3 TSX Penny Stocks With Market Caps Under CA$300M To Consider

Reviewed by Simply Wall St

The Canadian stock market has recently seen its large-cap stocks reach new all-time highs, contrasting with the volatility experienced by U.S. markets amid ongoing trade policy uncertainties and inflation concerns. Amidst these broader economic conditions, investors might find opportunities in penny stocks, which despite their somewhat outdated label, continue to offer intriguing investment prospects. Typically representing smaller or newer companies, penny stocks can provide a blend of affordability and growth potential when supported by strong financials; this article will explore three such promising Canadian options.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Rewards & Risks |

| Westbridge Renewable Energy (TSXV:WEB) | CA$0.79 | CA$79.91M | ✅ 3 ⚠️ 3 View Analysis > |

| NTG Clarity Networks (TSXV:NCI) | CA$2.17 | CA$91.82M | ✅ 4 ⚠️ 2 View Analysis > |

| Intermap Technologies (TSX:IMP) | CA$2.38 | CA$136.04M | ✅ 3 ⚠️ 2 View Analysis > |

| Silvercorp Metals (TSX:SVM) | CA$4.98 | CA$1.08B | ✅ 5 ⚠️ 2 View Analysis > |

| Orezone Gold (TSX:ORE) | CA$1.02 | CA$537.5M | ✅ 4 ⚠️ 2 View Analysis > |

| McChip Resources (TSXV:MCS) | CA$0.63 | CA$3.6M | ✅ 2 ⚠️ 5 View Analysis > |

| PetroTal (TSX:TAL) | CA$0.59 | CA$539.91M | ✅ 3 ⚠️ 3 View Analysis > |

| Pulse Seismic (TSX:PSD) | CA$2.61 | CA$132.47M | ✅ 1 ⚠️ 2 View Analysis > |

| Findev (TSXV:FDI) | CA$0.45 | CA$12.89M | ✅ 2 ⚠️ 3 View Analysis > |

| BluMetric Environmental (TSXV:BLM) | CA$1.43 | CA$52.89M | ✅ 2 ⚠️ 4 View Analysis > |

Click here to see the full list of 905 stocks from our TSX Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

High Tide (TSXV:HITI)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: High Tide Inc. operates in the cannabis retail sector across Canada, the United States, and internationally, with a market cap of CA$269.53 million.

Operations: The company generates revenue through two main segments: E-commerce, which accounts for CA$32.24 million, and Bricks and Mortar, contributing CA$504.46 million.

Market Cap: CA$269.53M

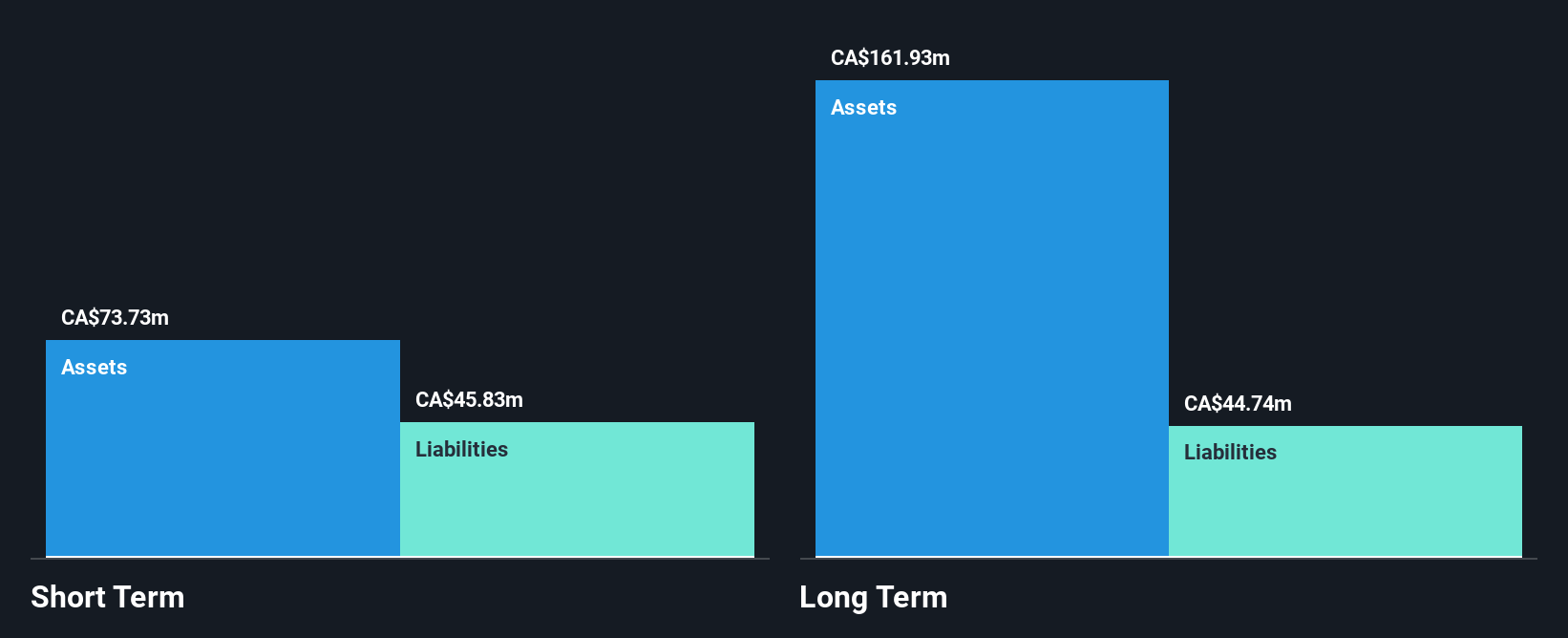

High Tide Inc. is expanding its retail footprint, recently opening multiple Canna Cabana locations across Canada, bringing the total to 199 stores. Despite being unprofitable with a negative return on equity of -4.48%, the company has a promising cash runway exceeding three years due to positive free cash flow growth. It has reduced its debt significantly over five years and maintains more cash than total debt, indicating financial prudence. The management team and board are experienced, contributing to strategic growth in areas with limited competition and high potential for market capture in both Canadian and international markets like Germany.

- Jump into the full analysis health report here for a deeper understanding of High Tide.

- Gain insights into High Tide's future direction by reviewing our growth report.

NEO Battery Materials (TSXV:NBM)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: NEO Battery Materials Ltd. is a Canadian company specializing in the production of silicon anode materials for lithium-ion batteries used in electric vehicles, electronics, and energy storage systems, with a market cap of CA$82.22 million.

Operations: NEO Battery Materials Ltd. does not have any reported revenue segments.

Market Cap: CA$82.22M

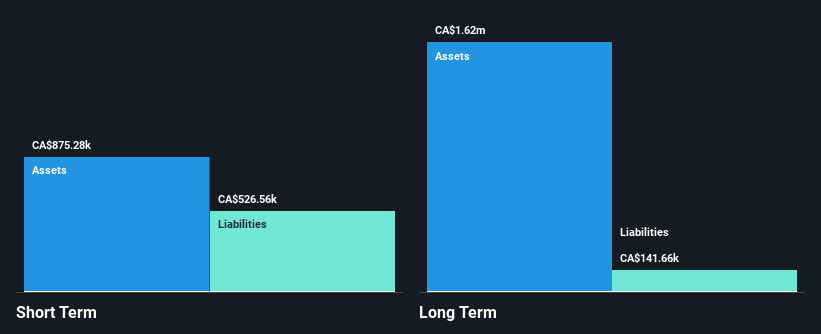

NEO Battery Materials Ltd. is a pre-revenue company focused on silicon anode materials, with recent strategic appointments enhancing its advisory and board capabilities. The addition of Dr. Matthew Dawson to the Scientific Advisory Board and Mr. Kenneth Hoffman to the Board of Directors aims to leverage their extensive industry experience for technological advancement and market expansion. Despite having no debt, NEO faces financial constraints with less than a year of cash runway and high share price volatility. Recent product developments like the NBMSiDE P-300N prototype highlight potential in battery technology, but commercialization remains crucial for future growth prospects.

- Click to explore a detailed breakdown of our findings in NEO Battery Materials' financial health report.

- Understand NEO Battery Materials' track record by examining our performance history report.

Northern Superior Resources (TSXV:SUP)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Northern Superior Resources Inc. is a junior mining company focused on the exploration and development of gold properties in Canada, with a market cap of CA$90.96 million.

Operations: Northern Superior Resources Inc. does not report any revenue segments.

Market Cap: CA$90.96M

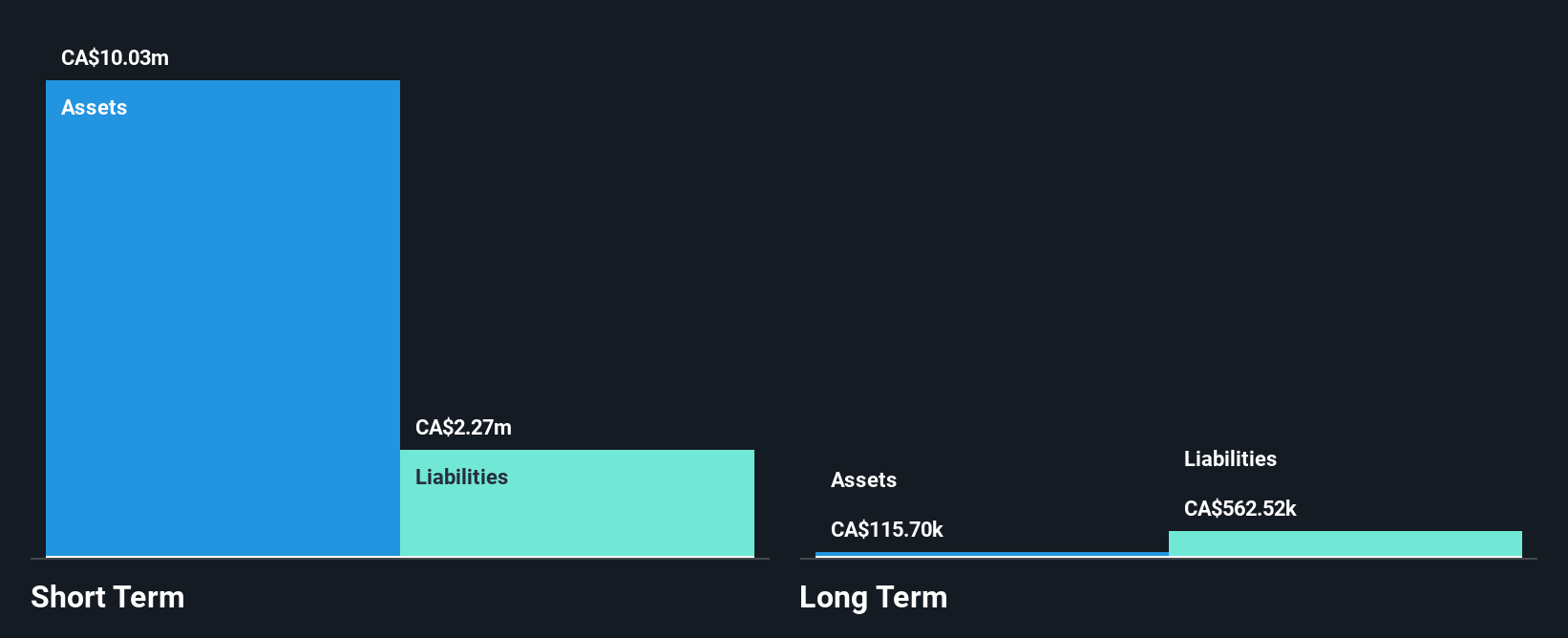

Northern Superior Resources Inc., a pre-revenue junior mining company, has recently reported promising results from its expansion drilling campaign at the Philibert gold property, revealing significant mineralization and high-grade discoveries. These findings enhance the potential for resource growth beyond the current estimates of 1.71 million ounces inferred and 279,000 ounces indicated. Despite being unprofitable with increasing losses over five years, Northern Superior is debt-free and maintains a stable cash runway exceeding one year. The company's management team is experienced but faces challenges in translating exploration success into financial stability amidst volatile share performance.

- Click here and access our complete financial health analysis report to understand the dynamics of Northern Superior Resources.

- Assess Northern Superior Resources' previous results with our detailed historical performance reports.

Where To Now?

- Click through to start exploring the rest of the 902 TSX Penny Stocks now.

- Ready To Venture Into Other Investment Styles? Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if High Tide might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:HITI

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives