Is BRP’s Recent Product Expansion a Turning Point for Its Share Price in 2025?

Reviewed by Bailey Pemberton

- Curious if BRP stock is actually good value right now? You are not alone, as investors constantly debate whether recent price shifts open the door to opportunity or hint at bigger risks ahead.

- After climbing 21.2% year-to-date and an impressive 26.4% over the past 12 months, BRP's share price has been on the move. However, it took a dip of 6.3% in the last week and 7.7% over the past month.

- Recent news about BRP has spotlighted the company’s aggressive product launches and expansion into new markets. This has fueled optimism about its long-term trajectory. Meanwhile, industry analysts have been discussing changing consumer trends and potential market headwinds, which adds another layer of intrigue to the stock’s story.

- Right now, BRP scores a 2 out of 6 on our undervaluation checks. This signals room for improvement, but also potential hidden value. We will unpack how different valuation methods measure up, and stick around as we reveal a smarter way to approach valuation at the end of the article.

BRP scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: BRP Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates a company’s intrinsic value by projecting its future cash flows and discounting them back to their present value. This approach helps investors assess what a business is truly worth today, based on its ability to generate cash in the future.

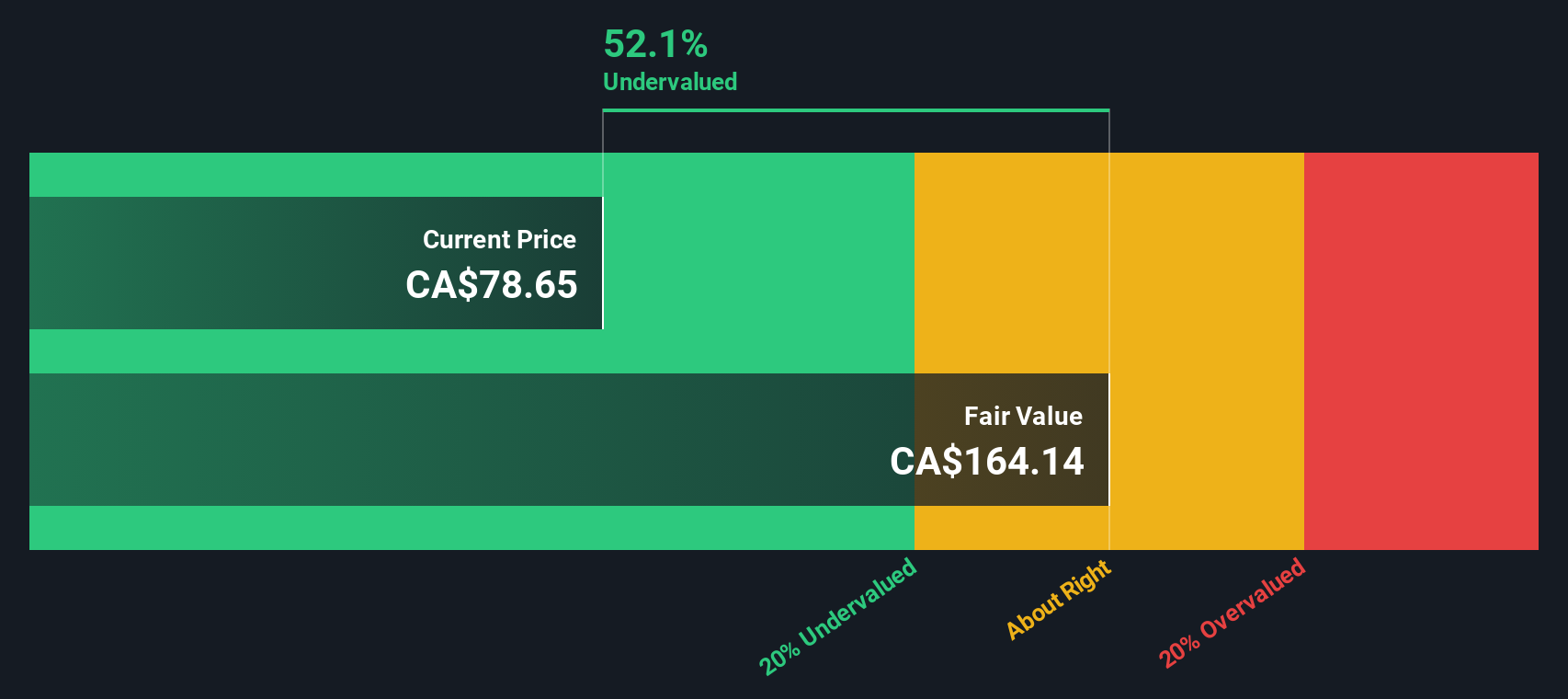

For BRP, the DCF model starts with its most recent Free Cash Flow of CA$431.4 Million. Analysts expect Free Cash Flow to grow steadily, reaching about CA$770 Million by 2028. From there, further projections indicate a potential rise to over CA$1.37 Billion by 2035, though these longer-term numbers are based on extrapolations rather than direct analyst forecasts.

Based on these future cash flows, the model produces an estimated intrinsic value for BRP stock of CA$327.50 per share. This figure is significantly above the current share price, which implies a discount of 73.2% and suggests the market is dramatically undervaluing the business.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests BRP is undervalued by 73.2%. Track this in your watchlist or portfolio, or discover 840 more undervalued stocks based on cash flows.

