- Canada

- /

- Consumer Durables

- /

- TSX:DBO

Revenues Tell The Story For D-BOX Technologies Inc. (TSE:DBO) As Its Stock Soars 26%

D-BOX Technologies Inc. (TSE:DBO) shares have continued their recent momentum with a 26% gain in the last month alone. The last month tops off a massive increase of 144% in the last year.

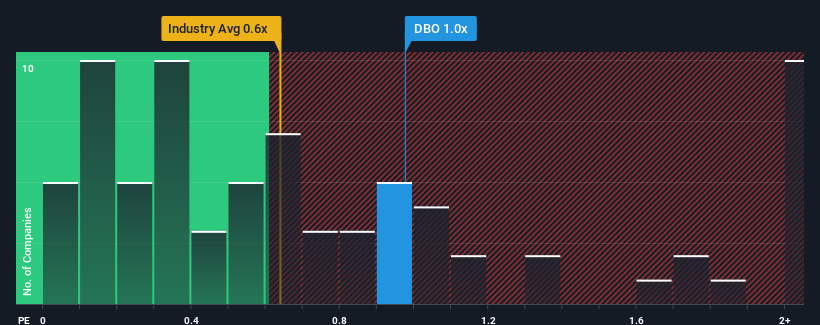

Following the firm bounce in price, given close to half the companies operating in Canada's Consumer Durables industry have price-to-sales ratios (or "P/S") below 0.3x, you may consider D-BOX Technologies as a stock to potentially avoid with its 1x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/S.

View our latest analysis for D-BOX Technologies

How Has D-BOX Technologies Performed Recently?

The revenue growth achieved at D-BOX Technologies over the last year would be more than acceptable for most companies. One possibility is that the P/S ratio is high because investors think this respectable revenue growth will be enough to outperform the broader industry in the near future. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on D-BOX Technologies will help you shine a light on its historical performance.Is There Enough Revenue Growth Forecasted For D-BOX Technologies?

The only time you'd be truly comfortable seeing a P/S as high as D-BOX Technologies' is when the company's growth is on track to outshine the industry.

If we review the last year of revenue growth, the company posted a worthy increase of 11%. Pleasingly, revenue has also lifted 157% in aggregate from three years ago, partly thanks to the last 12 months of growth. Therefore, it's fair to say the revenue growth recently has been superb for the company.

When compared to the industry's one-year growth forecast of 4.2%, the most recent medium-term revenue trajectory is noticeably more alluring

With this information, we can see why D-BOX Technologies is trading at such a high P/S compared to the industry. It seems most investors are expecting this strong growth to continue and are willing to pay more for the stock.

The Bottom Line On D-BOX Technologies' P/S

D-BOX Technologies shares have taken a big step in a northerly direction, but its P/S is elevated as a result. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

As we suspected, our examination of D-BOX Technologies revealed its three-year revenue trends are contributing to its high P/S, given they look better than current industry expectations. In the eyes of shareholders, the probability of a continued growth trajectory is great enough to prevent the P/S from pulling back. Unless the recent medium-term conditions change, they will continue to provide strong support to the share price.

Before you take the next step, you should know about the 1 warning sign for D-BOX Technologies that we have uncovered.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:DBO

D-BOX Technologies

Designs, manufactures, and commercializes haptic motion systems intended for theatrical entertainment, sim racing and simulation, and training business in the United States, Canada, Europe, Asia, South America, Oceania, and Africa.

Outstanding track record with flawless balance sheet.

Market Insights

Community Narratives