- Canada

- /

- Capital Markets

- /

- CNSX:VST

Investors Still Aren't Entirely Convinced By Victory Square Technologies Inc.'s (CSE:VST) Revenues Despite 53% Price Jump

Victory Square Technologies Inc. (CSE:VST) shares have continued their recent momentum with a 53% gain in the last month alone. This latest share price bounce rounds out a remarkable 712% gain over the last twelve months.

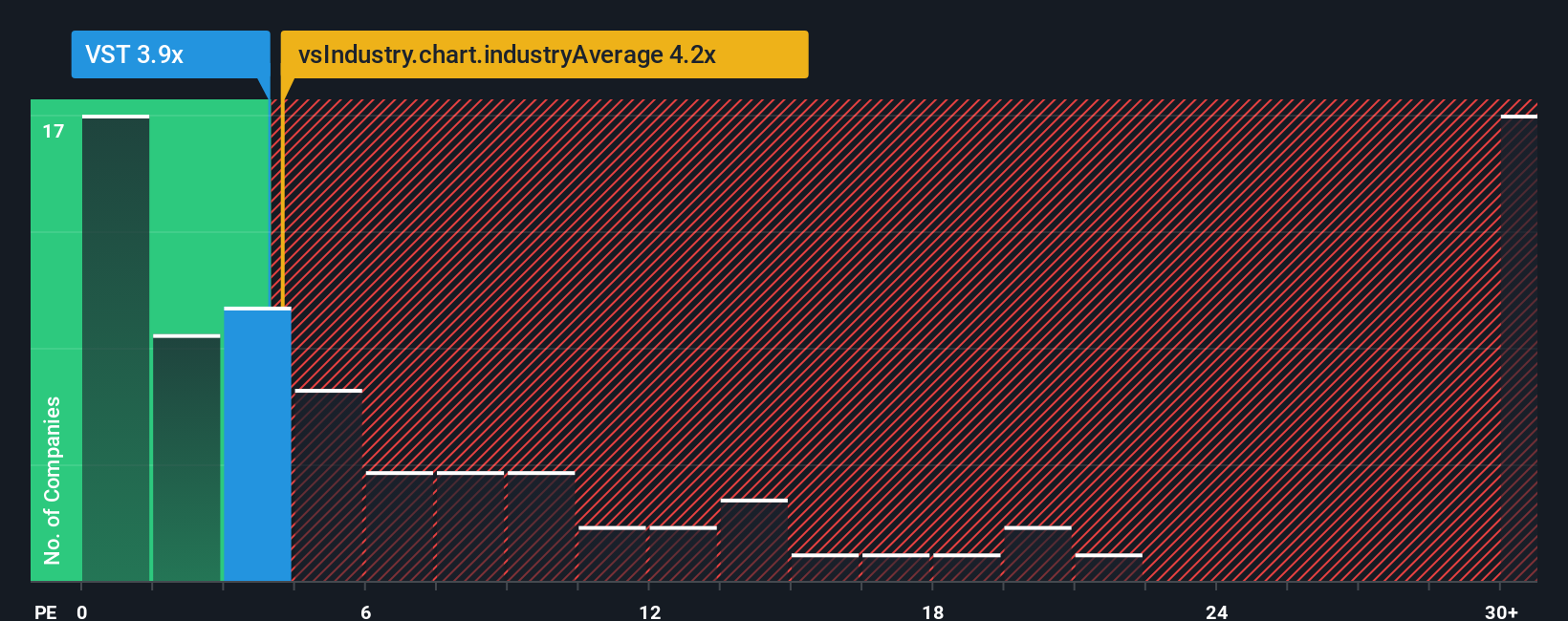

Even after such a large jump in price, you could still be forgiven for feeling indifferent about Victory Square Technologies' P/S ratio of 3.9x, since the median price-to-sales (or "P/S") ratio for the Capital Markets industry in Canada is also close to 4.2x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

See our latest analysis for Victory Square Technologies

How Victory Square Technologies Has Been Performing

With revenue growth that's exceedingly strong of late, Victory Square Technologies has been doing very well. Perhaps the market is expecting future revenue performance to taper off, which has kept the P/S from rising. Those who are bullish on Victory Square Technologies will be hoping that this isn't the case, so that they can pick up the stock at a lower valuation.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Victory Square Technologies will help you shine a light on its historical performance.Is There Some Revenue Growth Forecasted For Victory Square Technologies?

The only time you'd be comfortable seeing a P/S like Victory Square Technologies' is when the company's growth is tracking the industry closely.

Retrospectively, the last year delivered an exceptional 39% gain to the company's top line. The latest three year period has also seen an incredible overall rise in revenue, aided by its incredible short-term performance. So we can start by confirming that the company has done a tremendous job of growing revenue over that time.

Comparing that to the industry, which is predicted to shrink 27% in the next 12 months, the company's positive momentum based on recent medium-term revenue results is a bright spot for the moment.

With this information, we find it odd that Victory Square Technologies is trading at a fairly similar P/S to the industry. Apparently some shareholders believe the recent performance is at its limits and have been accepting lower selling prices.

The Final Word

Victory Square Technologies' stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

As mentioned previously, Victory Square Technologies currently trades on a P/S on par with the wider industry, but this is lower than expected considering its recent three-year revenue growth is beating forecasts for a struggling industry. When we see a history of positive growth in a struggling industry, but only an average P/S, we assume potential risks are what might be placing pressure on the P/S ratio. Without the guidance of analysts, perhaps shareholders are feeling uncertain over whether the revenue performance can continue amidst a declining industry outlook. The fact that the company's relative performance has not provided a kick to the share price suggests that some investors are anticipating revenue instability.

You should always think about risks. Case in point, we've spotted 3 warning signs for Victory Square Technologies you should be aware of, and 1 of them makes us a bit uncomfortable.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About CNSX:VST

Victory Square Technologies

A private equity and venture capital firm specializing in incubation, acquisition and invests in startups, Early stage and provides the senior leadership and resources needed to growth.

Low risk with questionable track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success