Approach 2: BRP Price vs Earnings

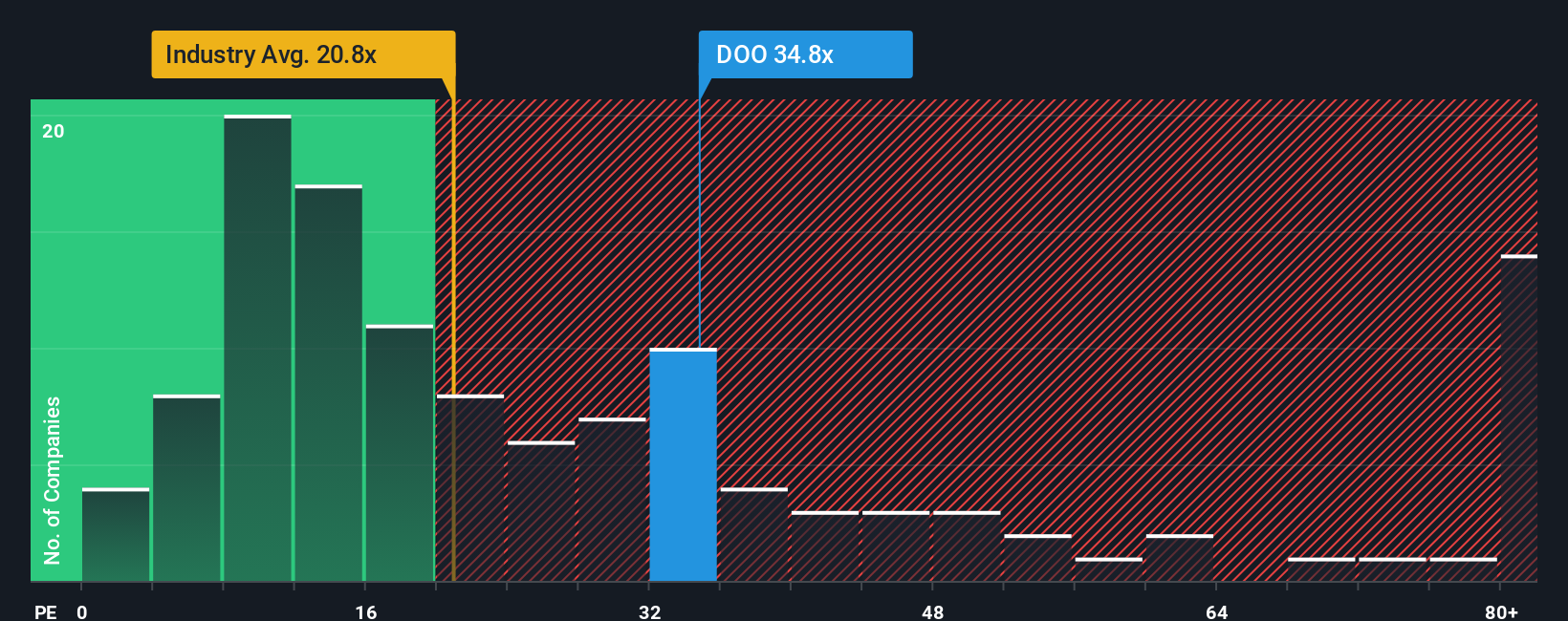

The Price-to-Earnings (PE) ratio is a widely used valuation metric for profitable companies like BRP, as it gives investors a sense of how much they are paying for each dollar of earnings. It is especially relevant when a company generates consistent profits, since it directly ties valuation to those reported earnings figures.

However, what counts as a "normal" or fair PE ratio can vary significantly. Higher growth expectations or lower perceived risk can justify a higher PE, while companies facing stalled earnings or greater uncertainty are often assigned lower multiples. That is why the PE ratio must always be considered in context, such as against industry averages, peers, and company-specific traits.

Currently, BRP trades at a PE ratio of 32.4x. That is notably higher than the Leisure industry average of 21.4x and above the peer average of 26.2x. Simply Wall St’s proprietary “Fair Ratio” for BRP comes in at 31.2x, a figure specifically tailored to account for BRP’s growth outlook, risk profile, profit margins, industry positioning, and market capitalization. This Fair Ratio is a more nuanced benchmark than simple peer or industry comparisons, because it captures the unique characteristics and upside or risks associated with the company.

With BRP’s actual PE ratio very close to its Fair Ratio, the stock appears fairly valued based on earnings multiples.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1411 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your BRP Narrative

Earlier we mentioned that there is an even better way to understand valuation. Let’s introduce you to Narratives. A Narrative is a simple, approachable tool that lets you tell the story behind your investment view. It connects your expectations for BRP’s future revenue, earnings and profit margins to a tailored fair value. Narratives bridge the gap between the company’s market story and the numbers, clearly laying out your assumptions and showing how they relate to potential returns.

Narratives are available on Simply Wall St’s Community page, used by millions of investors worldwide, and make it easy to see how your outlook compares to others. They dynamically update as new news or earnings arrive, so you can stay ahead of changes in BRP's outlook. With Narratives, you can quickly assess whether BRP fits your investment strategy by comparing your fair value to the current share price, all transparently linked to your chosen story and logic.

For example, some investors are optimistic about BRP, factoring in strong electric vehicle growth and international expansion, giving it a fair value as high as CA$114.0. Others are more cautious due to regulatory and market risks, setting their fair value closer to CA$50.0. Narratives let you decide which story best fits your view and see in real time how that translates into your investment approach.

Do you think there's more to the story for BRP? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BRP might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:DOO

BRP

Designs, develops, manufactures, and sells powersports vehicles and marine products in the Mexico, Canada, Austria, the United States, Finland, Australia, and Germany.

High growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives