- Canada

- /

- Diversified Financial

- /

- CNSX:PBIT

Benign Growth For POSaBIT Systems Corporation (CSE:PBIT) Underpins Stock's 50% Plummet

POSaBIT Systems Corporation (CSE:PBIT) shareholders won't be pleased to see that the share price has had a very rough month, dropping 50% and undoing the prior period's positive performance. For any long-term shareholders, the last month ends a year to forget by locking in a 67% share price decline.

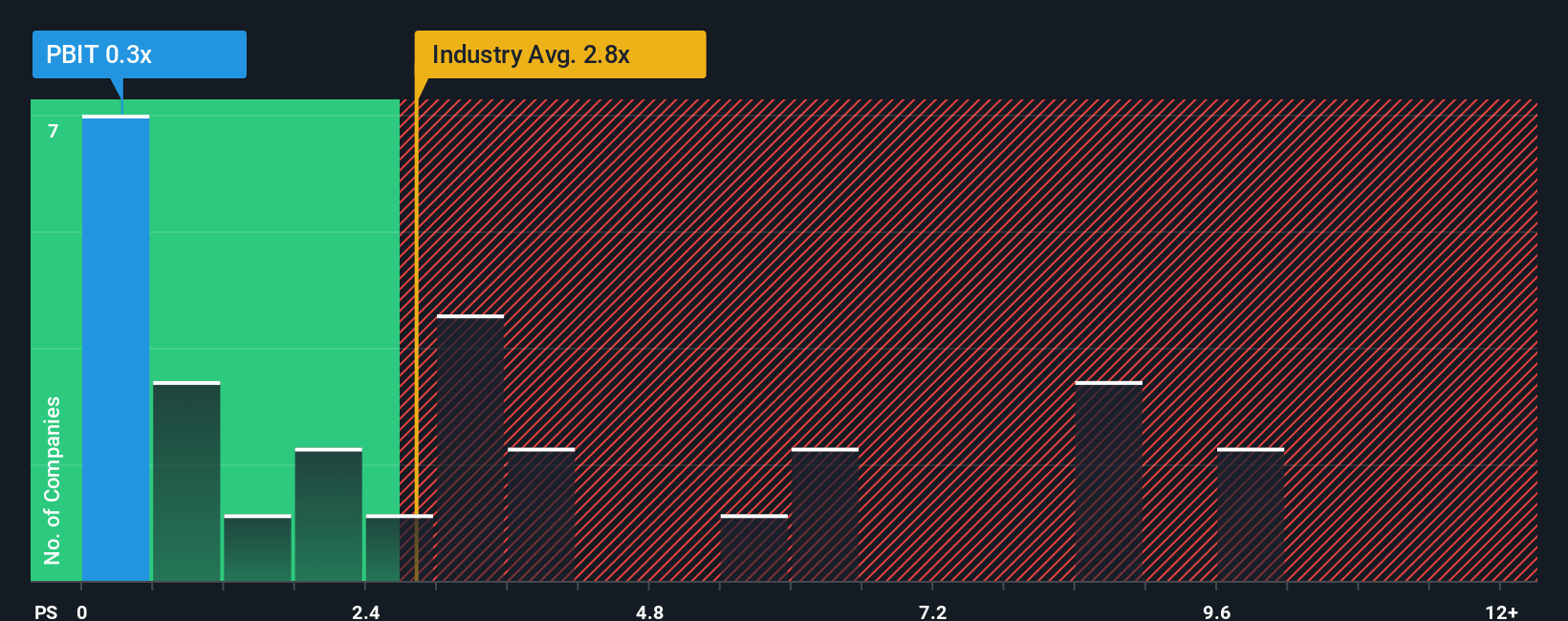

After such a large drop in price, given close to half the companies in Canada's Diversified Financial industry have price-to-sales ratios (or "P/S") above 6.2x, you may consider POSaBIT Systems as a highly attractive investment with its 0.3x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so limited.

See our latest analysis for POSaBIT Systems

How POSaBIT Systems Has Been Performing

For instance, POSaBIT Systems' receding revenue in recent times would have to be some food for thought. Perhaps the market believes the recent revenue performance isn't good enough to keep up the industry, causing the P/S ratio to suffer. Those who are bullish on POSaBIT Systems will be hoping that this isn't the case so that they can pick up the stock at a lower valuation.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on POSaBIT Systems will help you shine a light on its historical performance.How Is POSaBIT Systems' Revenue Growth Trending?

POSaBIT Systems' P/S ratio would be typical for a company that's expected to deliver very poor growth or even falling revenue, and importantly, perform much worse than the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 60%. As a result, revenue from three years ago have also fallen 40% overall. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

In contrast to the company, the rest of the industry is expected to grow by 35% over the next year, which really puts the company's recent medium-term revenue decline into perspective.

In light of this, it's understandable that POSaBIT Systems' P/S would sit below the majority of other companies. Nonetheless, there's no guarantee the P/S has reached a floor yet with revenue going in reverse. Even just maintaining these prices could be difficult to achieve as recent revenue trends are already weighing down the shares.

The Bottom Line On POSaBIT Systems' P/S

Having almost fallen off a cliff, POSaBIT Systems' share price has pulled its P/S way down as well. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our examination of POSaBIT Systems confirms that the company's shrinking revenue over the past medium-term is a key factor in its low price-to-sales ratio, given the industry is projected to grow. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. Given the current circumstances, it seems unlikely that the share price will experience any significant movement in either direction in the near future if recent medium-term revenue trends persist.

We don't want to rain on the parade too much, but we did also find 4 warning signs for POSaBIT Systems that you need to be mindful of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About CNSX:PBIT

POSaBIT Systems

Operates as a financial infrastructure provider to the Cannabis sector in the United States.

Slight risk and slightly overvalued.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

The "David vs. Goliath" AI Trade – Why Second Place is Worth Billions

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

The "Rate Cut" Supercycle Winner – Profitable & Accelerating

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026