Loblaw (TSX:L): Exploring Valuation Following Recent Share Price Cool-Off

Reviewed by Simply Wall St

Loblaw Companies (TSX:L) stock recently moved slightly lower, despite a solid year-to-date performance. Investors might be weighing the company's moderate revenue and profit growth against its longer-term gains while searching for fresh catalysts.

See our latest analysis for Loblaw Companies.

Loblaw’s share price has cooled off a touch after its impressive year-to-date run. The bigger story is the steady momentum in its longer-term total shareholder returns, with a 23% gain over the past year and a massive 115% over three years. The recent price dip seems less about business fundamentals and more about investors pausing after a strong climb, as the search for new growth drivers continues.

If you’re curious what other compelling opportunities might be gathering steam, now’s the perfect time to expand your search and discover fast growing stocks with high insider ownership

But with shares now reflecting years of steady growth and analyst targets only modestly above the current price, investors must ask themselves: does Loblaw still offer untapped value, or is the market already factoring in its future gains?

Most Popular Narrative: 4.8% Undervalued

Loblaw’s last closing price sits slightly below the most widely followed narrative’s fair value estimate, hinting at modest upside if projections hold true. The narrative focuses on strategic moves in healthcare and automation that could propel value beyond where the stock currently trades.

Ongoing investments in AI-driven supply chain optimization and retail automation are reducing logistics, inventory, and labor costs, directly benefiting gross and operating margins over time.

Want to know what really drives this valuation? The secret sauce is a bold set of future profit expectations and top-line growth projections that would surprise most retail veterans. Get the full details behind the high assumptions and see how analysts justify such a premium. Unpack the entire forecast now.

Result: Fair Value of $59.48 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, the narrative could be challenged if digital rivals erode Loblaw's market share or if margin pressures from value-focused formats persist.

Find out about the key risks to this Loblaw Companies narrative.

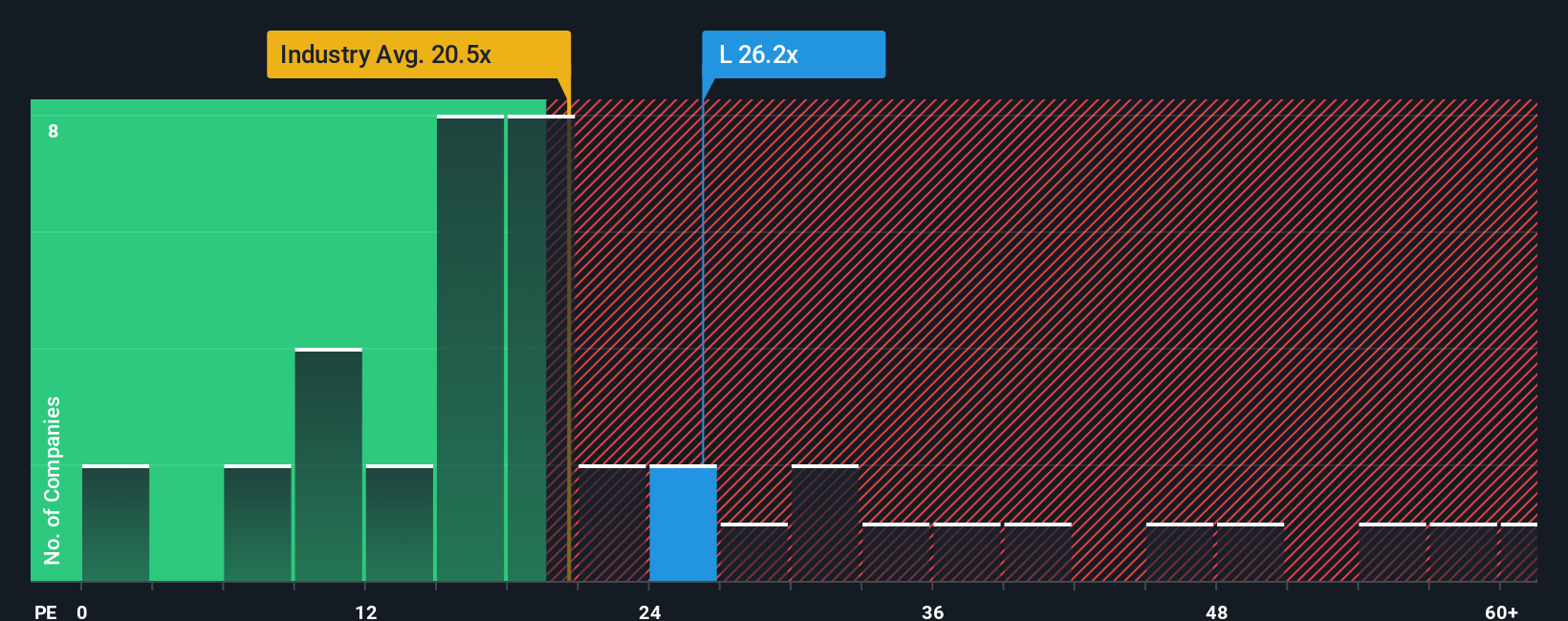

Another View: The Price-to-Earnings Perspective

While fair value estimates suggest Loblaw is modestly undervalued, the share price tells a different story by traditional price-to-earnings comparison. At 27.3 times earnings, Loblaw trades at a premium over both its North American industry average of 19.6x and the fair ratio of 24.4x. This premium could point to elevated expectations, but also suggests less margin for error if growth slows. Are investors paying up for too much optimism?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Loblaw Companies Narrative

If you see things differently or want your research to lead the story, you can craft your own narrative quickly, in just a few minutes. Do it your way

A great starting point for your Loblaw Companies research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors never settle for just one good pick. Give yourself a real advantage by tapping into fresh opportunities backed by financial expertise using these powerful tools:

- Tap into high-yield potential by checking out these 16 dividend stocks with yields > 3% that consistently outperform with robust dividend returns and solid financial health.

- Catch the momentum behind advanced medicine and technology when you search for tomorrow’s leaders among these 32 healthcare AI stocks pushing the boundaries of healthcare innovation.

- Stay ahead of the curve on value opportunities by finding stocks currently priced under their fair worth via these 875 undervalued stocks based on cash flows based on cash flow analytics and forward-looking metrics.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:L

Loblaw Companies

A food and pharmacy company, provides grocery, pharmacy and healthcare services, health and beauty products, apparel, general merchandise, financial services, and wireless mobile products and services in Canada and the United States.

Outstanding track record average dividend payer.

Similar Companies

Market Insights

Community Narratives