Positive Sentiment Still Eludes Tornado Infrastructure Equipment Ltd. (CVE:TGH) Following 29% Share Price Slump

Tornado Infrastructure Equipment Ltd. (CVE:TGH) shareholders that were waiting for something to happen have been dealt a blow with a 29% share price drop in the last month. Looking at the bigger picture, even after this poor month the stock is up 54% in the last year.

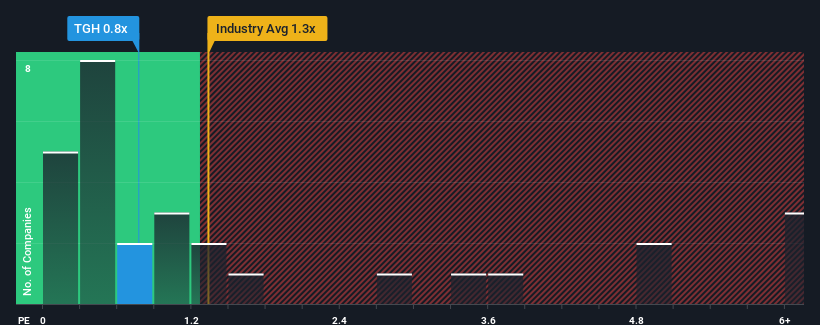

In spite of the heavy fall in price, there still wouldn't be many who think Tornado Infrastructure Equipment's price-to-sales (or "P/S") ratio of 0.8x is worth a mention when it essentially matches the median P/S in Canada's Machinery industry. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Check out our latest analysis for Tornado Infrastructure Equipment

What Does Tornado Infrastructure Equipment's P/S Mean For Shareholders?

Recent times have been advantageous for Tornado Infrastructure Equipment as its revenues have been rising faster than most other companies. Perhaps the market is expecting this level of performance to taper off, keeping the P/S from soaring. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Tornado Infrastructure Equipment.Do Revenue Forecasts Match The P/S Ratio?

The only time you'd be comfortable seeing a P/S like Tornado Infrastructure Equipment's is when the company's growth is tracking the industry closely.

If we review the last year of revenue growth, the company posted a terrific increase of 43%. Spectacularly, three year revenue growth has ballooned by several orders of magnitude, thanks in part to the last 12 months of revenue growth. So we can start by confirming that the company has done a tremendous job of growing revenue over that time.

Looking ahead now, revenue is anticipated to climb by 21% during the coming year according to the lone analyst following the company. That's shaping up to be materially higher than the 5.8% growth forecast for the broader industry.

With this information, we find it interesting that Tornado Infrastructure Equipment is trading at a fairly similar P/S compared to the industry. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

What We Can Learn From Tornado Infrastructure Equipment's P/S?

Following Tornado Infrastructure Equipment's share price tumble, its P/S is just clinging on to the industry median P/S. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Tornado Infrastructure Equipment currently trades on a lower than expected P/S since its forecasted revenue growth is higher than the wider industry. When we see a strong revenue outlook, with growth outpacing the industry, we can only assume potential uncertainty around these figures are what might be placing slight pressure on the P/S ratio. At least the risk of a price drop looks to be subdued, but investors seem to think future revenue could see some volatility.

You should always think about risks. Case in point, we've spotted 1 warning sign for Tornado Infrastructure Equipment you should be aware of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if Tornado Infrastructure Equipment might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSXV:TGH

Tornado Infrastructure Equipment

Through its subsidiaries, designs, fabricates, manufactures, and sells hydrovac trucks in North America.

Proven track record with adequate balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success