Caldwell Partners International And Two TSX Penny Stocks To Monitor

Reviewed by Simply Wall St

The Canadian market is currently navigating a period of subdued growth, influenced by slower consumer spending and a complex international economic landscape. Despite these challenges, penny stocks remain an intriguing area for investors seeking growth opportunities in smaller or newer companies. These stocks can offer significant potential when backed by strong financial health, making them worth monitoring for those interested in discovering hidden value within the market.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Rewards & Risks |

| Westbridge Renewable Energy (TSXV:WEB) | CA$2.17 | CA$54.35M | ✅ 3 ⚠️ 4 View Analysis > |

| Zoomd Technologies (TSXV:ZOMD) | CA$1.92 | CA$186.39M | ✅ 4 ⚠️ 1 View Analysis > |

| Montero Mining and Exploration (TSXV:MON) | CA$0.43 | CA$3.51M | ✅ 2 ⚠️ 4 View Analysis > |

| CEMATRIX (TSX:CEMX) | CA$0.33 | CA$48.82M | ✅ 3 ⚠️ 1 View Analysis > |

| Monument Mining (TSXV:MMY) | CA$1.07 | CA$362.36M | ✅ 3 ⚠️ 1 View Analysis > |

| Thor Explorations (TSXV:THX) | CA$1.175 | CA$765.09M | ✅ 3 ⚠️ 2 View Analysis > |

| Automotive Finco (TSXV:AFCC.H) | CA$1.12 | CA$22.4M | ✅ 2 ⚠️ 4 View Analysis > |

| Pulse Seismic (TSX:PSD) | CA$2.84 | CA$141.61M | ✅ 2 ⚠️ 1 View Analysis > |

| Hemisphere Energy (TSXV:HME) | CA$2.17 | CA$206.45M | ✅ 3 ⚠️ 2 View Analysis > |

| Matachewan Consolidated Mines (TSXV:MCM.A) | CA$0.72 | CA$9.82M | ✅ 2 ⚠️ 4 View Analysis > |

Click here to see the full list of 400 stocks from our TSX Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Caldwell Partners International (TSX:CWL)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: The Caldwell Partners International Inc. operates as an executive search firm offering candidate research and sourcing services across Canada, the United States, and Europe, with a market cap of CA$22.39 million.

Operations: Caldwell Partners International does not report specific revenue segments.

Market Cap: CA$22.39M

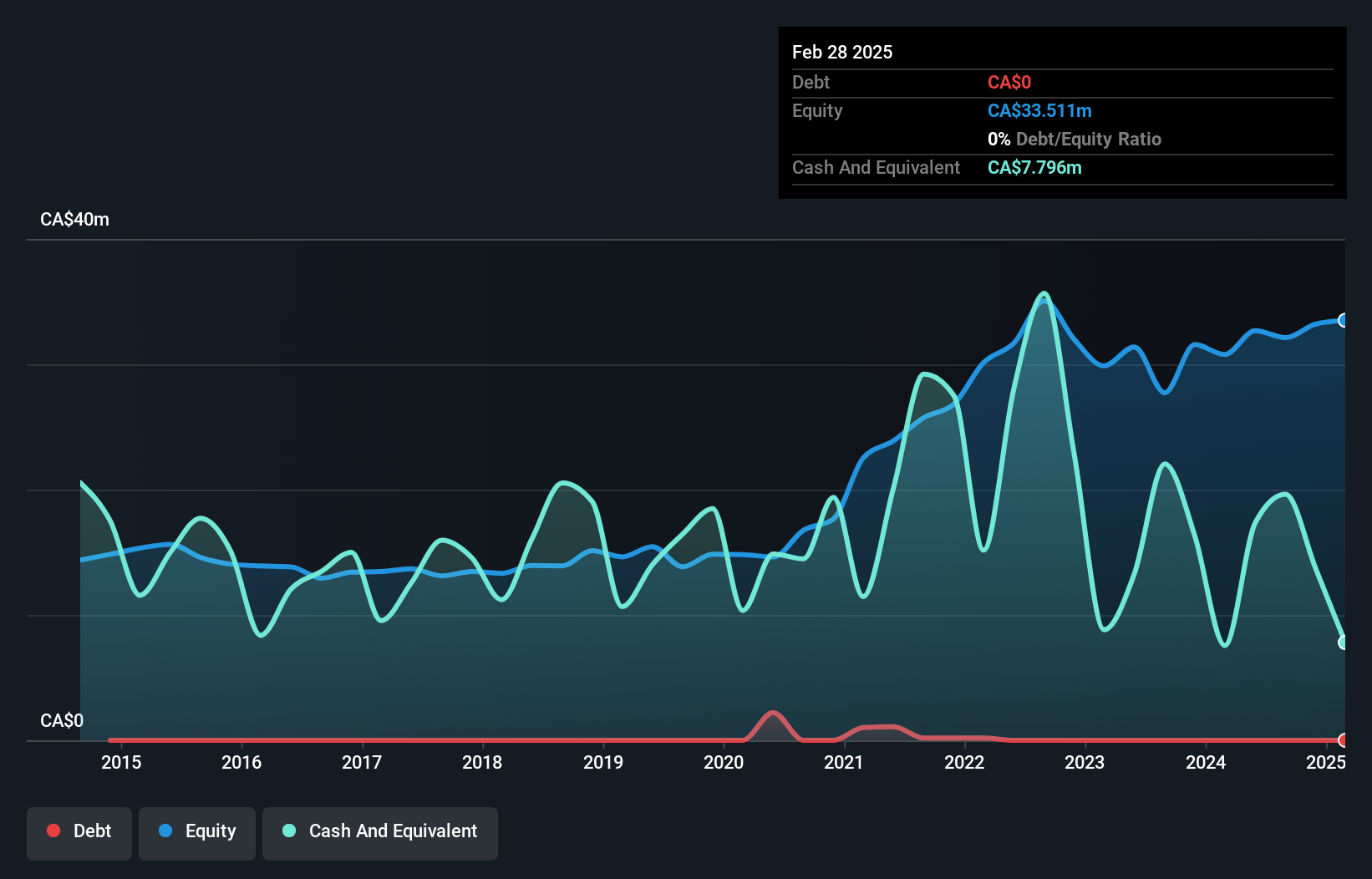

Caldwell Partners International, with a market cap of CA$22.39 million, has experienced challenges in profitability and growth. Despite its debt-free status and sufficient short-term assets to cover liabilities, the company reported a decline in net income to CA$2.56 million for the year ending August 31, 2025, down from CA$4.19 million the previous year. Earnings per share also decreased significantly. However, revenue increased to CA$104.06 million from CA$87.15 million last year, indicating some operational strength amidst declining profit margins and earnings growth challenges over recent years. The recent dividend increase suggests confidence in future cash flows despite current hurdles.

- Get an in-depth perspective on Caldwell Partners International's performance by reading our balance sheet health report here.

- Assess Caldwell Partners International's previous results with our detailed historical performance reports.

Cathedra Bitcoin (TSXV:CBIT)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Cathedra Bitcoin Inc. operates in the bitcoin mining and hosting sector across North America, with a market cap of CA$37.35 million.

Operations: The company generates revenue through two primary segments: Hosting, which contributes CA$13.50 million, and Bitcoin Mining, accounting for CA$9.43 million.

Market Cap: CA$37.35M

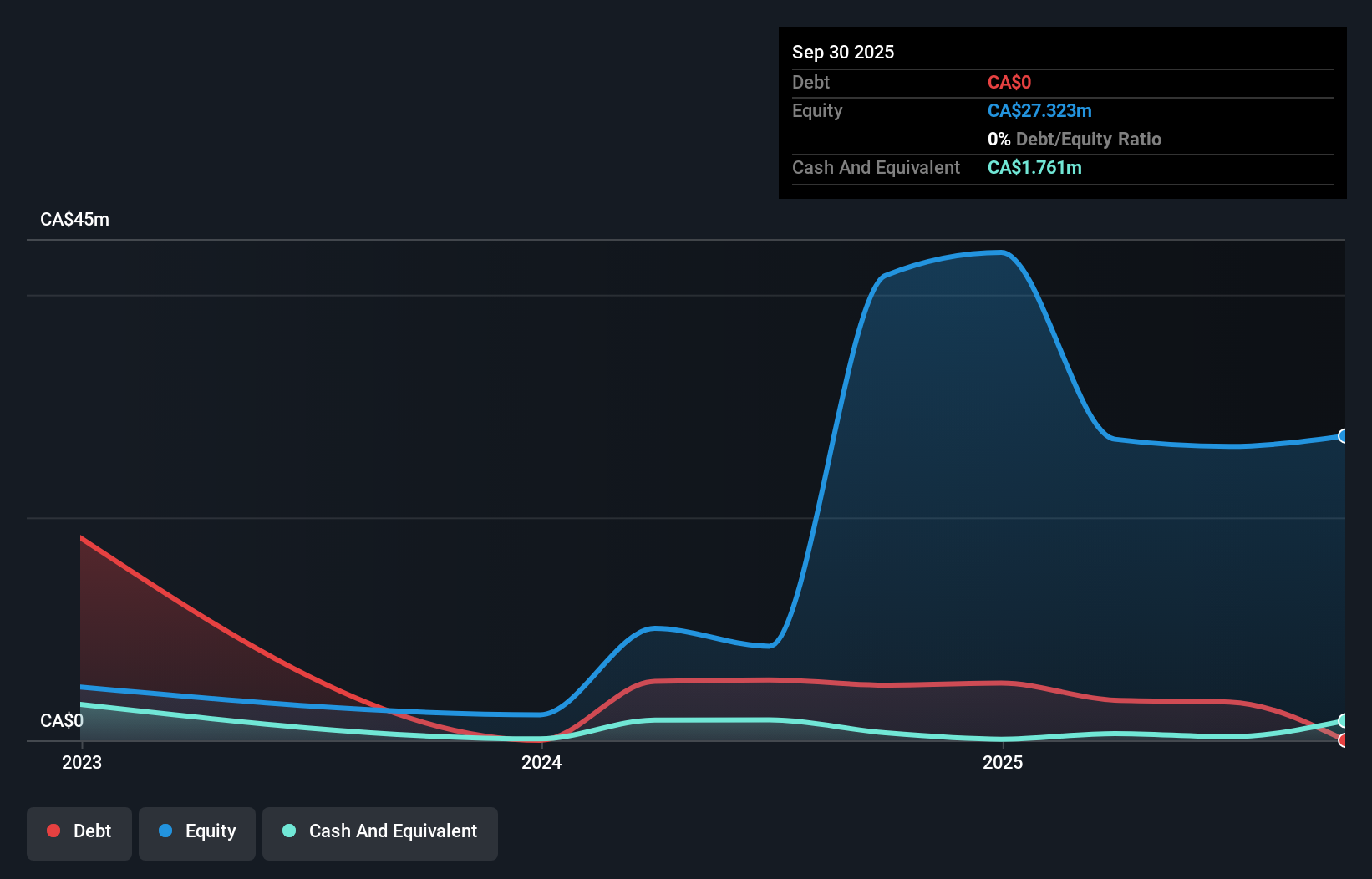

Cathedra Bitcoin Inc., with a market cap of CA$37.35 million, operates in the bitcoin mining and hosting sector but faces volatility and profitability challenges. Recent earnings for Q3 2025 show a net loss of CA$0.78 million, an improvement from the previous year's larger loss, though revenue slightly decreased to CA$5.51 million from CA$5.86 million year-on-year. The company remains debt-free with short-term assets covering liabilities, yet its negative return on equity and unprofitability highlight ongoing financial hurdles despite anticipated revenue growth of 17.99% per year amidst fluctuating share prices and recent stock split activities.

- Click here and access our complete financial health analysis report to understand the dynamics of Cathedra Bitcoin.

- Explore Cathedra Bitcoin's analyst forecasts in our growth report.

DMG Blockchain Solutions (TSXV:DMGI)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: DMG Blockchain Solutions Inc. is a North American blockchain and cryptocurrency company with a market cap of CA$53.39 million.

Operations: The company generates revenue from its Data Processing segment, amounting to CA$41.79 million.

Market Cap: CA$53.39M

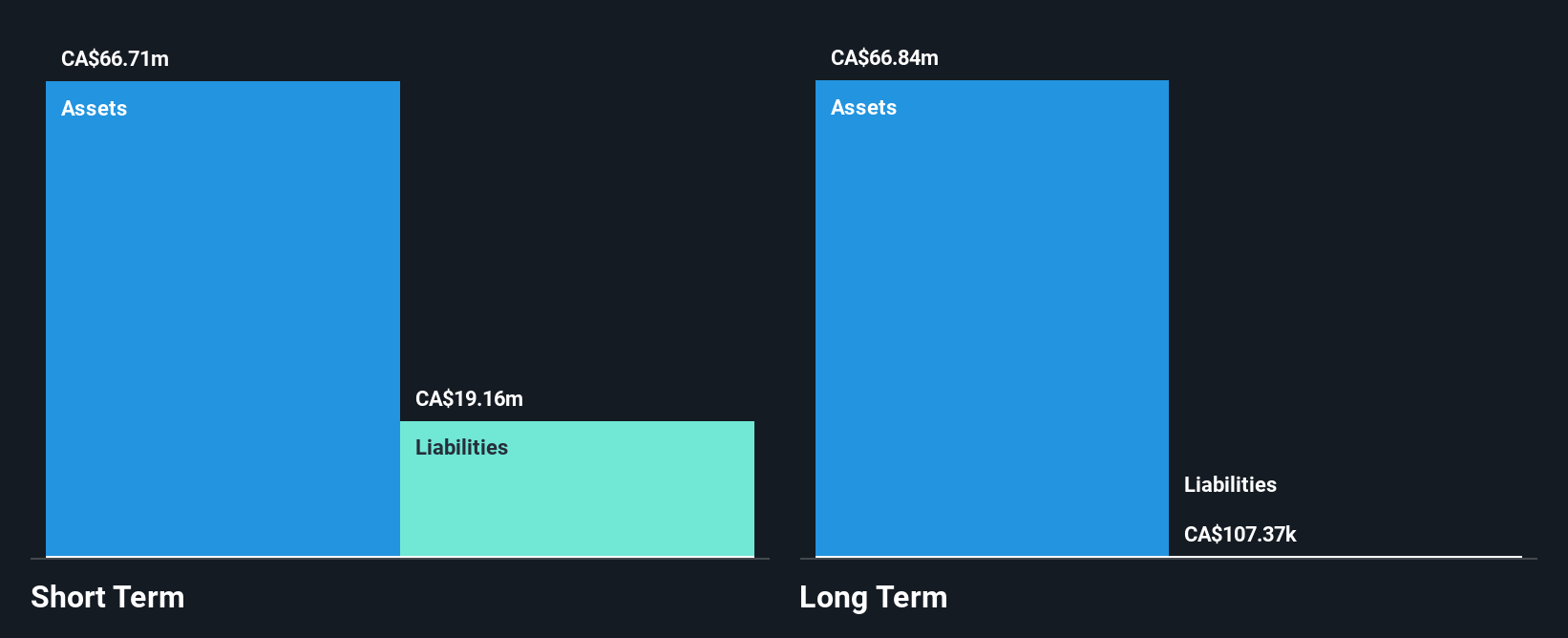

DMG Blockchain Solutions, with a market cap of CA$53.39 million, is expanding its data center capabilities in North America. Despite being unprofitable and experiencing increased losses over the past five years, it maintains a satisfactory net debt to equity ratio of 1% and covers both short and long-term liabilities with its assets. Recent strategic moves include acquiring property in Oregon for potential high-performance computing (HPC) data centers and forming a utility joint venture with Malahat Nation to develop AI infrastructure on Vancouver Island. Revenue from its Data Processing segment reached CA$41.79 million, showing growth potential despite profitability challenges.

- Click here to discover the nuances of DMG Blockchain Solutions with our detailed analytical financial health report.

- Review our growth performance report to gain insights into DMG Blockchain Solutions' future.

Next Steps

- Unlock our comprehensive list of 400 TSX Penny Stocks by clicking here.

- Seeking Other Investments? We've found 14 US stocks that are forecast to pay a dividend yeild of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:DMGI

DMG Blockchain Solutions

Operates as a blockchain and crypto-currency company in North America.

Flawless balance sheet with slight risk.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success