Dexterra Group Inc.'s (TSE:DXT) investors are due to receive a payment of CA$0.0875 per share on 13th of October. This makes the dividend yield 6.0%, which will augment investor returns quite nicely.

Check out our latest analysis for Dexterra Group

Dexterra Group Is Paying Out More Than It Is Earning

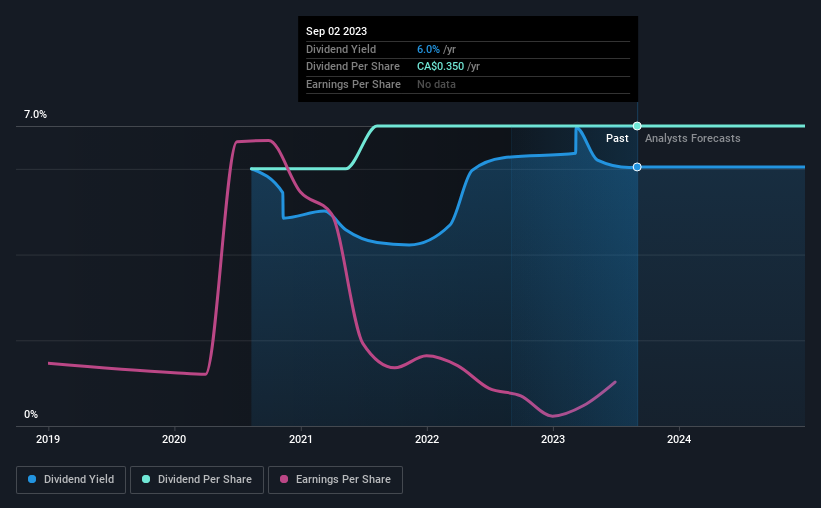

We like to see robust dividend yields, but that doesn't matter if the payment isn't sustainable. Prior to this announcement, the company was paying out 149% of what it was earning, however the dividend was quite comfortably covered by free cash flows at a cash payout ratio of only 46%. Healthy cash flows are always a positive sign, especially when they quite easily cover the dividend.

Earnings per share is forecast to rise by 56.4% over the next year. If the dividend continues on its recent course, the payout ratio in 12 months could be 128%, which is a bit high and could start applying pressure to the balance sheet.

Dexterra Group Doesn't Have A Long Payment History

The dividend hasn't seen any major cuts in the past, but the company has only been paying a dividend for 3 years, which isn't that long in the grand scheme of things. The dividend has gone from an annual total of CA$0.30 in 2020 to the most recent total annual payment of CA$0.35. This works out to be a compound annual growth rate (CAGR) of approximately 5.3% a year over that time. Dexterra Group has been growing its dividend at a decent rate, and the payments have been stable. However, the payment history is very short, so there is no evidence yet that the dividend can be sustained over a full economic cycle.

Dividend Growth May Be Hard To Come By

Investors who have held shares in the company for the past few years will be happy with the dividend income they have received. Unfortunately things aren't as good as they seem. Dexterra Group has seen earnings per share falling at 6.8% per year over the last five years. A modest decline in earnings isn't great, and it makes it quite unlikely that the dividend will grow in the future unless that trend can be reversed. It's not all bad news though, as the earnings are predicted to rise over the next 12 months - we would just be a bit cautious until this can turn into a longer term trend.

Dexterra Group's Dividend Doesn't Look Sustainable

In summary, while it's good to see that the dividend hasn't been cut, we are a bit cautious about Dexterra Group's payments, as there could be some issues with sustaining them into the future. In the past, the payments have been unstable, but over the short term the dividend could be reliable, with the company generating enough cash to cover it. We would be a touch cautious of relying on this stock primarily for the dividend income.

It's important to note that companies having a consistent dividend policy will generate greater investor confidence than those having an erratic one. At the same time, there are other factors our readers should be conscious of before pouring capital into a stock. Just as an example, we've come across 2 warning signs for Dexterra Group you should be aware of, and 1 of them is significant. Is Dexterra Group not quite the opportunity you were looking for? Why not check out our selection of top dividend stocks.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:DXT

Dexterra Group

Engages in the provision of support services for the creation, management, and operation of infrastructure in Canada.

Undervalued with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026