- Canada

- /

- Energy Services

- /

- TSX:AKT.A

Base Carbon And 2 More TSX Penny Stocks Worth Watching

Reviewed by Simply Wall St

The Canadian market is currently navigating a period of subdued growth, with recent data showing slower consumer spending partly due to a decline in the auto sector and slower population growth. Despite these challenges, investors continue to explore opportunities within the stock market, particularly in sectors that may offer resilience and potential upside. Penny stocks, though an older term, remain relevant as they often represent smaller or newer companies that can offer significant value when underpinned by strong financials. In this context, we've identified three penny stocks on the TSX worth watching for their financial strength and potential for future growth.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Rewards & Risks |

| Westbridge Renewable Energy (TSXV:WEB) | CA$2.14 | CA$54.86M | ✅ 3 ⚠️ 4 View Analysis > |

| Sailfish Royalty (TSXV:FISH) | CA$3.02 | CA$231.53M | ✅ 1 ⚠️ 4 View Analysis > |

| Zoomd Technologies (TSXV:ZOMD) | CA$1.98 | CA$193.44M | ✅ 4 ⚠️ 1 View Analysis > |

| Montero Mining and Exploration (TSXV:MON) | CA$0.43 | CA$3.59M | ✅ 2 ⚠️ 4 View Analysis > |

| CEMATRIX (TSX:CEMX) | CA$0.33 | CA$50.32M | ✅ 3 ⚠️ 1 View Analysis > |

| Thor Explorations (TSXV:THX) | CA$1.19 | CA$781.72M | ✅ 3 ⚠️ 2 View Analysis > |

| Automotive Finco (TSXV:AFCC.H) | CA$1.12 | CA$22.2M | ✅ 2 ⚠️ 4 View Analysis > |

| Pulse Seismic (TSX:PSD) | CA$2.83 | CA$140.59M | ✅ 2 ⚠️ 2 View Analysis > |

| Hemisphere Energy (TSXV:HME) | CA$1.96 | CA$205.5M | ✅ 3 ⚠️ 2 View Analysis > |

| Matachewan Consolidated Mines (TSXV:MCM.A) | CA$0.80 | CA$10.92M | ✅ 2 ⚠️ 4 View Analysis > |

Click here to see the full list of 403 stocks from our TSX Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Base Carbon (NEOE:BCBN)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Base Carbon Inc., along with its subsidiaries, offers capital, development expertise, and management operating resources, with a market cap of CA$100.91 million.

Operations: The company's revenue primarily comes from the development and deployment of its projects, amounting to $6.21 million.

