Assessing Canada Goose (TSX:GOOS) Valuation After Recent Share Price Volatility

Reviewed by Simply Wall St

See our latest analysis for Canada Goose Holdings.

After a strong run over the past 12 months, Canada Goose has recently hit some turbulence, with a 1-day share price drop of nearly 14% and a 7-day decline of just over 10%. Still, the long-term momentum is intact, as shown by its 12-month total shareholder return of almost 28%. This comes despite significant pullbacks over the past 3 and 5 years. Investors seem to be weighing the company’s growth potential against ongoing risks as the price adjusts to changing sentiment and market conditions.

If this volatility has you thinking about where else to look, why not take this chance to discover fast growing stocks with high insider ownership

With shares backing off recent highs yet still up strongly from last year, the key question is whether Canada Goose stock now trades below its true worth or if the market has already priced in expected growth. Could this be a fresh buying opportunity, or have future gains been accounted for?

Most Popular Narrative: 18% Undervalued

With the most widely followed narrative estimating Canada Goose Holdings’ fair value at CA$21.03, shares are currently trading at CA$17.20. This implies a meaningful disconnect from this outlook and sets the stage for a closer look at the forces and forward assumptions that underpin this valuation.

Exceptional revenue growth in North America and Mainland China, especially driven by rising affluence and demand for premium/luxury goods in Asia, highlights Canada Goose's ability to tap expanding high-end consumer markets. This suggests a longer-term expansion of the addressable customer base and continued international revenue growth.

Want to know the quantitative engine behind that bullish price? Insiders are betting on international expansion, innovative product moves, and a leap in future margins. The real narrative reveal is a profit and growth forecast that could surprise even seasoned market-watchers. Uncover the exact numbers powering this projection before the rest of the crowd catches on.

Result: Fair Value of $21.03 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent weakness in key markets like the U.K. and rising operating costs could challenge Canada Goose’s growth story if these pressures do not ease.

Find out about the key risks to this Canada Goose Holdings narrative.

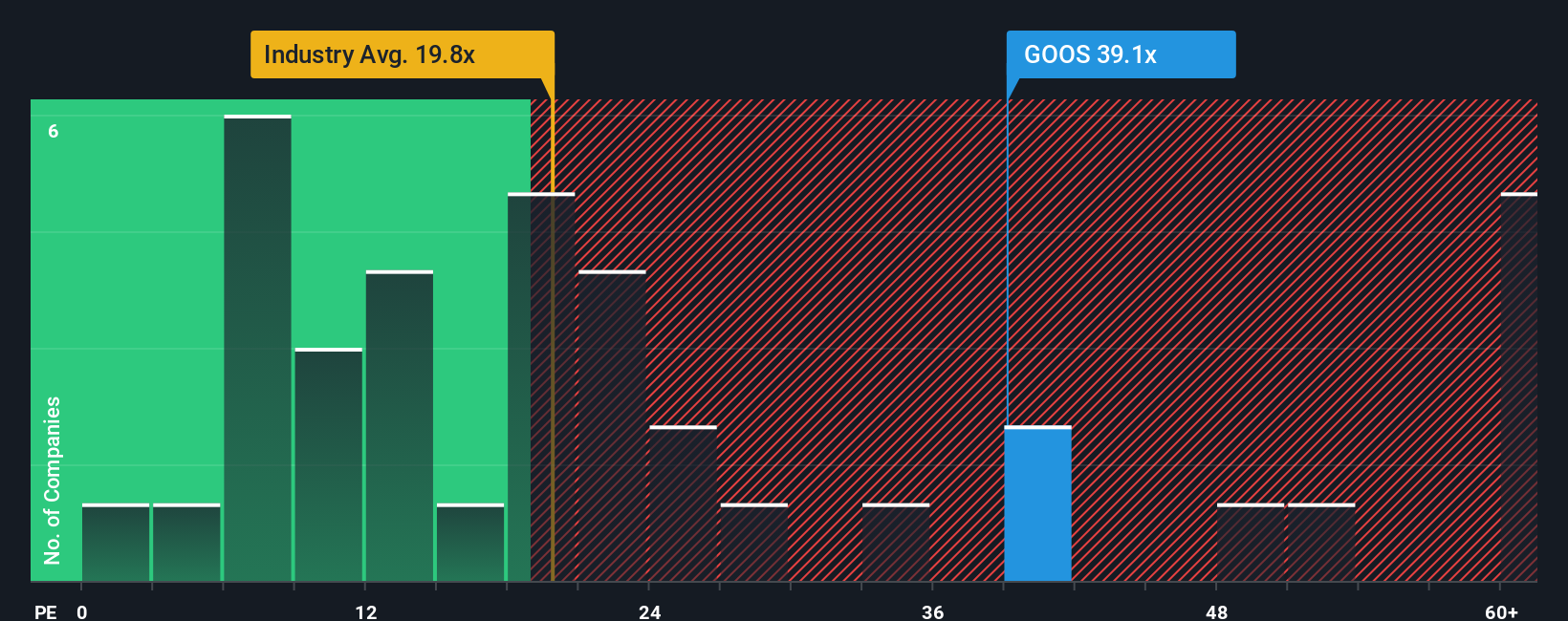

Another View: Examining Valuation Multiples

Looking at Canada Goose’s valuation through its price-to-earnings ratio shows a less optimistic perspective. The company trades at 63.2x earnings, which is well above both the peer average (28.6x) and the broader industry (20x). The fair ratio, which is the level the market may eventually move toward, is just 16.1x. Such a gap highlights significant valuation risk if sentiment or fundamentals shift.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Canada Goose Holdings Narrative

If you have a different perspective or want to dive into the numbers yourself, you can easily craft your own view in just a few minutes. Do it your way

A great starting point for your Canada Goose Holdings research is our analysis highlighting 4 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don’t let opportunity pass you by when there are dozens of standout stocks worth your attention. Power up your portfolio with smart, targeted investment ideas curated by the Simply Wall Street Screener.

- Capitalize on major medical breakthroughs by checking out these 32 healthcare AI stocks, which are reshaping healthcare with AI-driven innovation and robust growth potential.

- Unlock steady income streams with these 17 dividend stocks with yields > 3%, featuring generous yields and reliable performance for investors who value consistent returns.

- Position yourself at the leading edge of technological disruption and research progress by reviewing these 28 quantum computing stocks in quantum computing.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:GOOS

Canada Goose Holdings

Designs, manufactures, and sells performance luxury outerwear, apparel, footwear, and accessories for men, women, youth, children, and babies.

Slight risk with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives