- Canada

- /

- Commercial Services

- /

- TSXV:EWS

Environmental Waste International Insiders Recover Some Losses, Which Stand At CA$356k

Insiders who purchased CA$622.6k worth of Environmental Waste International Inc. (CVE:EWS) shares over the past year recouped some of their losses after price gained 50% last week. However, the purchase is proving to be an expensive wager as insiders are yet to get ahead of their losses which currently stand at CA$356k since the time of purchase.

While insider transactions are not the most important thing when it comes to long-term investing, logic dictates you should pay some attention to whether insiders are buying or selling shares.

Check out our latest analysis for Environmental Waste International

Environmental Waste International Insider Transactions Over The Last Year

The insider Emanuel Gerard made the biggest insider purchase in the last 12 months. That single transaction was for CA$573k worth of shares at a price of CA$0.035 each. So it's clear an insider wanted to buy, even at a higher price than the current share price (being CA$0.015). While their view may have changed since the purchase was made, this does at least suggest they have had confidence in the company's future. In our view, the price an insider pays for shares is very important. Generally speaking, it catches our eye when insiders have purchased shares at above current prices, as it suggests they believed the shares were worth buying, even at a higher price.

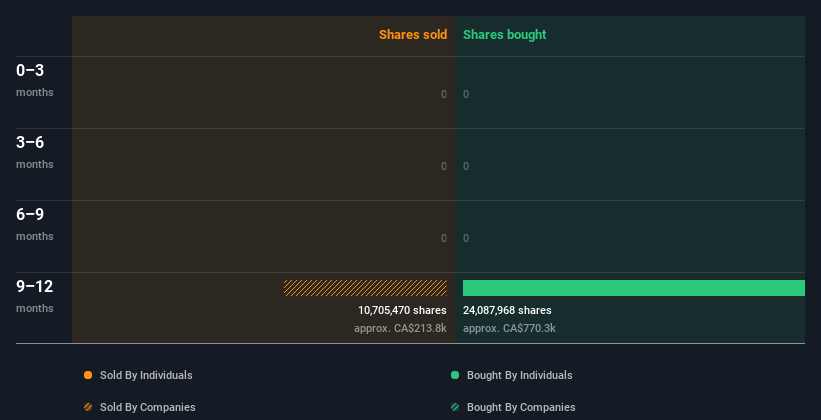

Environmental Waste International insiders may have bought shares in the last year, but they didn't sell any. You can see the insider transactions (by companies and individuals) over the last year depicted in the chart below. If you click on the chart, you can see all the individual transactions, including the share price, individual, and the date!

There are plenty of other companies that have insiders buying up shares. You probably do not want to miss this free list of growing companies that insiders are buying.

Does Environmental Waste International Boast High Insider Ownership?

I like to look at how many shares insiders own in a company, to help inform my view of how aligned they are with insiders. We usually like to see fairly high levels of insider ownership. Insiders own 20% of Environmental Waste International shares, worth about CA$670k. We've certainly seen higher levels of insider ownership elsewhere, but these holdings are enough to suggest alignment between insiders and the other shareholders.

So What Does This Data Suggest About Environmental Waste International Insiders?

The fact that there have been no Environmental Waste International insider transactions recently certainly doesn't bother us. But insiders have shown more of an appetite for the stock, over the last year. Overall we don't see anything to make us think Environmental Waste International insiders are doubting the company, and they do own shares. In addition to knowing about insider transactions going on, it's beneficial to identify the risks facing Environmental Waste International. When we did our research, we found 7 warning signs for Environmental Waste International (6 are potentially serious!) that we believe deserve your full attention.

But note: Environmental Waste International may not be the best stock to buy. So take a peek at this free list of interesting companies with high ROE and low debt.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions of direct interests only, but not derivative transactions or indirect interests.

Valuation is complex, but we're here to simplify it.

Discover if Environmental Waste International might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSXV:EWS

Environmental Waste International

Researches, designs, develops, sells, and maintains systems based on the patented Reverse Polymerization process, Microwave Delivery System, and Hybrid Microwave Process.

Moderate with weak fundamentals.