- Canada

- /

- Professional Services

- /

- TSX:TRI

Thomson Reuters (TSX:TRI) Margin Decline Challenges Premium Valuation Narrative

Reviewed by Simply Wall St

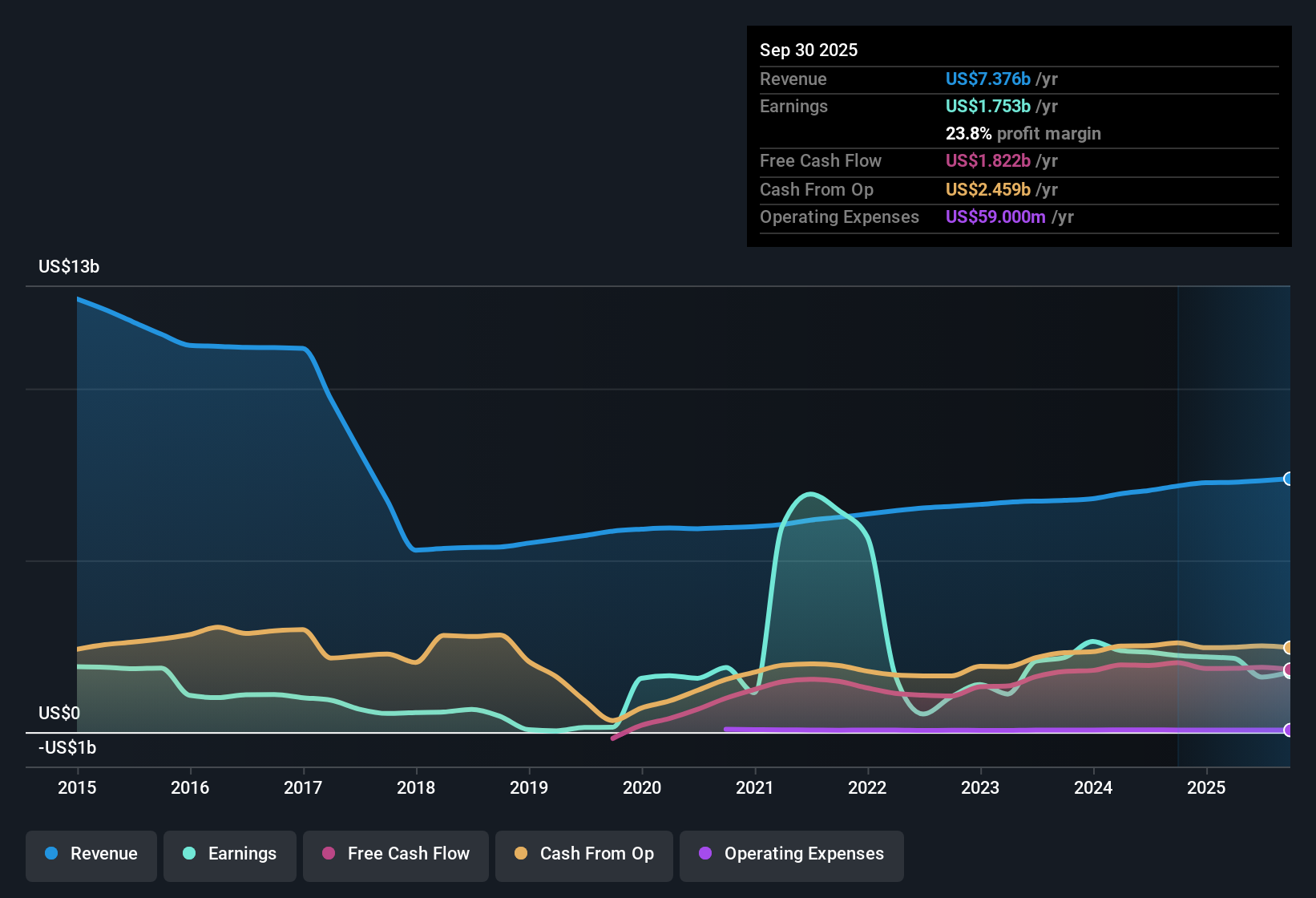

Thomson Reuters (TSX:TRI) is forecast to deliver annual earnings growth of 8.6% and revenue growth of 7.5% per year. Revenue growth is expected to outpace the Canadian market average of 5.1%. Recent profit margins have tightened to 23.8%, down from last year’s 31.2%, while earnings have declined by 18% per year over the past five years. Although profits are expected to pick up, the anticipated growth is modest and trails the high-growth benchmarks investors often look for during earnings season.

See our full analysis for Thomson Reuters.The next section will set these results against the broader narratives that investors and the market have built around Thomson Reuters. Some expectations may be confirmed, while others could get a reality check.

See what the community is saying about Thomson Reuters

High PE Remains Above Peers and Industry

- With a price-to-earnings ratio of 37.7x, Thomson Reuters trades at a substantial premium to the peer average of 29.1x and the North American Professional Services industry average of 25.6x. This raises the bar for future outperformance.

- Analysts' consensus view highlights that the company’s high-quality earnings and recurring revenue streams, fueled by AI-driven automation and proprietary content, help justify this elevated valuation.

- Strategic innovations and integrated workflow solutions are expected to support margin expansion over the long term. However, continued competition and cost pressures could put this premium at risk.

- Bulls point to a projected annual revenue growth rate of 7.5%, exceeding the Canadian market average of 5.1%, as a rationale for the valuation gap versus peers.

See why market watchers remain focused on TRI's high valuation and future growth in the full consensus narrative. 📊 Read the full Thomson Reuters Consensus Narrative.

Profit Margin Trends Lag Analyst Optimism

- Profit margins have compressed to 23.8% from last year’s 31.2%, a notable drop that directly contrasts with analyst forecasts for margin improvement from 21.9% to 22.9% over the next three years.

- Consensus narrative points to ongoing investments in AI and workflow automation, intended to unlock operating leverage and address persistent talent shortages.

- While analysts expect margin expansion, the recent downward trend highlights execution risk, particularly if rising compliance costs or integration challenges from acquisitions fail to deliver anticipated synergies.

- Strong liquidity and a $10 billion capital capacity by 2027 provide room for margin-lifting M&A. However, integration hurdles could limit these benefits if not managed well.

Share Price Below Both Fair Value and Analyst Targets

- At a current share price of CA$206.63, Thomson Reuters trades below its DCF fair value of CA$242.08 and under the latest consensus analyst target of CA$271.96, offering a 10.7% upside to target.

- Consensus narrative underscores that realizing analyst price targets would require revenue of $9.2 billion and earnings of $2.1 billion by 2028, along with a forward PE of 51.2x.

- Consensus sees the company’s “category leader” status, proprietary content, and integration with complex regulatory environments as supporting drivers for this upside. However, it also warns that slow client adoption of AI and legal tech, as well as PE compression, could limit valuation gains.

- Critics highlight that some analyst assumptions rest on both improved margins and faster than historical earnings growth, despite recent earnings declining by 18% annually over five years.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Thomson Reuters on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a new angle on the numbers? Build your unique narrative in just minutes and make your point of view count. Do it your way

A great starting point for your Thomson Reuters research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

Thomson Reuters faces pressure from declining profit margins and only modest projected earnings growth. Despite this, the company has a premium valuation compared to peers and the market.

If you want companies where valuation is supported by stronger growth or room for upside, check out these 840 undervalued stocks based on cash flows and see how better-priced opportunities compare.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Thomson Reuters might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:TRI

Thomson Reuters

Operates as a content and technology company in the Americas, Europe, the Middle East, Africa, and the Asia Pacific.

Adequate balance sheet second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives