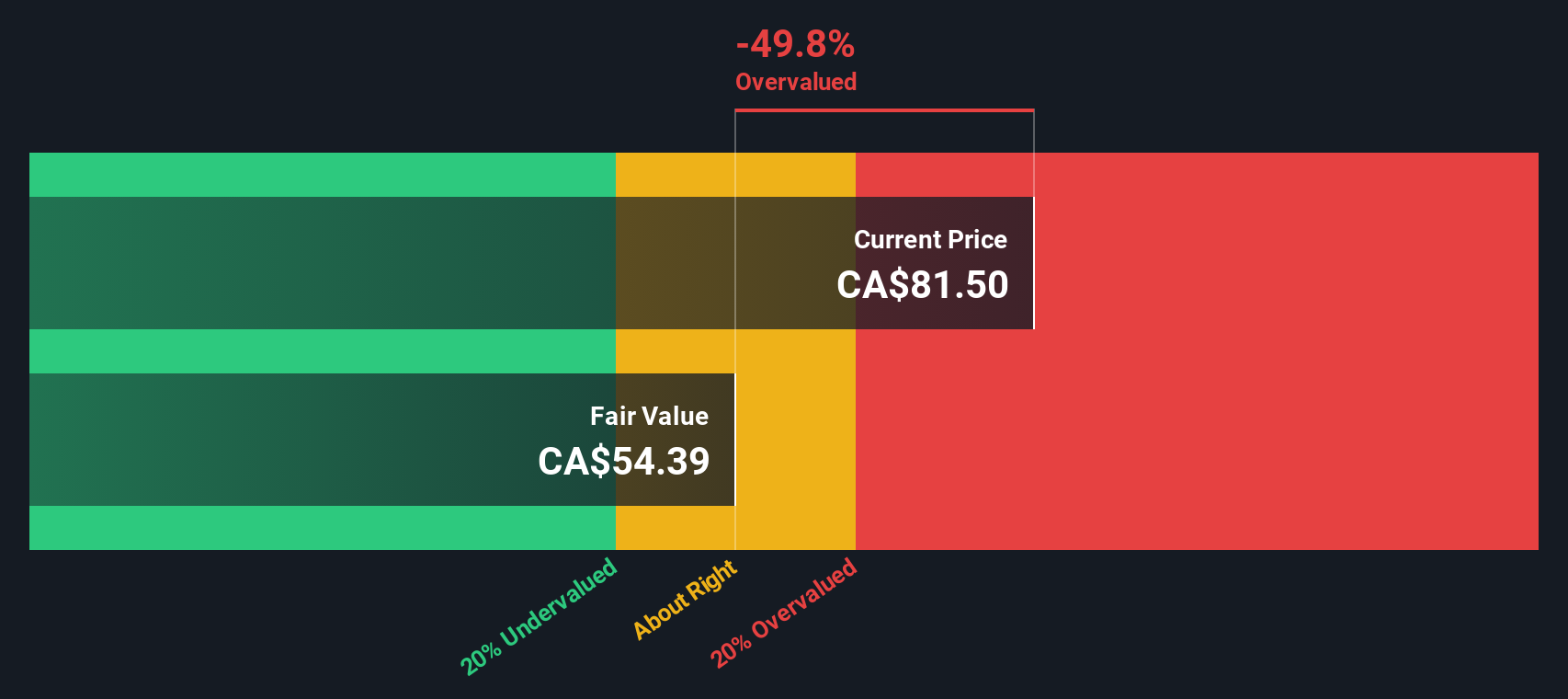

- According to our valuation checks, Brookfield Asset Management scores just 2/6 for being undervalued. Next, we will walk through those traditional valuation approaches, but keep reading for a perspective on fair value that goes beyond the usual numbers.

Brookfield Asset Management scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Brookfield Asset Management Excess Returns Analysis

The Excess Returns Model evaluates a stock by examining how efficiently a company earns above its cost of equity. Essentially, it measures whether Brookfield Asset Management turns shareholder investments into profits that outperform what investors require for the risk taken. This method highlights return on invested capital and sustained profitability as key drivers of intrinsic value.

For Brookfield Asset Management, the analysis starts with a Book Value of CA$5.25 per share, while the projected Stable Book Value is CA$5.78 per share, based on the combined outlook from four analyst estimates. The model uses a Stable Earnings Per Share (EPS) estimate of CA$1.96, with Brookfield maintaining a robust average Return on Equity (ROE) of 33.82%. The company's Cost of Equity sits at CA$0.44 per share, resulting in a solid Excess Return of CA$1.52 per share. This indicates Brookfield is consistently generating profits well above its cost of capital.

Despite this profitability, the Excess Returns Model’s calculation puts the estimated intrinsic value significantly below the current stock price. It suggests the shares are 48.0% overvalued compared to their underlying long-term earning power.

Result: OVERVALUED

Our Excess Returns analysis suggests Brookfield Asset Management may be overvalued by 48.0%. Discover 840 undervalued stocks or create your own screener to find better value opportunities.

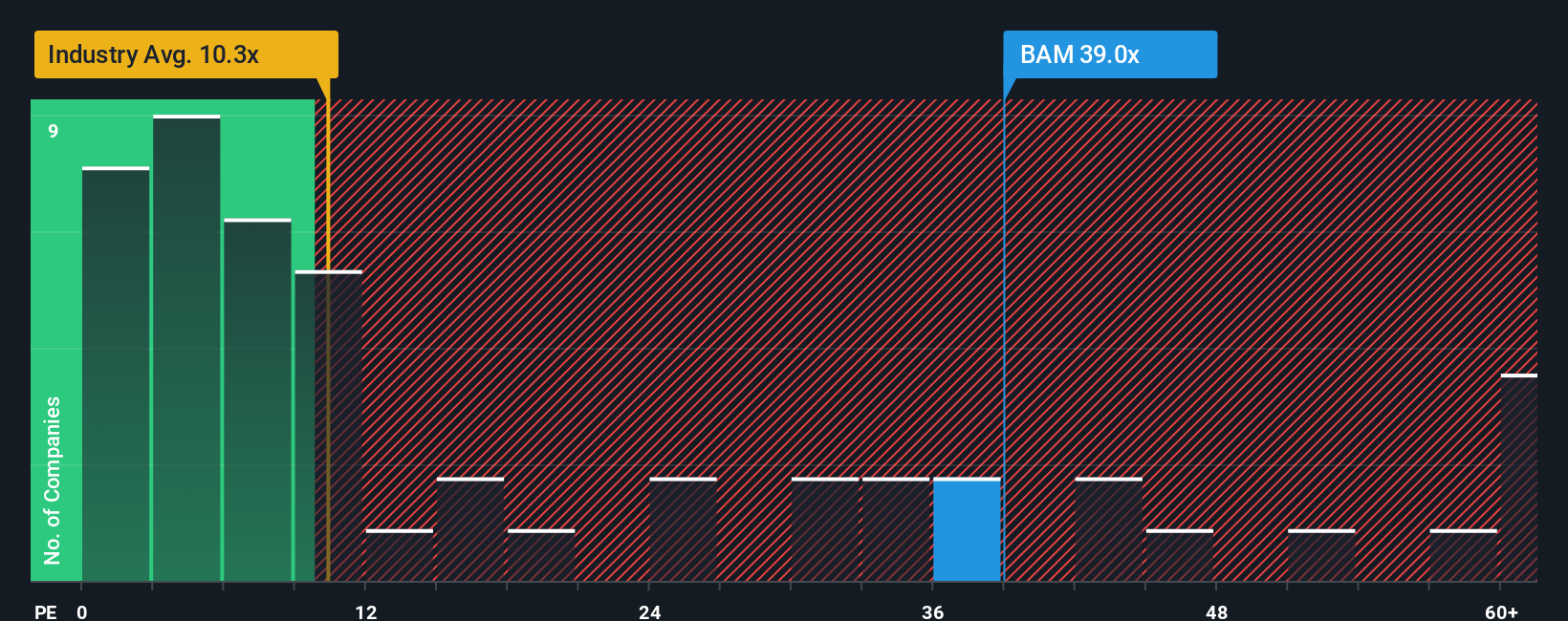

Approach 2: Brookfield Asset Management Price vs Earnings

The Price-to-Earnings (PE) ratio is a popular valuation metric for profitable companies like Brookfield Asset Management because it compares a company’s stock price to its earnings. This provides a straightforward snapshot of how much investors are willing to pay for each dollar of profit. For firms with steady and established profit streams, the PE ratio offers a practical way to measure whether a stock is priced reasonably compared to its earnings power.

The appropriate or “fair” PE ratio for a company depends on future growth expectations, profit stability, and the level of risk that investors perceive. Generally, higher growth companies command higher PE ratios, while industries facing uncertainty or increased risk tend to trade at lower multiples.

Brookfield Asset Management currently trades at a PE ratio of 35.7x. This is notably higher than the Capital Markets industry average of 9.6x and also above the average of its closest peers at 53.5x. To provide a more nuanced perspective, Simply Wall St introduces a proprietary “Fair Ratio,” calculated to be 36.6x for Brookfield. This Fair Ratio incorporates factors such as the company’s projected growth, risk profile, profitability, market cap, and its specific industry conditions. This approach makes it much more informative than simple peer or industry comparisons.

Comparing Brookfield’s actual PE ratio (35.7x) with the Fair Ratio (36.6x), the stock appears to be valued about right based on the company’s current fundamentals and outlook.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1411 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Brookfield Asset Management Narrative

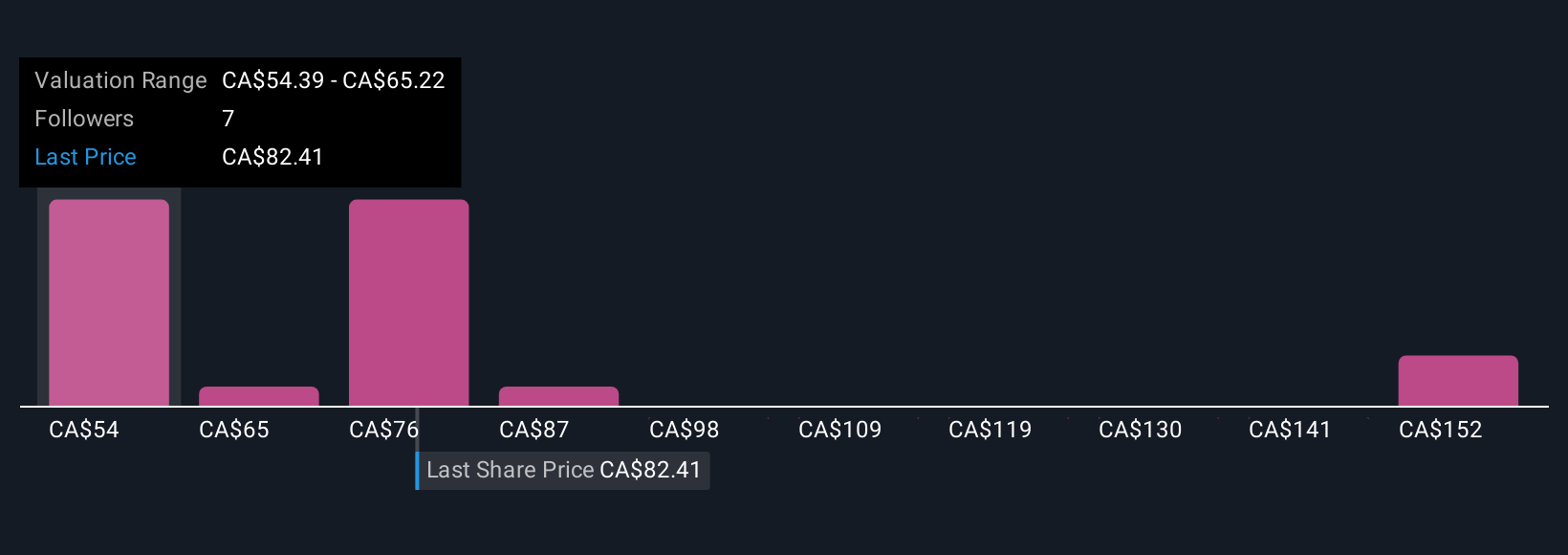

Earlier we mentioned that there is an even better way to understand valuation. Let’s introduce you to Narratives. A Narrative is a simple, powerful framework that lets you link your view of a company’s story to concrete financial assumptions, creating your own tailored forecasts and fair values. This approach makes it easy to see how your perspective on Brookfield Asset Management’s future—whether you are optimistic about its global expansion or cautious about risks—influences your view of its real worth.

Narratives are available to everyone on the Simply Wall St platform, found right on the Community page, and they are used by millions of investors. With Narratives, you can monitor how your story translates into fair value and easily compare it to today’s price to decide when you might want to buy or sell. They are continuously updated when new information comes in so your investment thesis stays relevant and informed. For example, some investors currently estimate Brookfield’s fair value well above $92 per share, while others see it closer to $45, all depending on their different stories and forecasts for the company.

Do you think there's more to the story for Brookfield Asset Management? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Brookfield Asset Management might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:BAM

Brookfield Asset Management

A private equity firm specializing in acquisitions and growth capital investments.

Outstanding track record with high growth potential.

Market Insights

Community Narratives