Market Cap: CA$100.91M

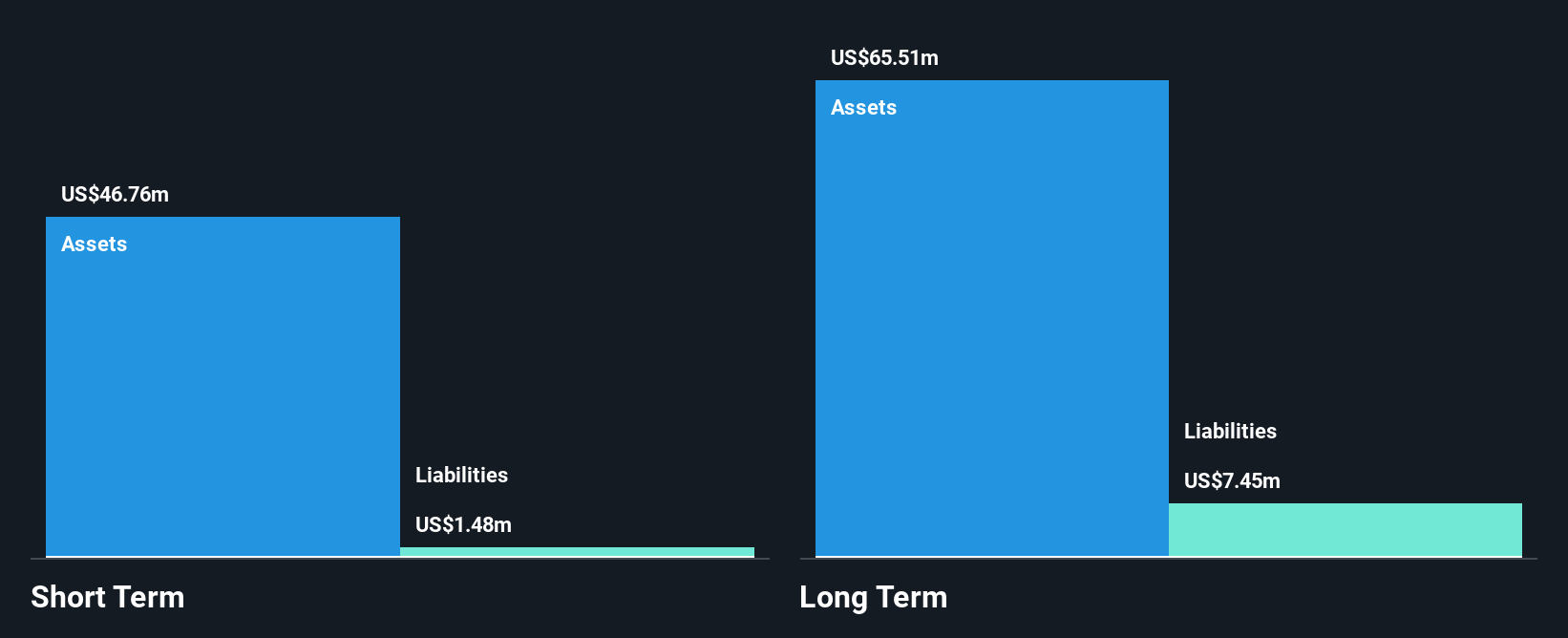

Base Carbon Inc. reported a significant improvement in its financial performance for the third quarter of 2025, with net income reaching US$1.61 million compared to US$0.061 million a year ago, despite a drop in nine-month revenue to US$1.81 million from US$23.55 million last year. The company is debt-free, with short-term assets of $46.4M comfortably covering both short and long-term liabilities totaling $8.9M combined, which indicates solid liquidity management for a penny stock despite ongoing unprofitability and negative return on equity at -13.83%. Management and board are experienced with average tenures over three years.

- Click to explore a detailed breakdown of our findings in Base Carbon's financial health report.

- Learn about Base Carbon's historical performance here.

AKITA Drilling (TSX:AKT.A)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: AKITA Drilling Ltd. operates as an oil and gas drilling contractor in Canada and the United States, with a market cap of CA$73.47 million.

Operations: The company generates revenue through its Contract Drilling Services segment, which amounted to CA$222.12 million.

Market Cap: CA$73.47M

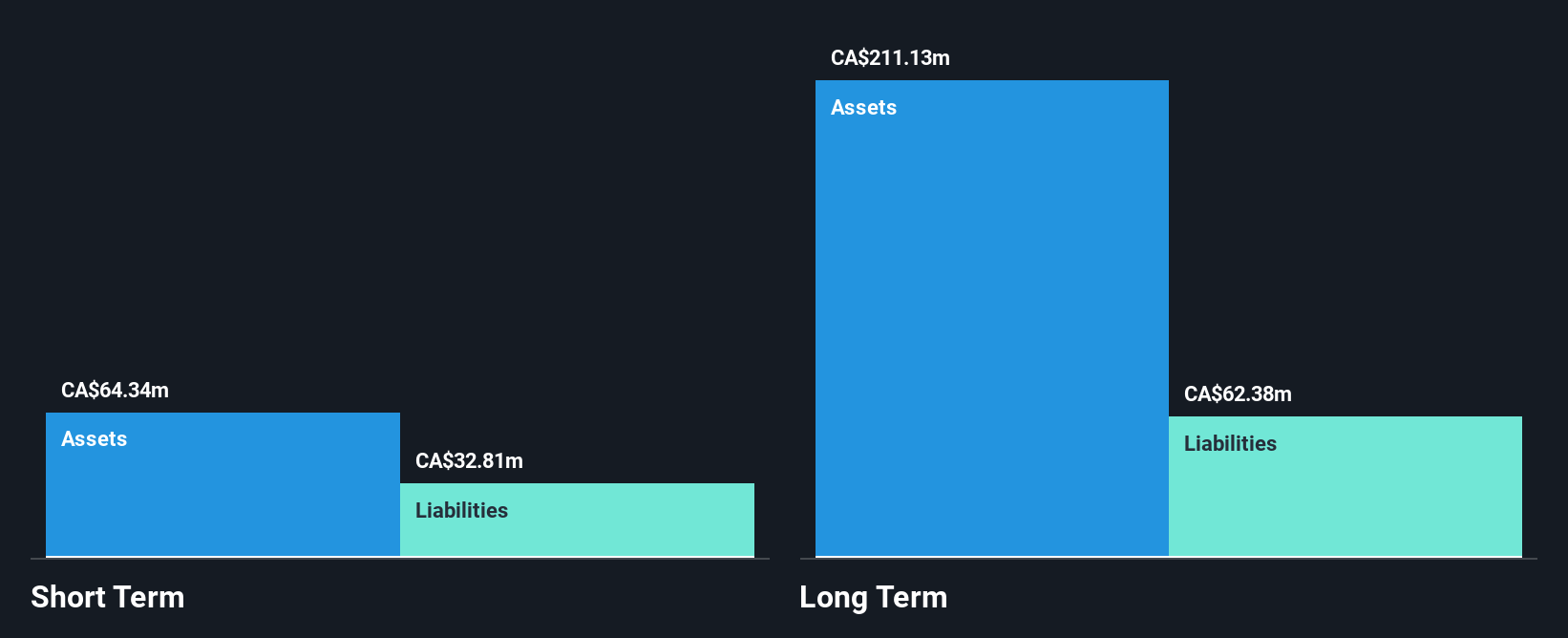

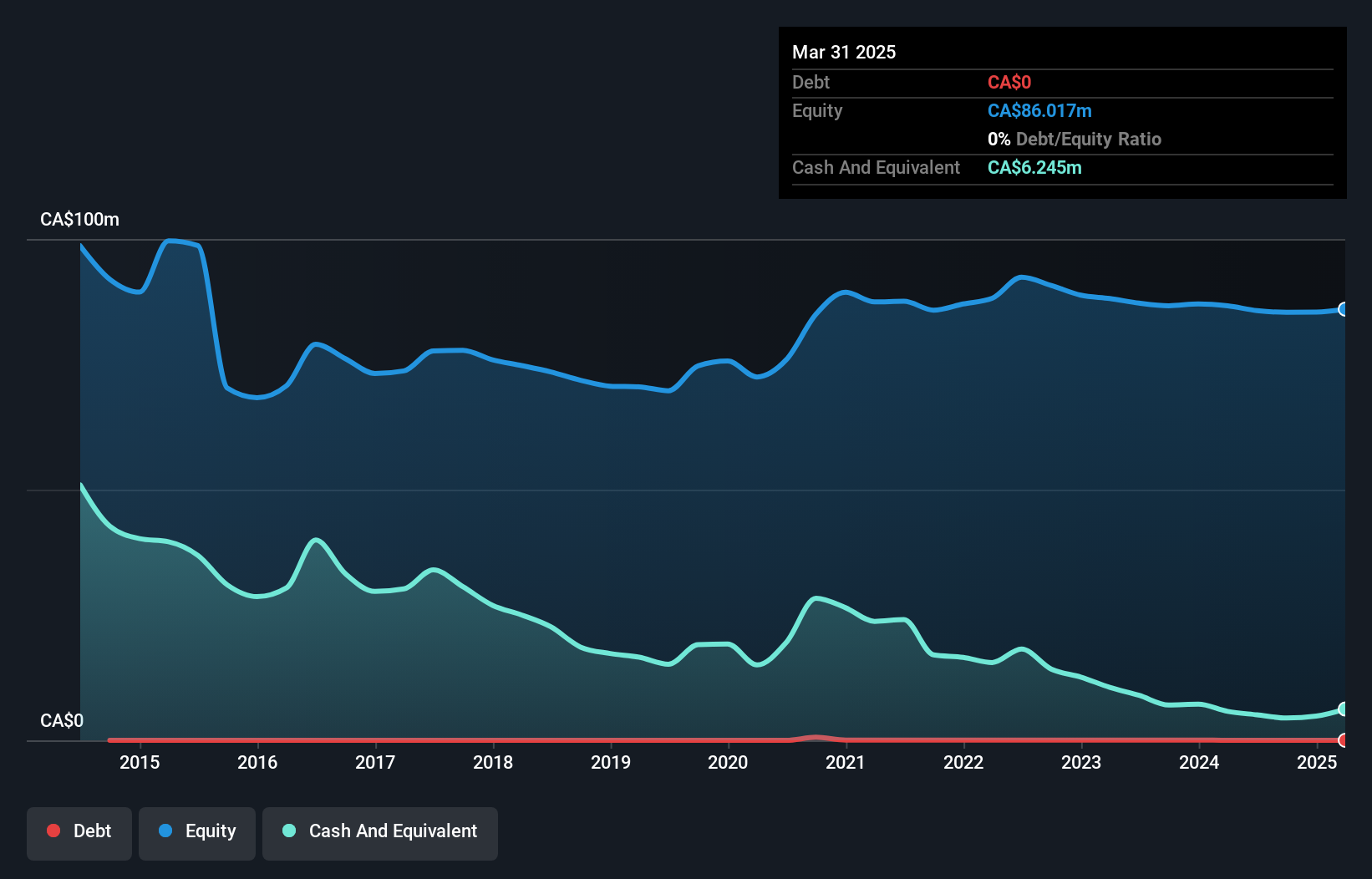

AKITA Drilling Ltd. has shown substantial financial improvement, with net income rising to CA$12.47 million for the first nine months of 2025 from CA$3.25 million a year ago, reflecting a significant earnings growth of 957.1% over the past year. The company's seasoned board and management team bring stability, while its short-term assets surpass short-term liabilities, although they fall short of covering long-term liabilities entirely. Debt levels are satisfactory with well-covered interest payments by EBIT and operating cash flow effectively managing debt obligations. Despite trading below estimated fair value, return on equity remains low at 12.1%.

- Jump into the full analysis health report here for a deeper understanding of AKITA Drilling.

- Gain insights into AKITA Drilling's future direction by reviewing our growth report.

Strategic Metals (TSXV:SMD)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Strategic Metals Ltd. is an exploration stage company focused on acquiring, exploring, and evaluating mineral properties in Canada, with a market cap of CA$28.29 million.

Operations: Strategic Metals Ltd. has not reported any specific revenue segments.

Market Cap: CA$28.29M

Strategic Metals Ltd., a pre-revenue exploration company, has shown improvement with a net income of CA$0.15 million in Q2 2025, reversing from a prior loss. The firm is debt-free and maintains robust short-term asset coverage over liabilities. Its experienced board and management team provide stability, while its cash runway extends beyond three years under current conditions. Despite past earnings volatility, the company recently completed a share buyback of 7.04 million shares for CA$1.23 million, indicating confidence in its financial strategy amidst ongoing challenges in achieving profitability due to its exploration stage status.

- Take a closer look at Strategic Metals' potential here in our financial health report.

- Review our historical performance report to gain insights into Strategic Metals' track record.

Taking Advantage

- Dive into all 403 of the TSX Penny Stocks we have identified here.

- Looking For Alternative Opportunities? Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:AKT.A

AKITA Drilling

Operates as an oil and gas drilling contractor in Canada and the United States.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success