Here's Why Shareholders Should Examine Canada Goose Holdings Inc.'s (TSE:GOOS) CEO Compensation Package More Closely

Key Insights

- Canada Goose Holdings to hold its Annual General Meeting on 2nd of August

- Total pay for CEO Dani Reiss includes CA$1.38m salary

- Total compensation is similar to the industry average

- Over the past three years, Canada Goose Holdings' EPS fell by 1.8% and over the past three years, the total loss to shareholders 70%

Shareholders will probably not be too impressed with the underwhelming results at Canada Goose Holdings Inc. (TSE:GOOS) recently. At the upcoming AGM on 2nd of August, shareholders can hear from the board including their plans for turning around performance. This will be also be a chance where they can challenge the board on company direction and vote on resolutions such as executive remuneration. We present the case why we think CEO compensation is out of sync with company performance.

See our latest analysis for Canada Goose Holdings

How Does Total Compensation For Dani Reiss Compare With Other Companies In The Industry?

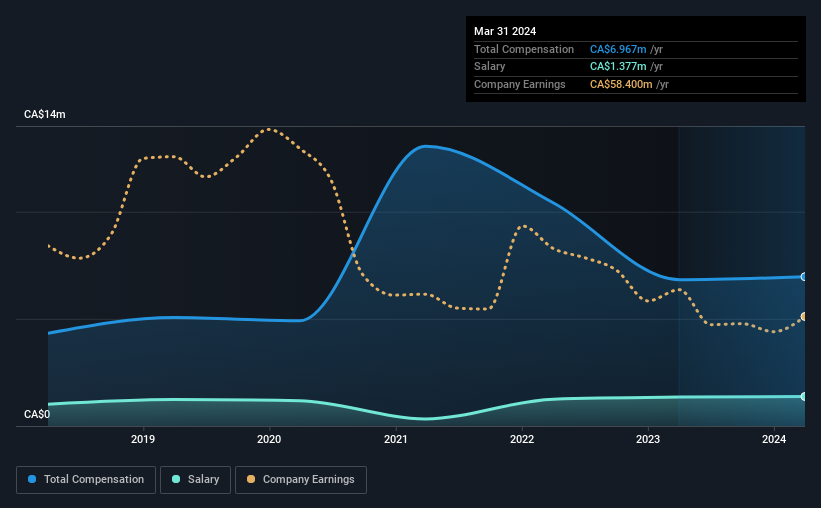

According to our data, Canada Goose Holdings Inc. has a market capitalization of CA$1.5b, and paid its CEO total annual compensation worth CA$7.0m over the year to March 2024. This means that the compensation hasn't changed much from last year. While this analysis focuses on total compensation, it's worth acknowledging that the salary portion is lower, valued at CA$1.4m.

On comparing similar companies from the Canada Luxury industry with market caps ranging from CA$553m to CA$2.2b, we found that the median CEO total compensation was CA$7.4m. So it looks like Canada Goose Holdings compensates Dani Reiss in line with the median for the industry. Furthermore, Dani Reiss directly owns CA$319m worth of shares in the company, implying that they are deeply invested in the company's success.

| Component | 2024 | 2023 | Proportion (2024) |

| Salary | CA$1.4m | CA$1.3m | 20% |

| Other | CA$5.6m | CA$5.5m | 80% |

| Total Compensation | CA$7.0m | CA$6.8m | 100% |

On an industry level, it's fascinating to see that all of total compensation represents salary and non-salary benefits do not factor into the equation at all. Canada Goose Holdings sets aside a smaller share of compensation for salary, in comparison to the overall industry. If non-salary compensation dominates total pay, it's an indicator that the executive's salary is tied to company performance.

A Look at Canada Goose Holdings Inc.'s Growth Numbers

Over the last three years, Canada Goose Holdings Inc. has shrunk its earnings per share by 1.8% per year. Its revenue is up 9.7% over the last year.

A lack of EPS improvement is not good to see. And the modest revenue growth over 12 months isn't much comfort against the reduced EPS. These factors suggest that the business performance wouldn't really justify a high pay packet for the CEO. Looking ahead, you might want to check this free visual report on analyst forecasts for the company's future earnings..

Has Canada Goose Holdings Inc. Been A Good Investment?

Few Canada Goose Holdings Inc. shareholders would feel satisfied with the return of -70% over three years. This suggests it would be unwise for the company to pay the CEO too generously.

To Conclude...

Not only have shareholders not seen a favorable return on their investment, but the business hasn't performed well either. Few shareholders would be willing to award the CEO with a pay raise. At the upcoming AGM, they can question the management's plans and strategies to turn performance around and reassess their investment thesis in regards to the company.

While it is important to pay attention to CEO remuneration, investors should also consider other elements of the business. We did our research and spotted 2 warning signs for Canada Goose Holdings that investors should look into moving forward.

Important note: Canada Goose Holdings is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:GOOS

Canada Goose Holdings

Designs, manufactures, and sells performance luxury outerwear, apparel, footwear, and accessories for men, women, youth, children, and babies.

Moderate growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives