Unpleasant Surprises Could Be In Store For Loblaw Companies Limited's (TSE:L) Shares

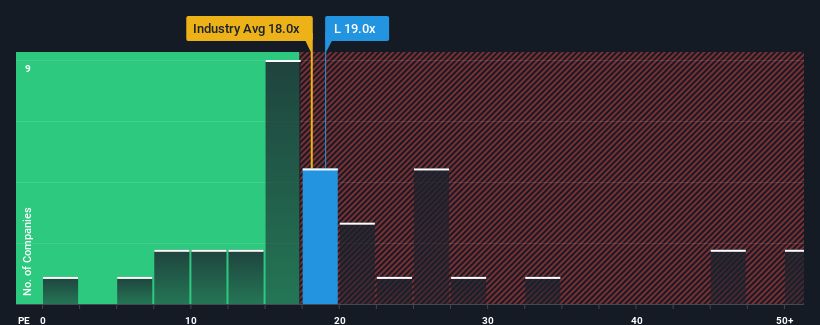

When close to half the companies in Canada have price-to-earnings ratios (or "P/E's") below 13x, you may consider Loblaw Companies Limited (TSE:L) as a stock to potentially avoid with its 19x P/E ratio. However, the P/E might be high for a reason and it requires further investigation to determine if it's justified.

With its earnings growth in positive territory compared to the declining earnings of most other companies, Loblaw Companies has been doing quite well of late. The P/E is probably high because investors think the company will continue to navigate the broader market headwinds better than most. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Check out our latest analysis for Loblaw Companies

What Are Growth Metrics Telling Us About The High P/E?

Loblaw Companies' P/E ratio would be typical for a company that's expected to deliver solid growth, and importantly, perform better than the market.

If we review the last year of earnings, the company posted a result that saw barely any deviation from a year ago. Still, the latest three year period has seen an excellent 136% overall rise in EPS, in spite of its uninspiring short-term performance. Therefore, it's fair to say the earnings growth recently has been superb for the company.

Turning to the outlook, the next three years should generate growth of 6.3% per year as estimated by the nine analysts watching the company. With the market predicted to deliver 9.9% growth each year, the company is positioned for a weaker earnings result.

With this information, we find it concerning that Loblaw Companies is trading at a P/E higher than the market. Apparently many investors in the company are way more bullish than analysts indicate and aren't willing to let go of their stock at any price. Only the boldest would assume these prices are sustainable as this level of earnings growth is likely to weigh heavily on the share price eventually.

What We Can Learn From Loblaw Companies' P/E?

Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our examination of Loblaw Companies' analyst forecasts revealed that its inferior earnings outlook isn't impacting its high P/E anywhere near as much as we would have predicted. Right now we are increasingly uncomfortable with the high P/E as the predicted future earnings aren't likely to support such positive sentiment for long. This places shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 1 warning sign with Loblaw Companies, and understanding should be part of your investment process.

You might be able to find a better investment than Loblaw Companies. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:L

Loblaw Companies

A food and pharmacy company, provides grocery, pharmacy and healthcare services, health and beauty products, apparels, general merchandise, financial services, and wireless mobile products and services in Canada.

Solid track record average dividend payer.