What Gildan Activewear (TSX:GIL)'s Dividend and Buyback Commitments Mean After Q3 Earnings Update

Reviewed by Sasha Jovanovic

- Gildan Activewear Inc. recently reported third-quarter 2025 earnings, with sales of US$910.57 million and net income of US$120.16 million, while also reaffirming its full-year revenue growth guidance, announcing a US$0.226 per share dividend, and updating on its share buyback program.

- The company’s ongoing share repurchases and continued dividend payments highlight a sustained commitment to returning capital to shareholders, even as quarterly earnings saw a modest year-over-year decrease.

- We'll assess how the earnings results and confirmed revenue growth outlook influence Gildan's investment narrative and future prospects.

This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

Gildan Activewear Investment Narrative Recap

To be a Gildan Activewear shareholder, you likely need to believe in the company’s ability to deliver consistent earnings growth and margin stability, even as it navigates competitive global apparel markets and raw material cost pressures. The recent Q3 earnings report, which showed improving sales yet a slight dip in net income, does not materially change the core short-term catalyst: successful execution of new sales programs, nor does it significantly influence the ongoing risk from uneven global demand.

Of the recent announcements, the reaffirmation of Gildan’s mid-single-digit full-year revenue growth guidance is especially relevant. This is crucial for investors focused on near-term momentum, as management’s confidence suggests that major revenue drivers, like new product launches and expanded distribution, are tracking as planned, despite modest earnings pressure in the quarter.

However, it is important to note that if adoption of these new programs falters, especially outside North America...

Read the full narrative on Gildan Activewear (it's free!)

Gildan Activewear's outlook anticipates $3.8 billion in revenue and $546.2 million in earnings by 2028. This is based on analysts expecting 4.6% annual revenue growth and a $59.8 million increase in earnings from the current $486.4 million.

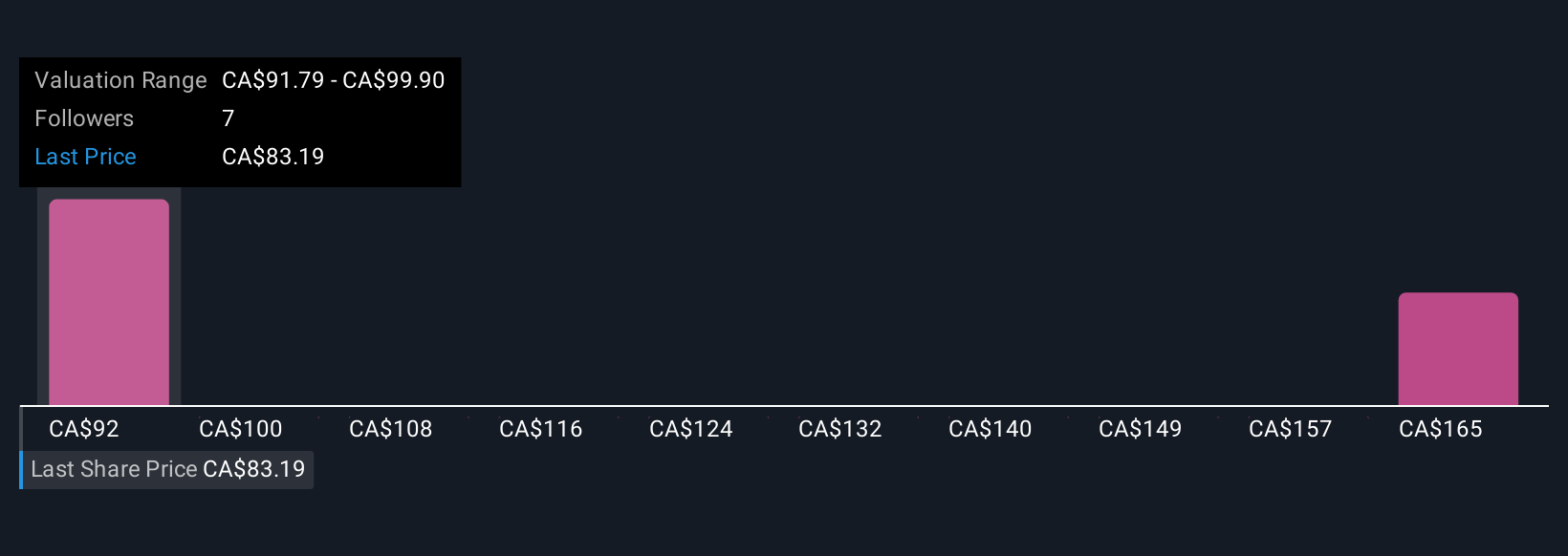

Uncover how Gildan Activewear's forecasts yield a CA$100.77 fair value, a 30% upside to its current price.

Exploring Other Perspectives

Fair value estimates from the Simply Wall St Community span from US$100.77 to US$190.90, reflecting two individual perspectives on Gildan’s outlook. While some see sizable upside, many professional analysts are also monitoring program execution as the key to supporting future revenue growth.

Explore 2 other fair value estimates on Gildan Activewear - why the stock might be worth over 2x more than the current price!

Build Your Own Gildan Activewear Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Gildan Activewear research is our analysis highlighting 5 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Gildan Activewear research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Gildan Activewear's overall financial health at a glance.

Contemplating Other Strategies?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 35 best rare earth metal stocks of the very few that mine this essential strategic resource.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:GIL

Very undervalued with exceptional growth potential.

Similar Companies

Market Insights

Community Narratives