- Canada

- /

- Professional Services

- /

- TSX:TRI

Thomson Reuters (TSX:TRI): Assessing Valuation After Q3 Growth and AI-Driven Legal Tech Expansion

Reviewed by Simply Wall St

Thomson Reuters (TSX:TRI) reported third quarter results with higher sales and net income compared to a year ago. The company also rolled out new AI-powered products and expanded its legal tech platform internationally.

See our latest analysis for Thomson Reuters.

Thomson Reuters’ strong quarterly results and its ambitious push into AI-powered legal tech have been key talking points for investors this year. While the stock is still down almost 6% year-to-date on share price return, its three-year total shareholder return of over 60% highlights meaningful long-term momentum, even through recent volatility.

If you want to see how other tech-driven companies are reshaping their industries, it is a great moment to check out the possibilities in our See the full list for free..

With solid earnings growth and a rollout of new AI strategies, does Thomson Reuters offer hidden value to investors at today’s price, or is the optimism about future growth already fully reflected in the stock?

Most Popular Narrative: 20.9% Undervalued

The narrative consensus places Thomson Reuters’ fair value well above its last close, signaling analyst conviction that the current price does not fully reflect future earnings power and margin expansion hopes.

The company's proprietary, authoritative content and integrated product suite positions it as a trusted platform, benefiting from the global proliferation of data and increasingly complex regulatory environments. This category leader status, combined with tight workflow integration, supports higher client retention and market share gains, boosting long-term recurring revenues.

Curious about why analysts believe future earnings could reset investor expectations? A handful of bold financial assumptions underpins this fair value target, but the recipe may surprise you. Want to see the detailed growth levers and profit drivers that shape the narrative’s high conviction? Dive in before the numbers change direction.

Result: Fair Value of $276.64 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, intensifying competition in legal tech and slow adoption of AI solutions could stall Thomson Reuters’ momentum and challenge these upbeat analyst projections.

Find out about the key risks to this Thomson Reuters narrative.

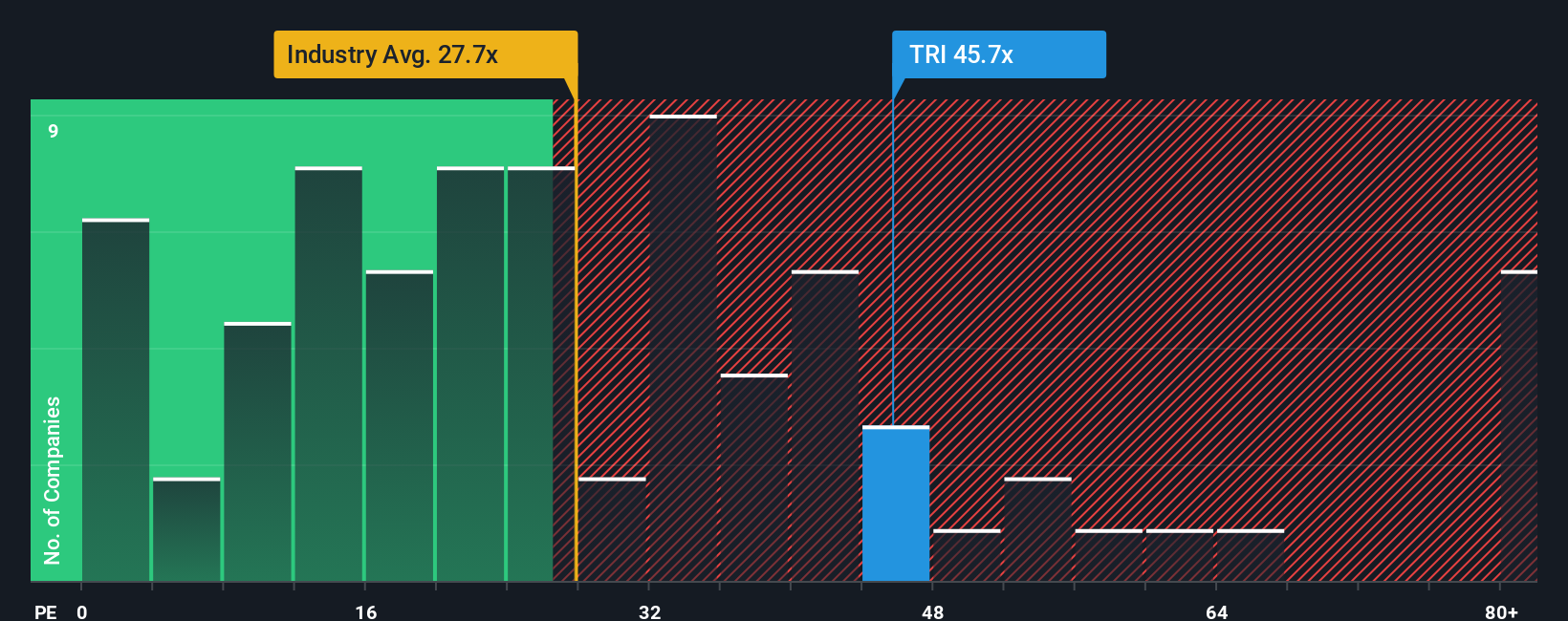

Another View: Price Ratios Signal Caution

Looking at valuation through price ratios, Thomson Reuters trades at 43.8 times earnings, which is significantly higher than the North American industry average of 25.4 times and its peer average of 29.1 times. The fair ratio is lower at 31.9 times, suggesting investors may be paying a premium for expected growth. Does this leave too much room for disappointment if results underwhelm?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Thomson Reuters Narrative

If you see the story unfolding differently, or want to dig into the data your own way, you can build a personalized perspective of Thomson Reuters in just a few minutes. Do it your way.

A great starting point for your Thomson Reuters research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Smart Investment Opportunities?

Don’t wait on the sidelines while great companies are gaining momentum. Let our screeners help you uncover the next standout opportunities tailored to your investing style.

- Supercharge your portfolio by tapping into emerging technology trends with these 26 AI penny stocks making waves in artificial intelligence innovation.

- Take charge of your search for steady income by checking out these 18 dividend stocks with yields > 3% featuring attractive yields and solid fundamentals.

- Get ahead of the curve by focusing on these 82 cryptocurrency and blockchain stocks breaking ground in decentralized finance and blockchain advancements.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Thomson Reuters might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:TRI

Thomson Reuters

Operates as a content and technology company in the Americas, Europe, the Middle East, Africa, and the Asia Pacific.

Adequate balance sheet second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives