The Canadian market has been navigating a landscape of shifting business models, particularly in the tech sector, where asset-heavy investments in AI infrastructure are becoming more prominent. Amidst these trends, diversification remains crucial for investors seeking balanced portfolios. Penny stocks, though an outdated term, still hold relevance as they often represent smaller or newer companies with potential for growth and value. In this article, we explore three such penny stocks that demonstrate financial strength and could offer intriguing opportunities for those looking beyond the larger market players.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Rewards & Risks |

| Westbridge Renewable Energy (TSXV:WEB) | CA$2.05 | CA$53.85M | ✅ 3 ⚠️ 4 View Analysis > |

| Canso Select Opportunities (TSXV:CSOC.A) | CA$4.50 | CA$21.61M | ✅ 2 ⚠️ 2 View Analysis > |

| Zoomd Technologies (TSXV:ZOMD) | CA$1.75 | CA$187.39M | ✅ 4 ⚠️ 1 View Analysis > |

| Montero Mining and Exploration (TSXV:MON) | CA$0.39 | CA$3.34M | ✅ 2 ⚠️ 4 View Analysis > |

| Thor Explorations (TSXV:THX) | CA$1.15 | CA$718.52M | ✅ 3 ⚠️ 1 View Analysis > |

| Automotive Finco (TSXV:AFCC.H) | CA$1.12 | CA$22M | ✅ 2 ⚠️ 3 View Analysis > |

| Rio2 (TSX:RIO) | CA$2.18 | CA$945.72M | ✅ 4 ⚠️ 3 View Analysis > |

| Pulse Seismic (TSX:PSD) | CA$2.86 | CA$145.67M | ✅ 2 ⚠️ 1 View Analysis > |

| Hemisphere Energy (TSXV:HME) | CA$2.19 | CA$203.61M | ✅ 3 ⚠️ 2 View Analysis > |

| Matachewan Consolidated Mines (TSXV:MCM.A) | CA$0.75 | CA$10.23M | ✅ 2 ⚠️ 4 View Analysis > |

Click here to see the full list of 410 stocks from our TSX Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Lara Exploration (TSXV:LRA)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Lara Exploration Ltd. is engaged in the acquisition, exploration, development, and evaluation of mineral properties in Brazil, Peru, and Chile with a market cap of CA$128.78 million.

Operations: Lara Exploration Ltd. does not report specific revenue segments.

Market Cap: CA$128.78M

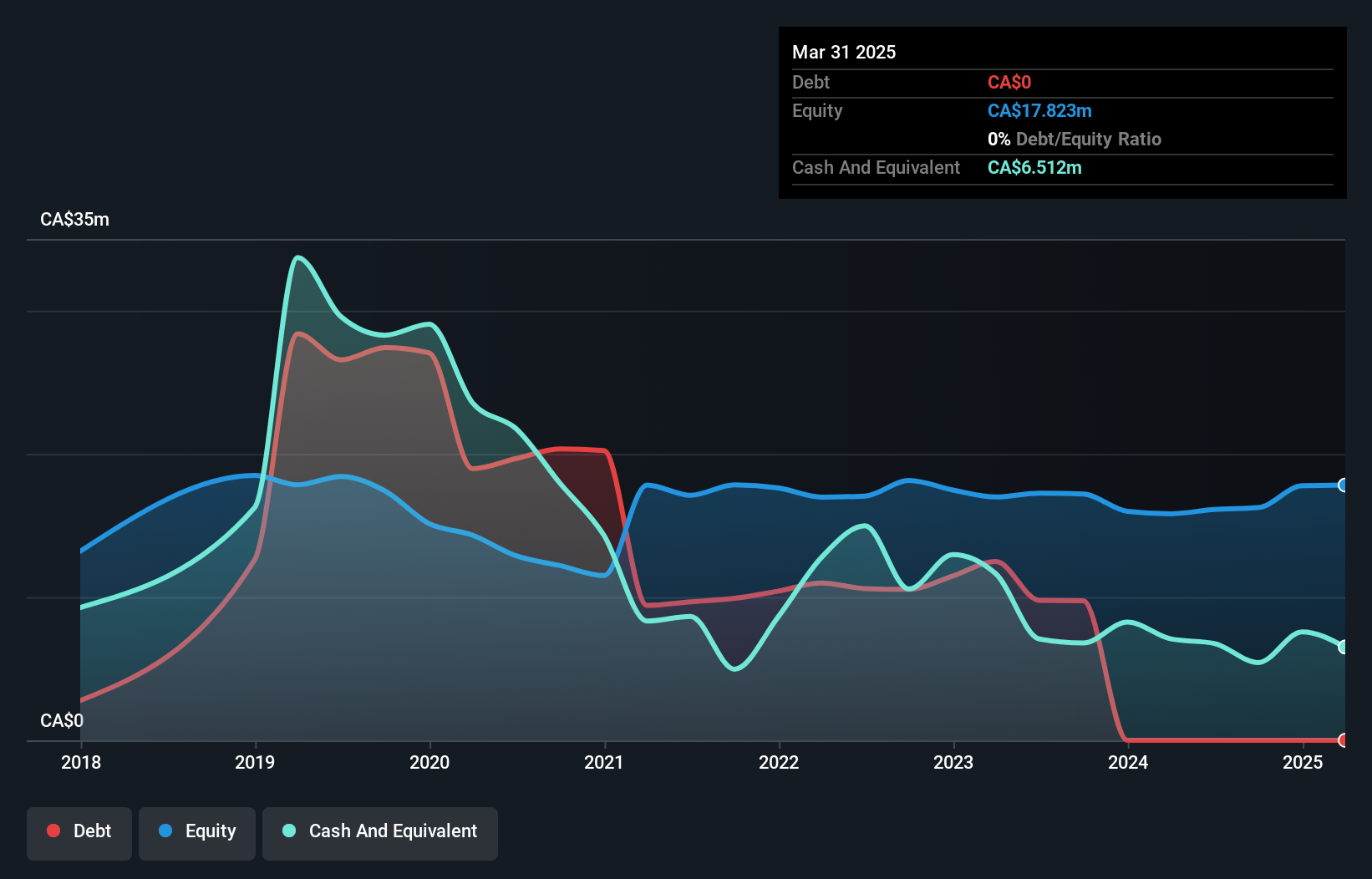

Lara Exploration Ltd. is a pre-revenue company with a market cap of CA$128.78 million, focusing on mineral properties in Brazil, Peru, and Chile. Recent developments include the Preliminary Economic Assessment for its Planalto Copper-Gold deposit in Brazil, which forecasts significant copper and gold production over an 18-year mine life. Despite being unprofitable with declining earnings over the past five years, Lara remains debt-free and has sufficient cash runway for more than a year. The management team is experienced, and there has been no meaningful shareholder dilution recently. The company's short-term assets significantly exceed its liabilities.

- Jump into the full analysis health report here for a deeper understanding of Lara Exploration.

- Understand Lara Exploration's track record by examining our performance history report.

Mene (TSXV:MENE)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Mene Inc. designs, manufactures, and markets 24 karat gold and platinum jewelry worldwide with a market cap of CA$46.77 million.

Operations: The company's revenue is derived from its Jewelry & Watches segment, which generated CA$27.47 million.

Market Cap: CA$46.77M

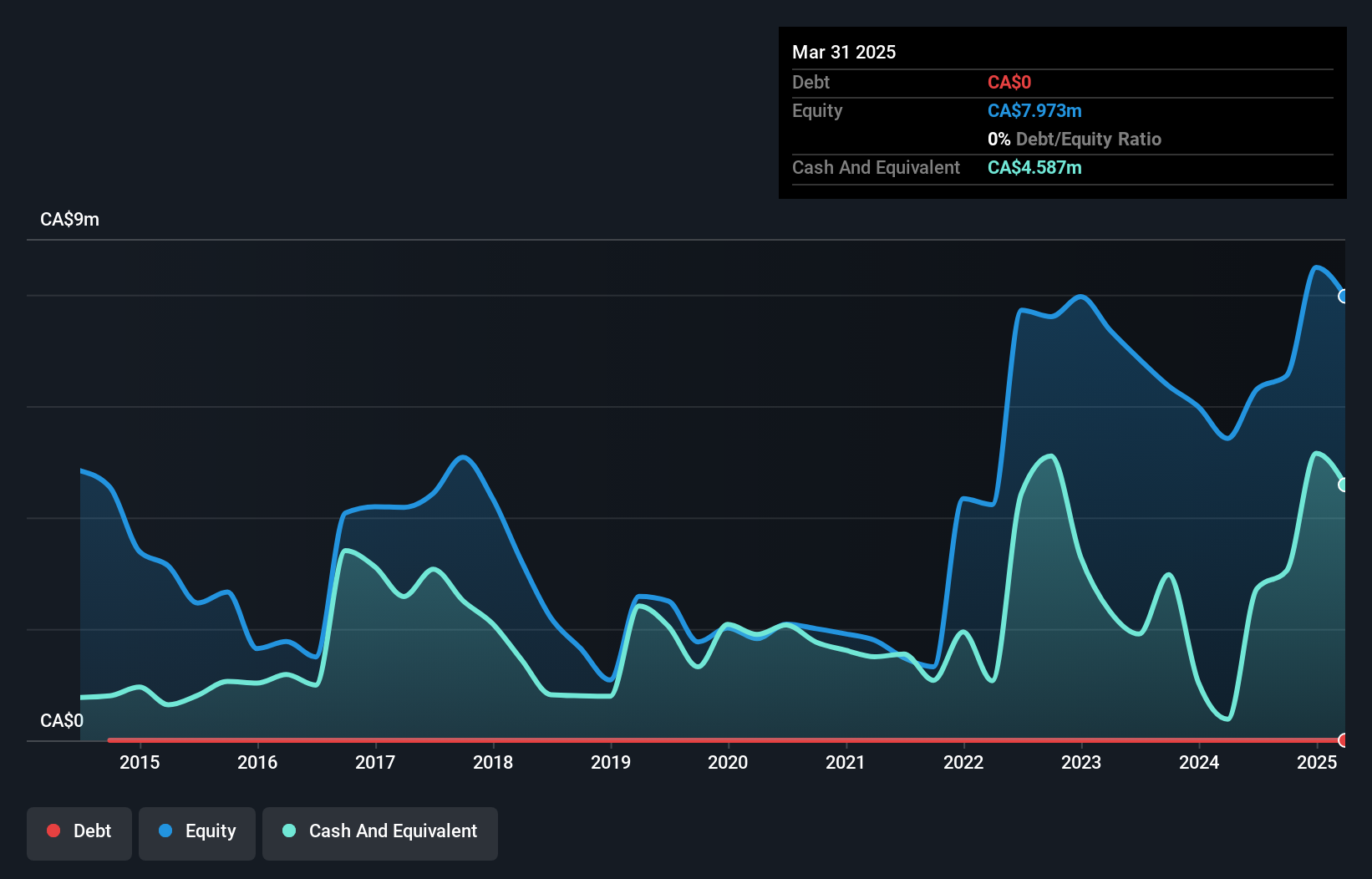

Mene Inc., with a market cap of CA$46.77 million, operates in the jewelry sector, generating CA$27.47 million in revenue from its Jewelry & Watches segment. Despite being unprofitable with a negative return on equity of -1.86%, the company has managed to reduce losses by 30.2% annually over five years and maintains a stable cash runway exceeding three years due to positive free cash flow growth. Mene's short-term assets (CA$17.7M) comfortably cover both its short-term and long-term liabilities, while it remains debt-free, reflecting prudent financial management amidst high share price volatility.

- Get an in-depth perspective on Mene's performance by reading our balance sheet health report here.

- Assess Mene's previous results with our detailed historical performance reports.

Yorbeau Resources (TSX:YRB)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Yorbeau Resources Inc. is involved in the acquisition, development, and exploration of mineral properties in Canada with a market cap of CA$30 million.

Operations: The company generates revenue primarily from its mining exploration activities, amounting to CA$0.06 million.

Market Cap: CA$30M

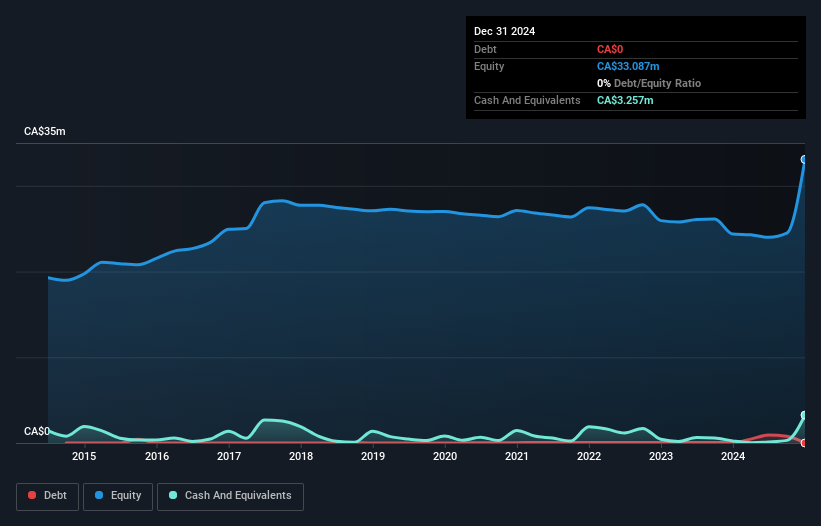

Yorbeau Resources Inc., with a market cap of CA$30 million, is pre-revenue, generating CA$0.06 million from its exploration activities. The company has recently turned profitable, reporting a net income of CA$0.4017 million for the first nine months of 2025. It operates debt-free and maintains a strong financial position with short-term assets far exceeding liabilities. Despite high share price volatility, Yorbeau's return on equity stands at an impressive 26.9%, and it trades at a favorable price-to-earnings ratio of 3.3x compared to the Canadian market average, suggesting potential value for investors seeking speculative opportunities in penny stocks.

- Click here to discover the nuances of Yorbeau Resources with our detailed analytical financial health report.

- Explore historical data to track Yorbeau Resources' performance over time in our past results report.

Key Takeaways

- Dive into all 410 of the TSX Penny Stocks we have identified here.

- Seeking Other Investments? We've found 18 US stocks that are forecast to pay a dividend yeild of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:MENE

Mene

Designs, manufactures, and markets 24 karat gold and platinum jewelry worldwide.

Flawless balance sheet with very low risk.

Market Insights

Community Narratives