- Canada

- /

- Metals and Mining

- /

- CNSX:LEO

TSX Opportunities: Lion Copper and Gold Among 3 Promising Penny Stocks

Reviewed by Simply Wall St

As October wrapped up, Canadian markets remained resilient, brushing off potential disruptions and closing near record highs despite a more cautious stance from central banks and mixed corporate earnings. In these conditions, investors often turn their attention to penny stocks, a term that may feel outdated but still represents significant opportunities in the investment landscape. These smaller or newer companies can offer growth potential at lower price points, especially when they possess strong financials and solid fundamentals.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Rewards & Risks |

| Westbridge Renewable Energy (TSXV:WEB) | CA$2.26 | CA$58.9M | ✅ 3 ⚠️ 4 View Analysis > |

| Canso Select Opportunities (TSXV:CSOC.A) | CA$4.50 | CA$22.73M | ✅ 2 ⚠️ 2 View Analysis > |

| Zoomd Technologies (TSXV:ZOMD) | CA$2.22 | CA$236.76M | ✅ 4 ⚠️ 1 View Analysis > |

| Montero Mining and Exploration (TSXV:MON) | CA$0.425 | CA$3.55M | ✅ 2 ⚠️ 4 View Analysis > |

| Thor Explorations (TSXV:THX) | CA$1.03 | CA$671.95M | ✅ 3 ⚠️ 2 View Analysis > |

| Automotive Finco (TSXV:AFCC.H) | CA$1.08 | CA$20.61M | ✅ 2 ⚠️ 3 View Analysis > |

| Rio2 (TSX:RIO) | CA$2.16 | CA$936.88M | ✅ 4 ⚠️ 3 View Analysis > |

| Pulse Seismic (TSX:PSD) | CA$2.86 | CA$148.2M | ✅ 2 ⚠️ 1 View Analysis > |

| Hemisphere Energy (TSXV:HME) | CA$2.06 | CA$196.03M | ✅ 3 ⚠️ 2 View Analysis > |

| Matachewan Consolidated Mines (TSXV:MCM.A) | CA$0.73 | CA$9.08M | ✅ 2 ⚠️ 4 View Analysis > |

Click here to see the full list of 412 stocks from our TSX Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

Lion Copper and Gold (CNSX:LEO)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Lion Copper and Gold Corp. is a mineral exploration company focused on acquiring, exploring, and developing copper projects in the United States, with a market cap of CA$57.85 million.

Operations: Lion Copper and Gold Corp. has not reported any revenue segments.

Market Cap: CA$57.85M

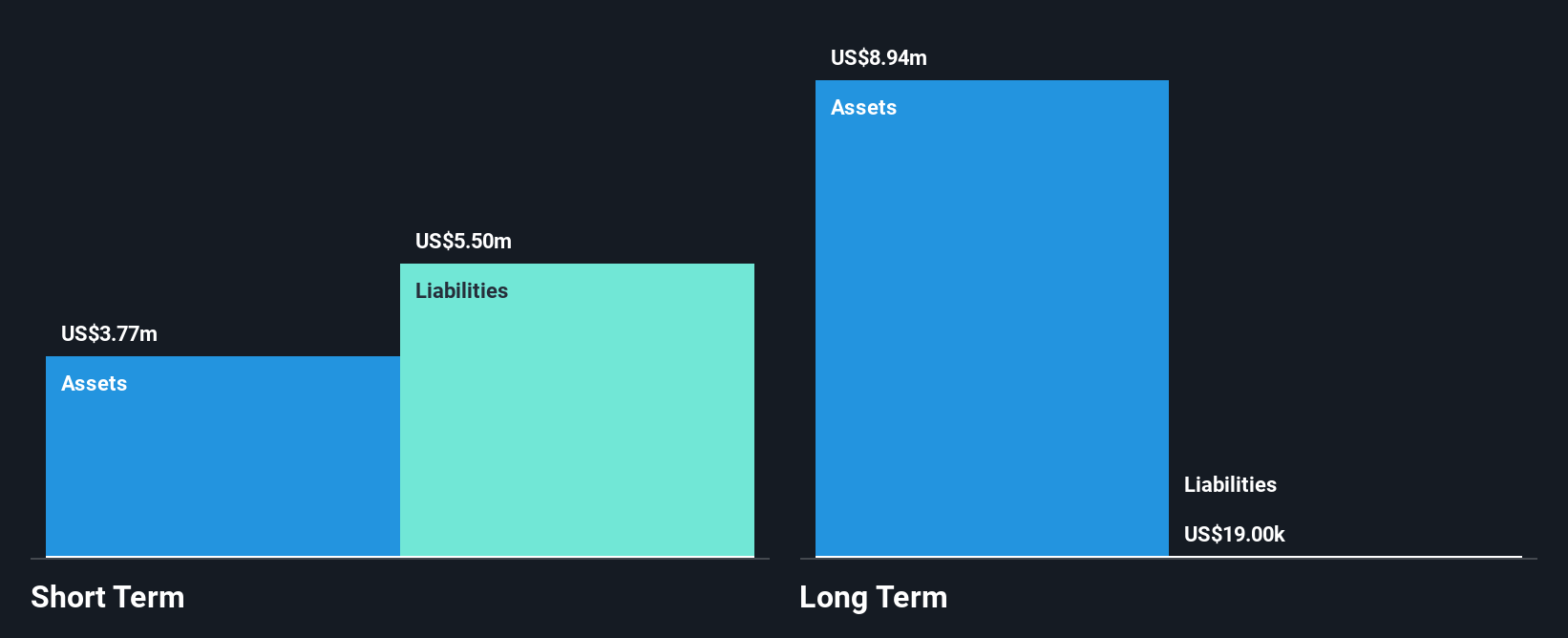

Lion Copper and Gold Corp., with a market cap of CA$57.85 million, is pre-revenue and focuses on copper projects in the U.S. Recent activities include a non-brokered private placement to raise $2.5 million through convertible debentures, highlighting its need for capital to sustain operations as it forecasts only 4-7 months of cash runway based on current free cash flow estimates. The company also filed a Pre-Feasibility Study for its Yerington Copper Project, indicating potential for significant production but remains unprofitable with increasing losses over recent years and short-term liabilities exceeding assets by $1.7 million.

- Take a closer look at Lion Copper and Gold's potential here in our financial health report.

- Gain insights into Lion Copper and Gold's past trends and performance with our report on the company's historical track record.

Cronos Group (TSX:CRON)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Cronos Group Inc. is a cannabinoid company involved in the cultivation, production, distribution, and marketing of cannabis products across Canada, Israel, and internationally with a market cap of CA$1.33 billion.

Operations: Cronos Group Inc. has not reported any specific revenue segments.

Market Cap: CA$1.33B

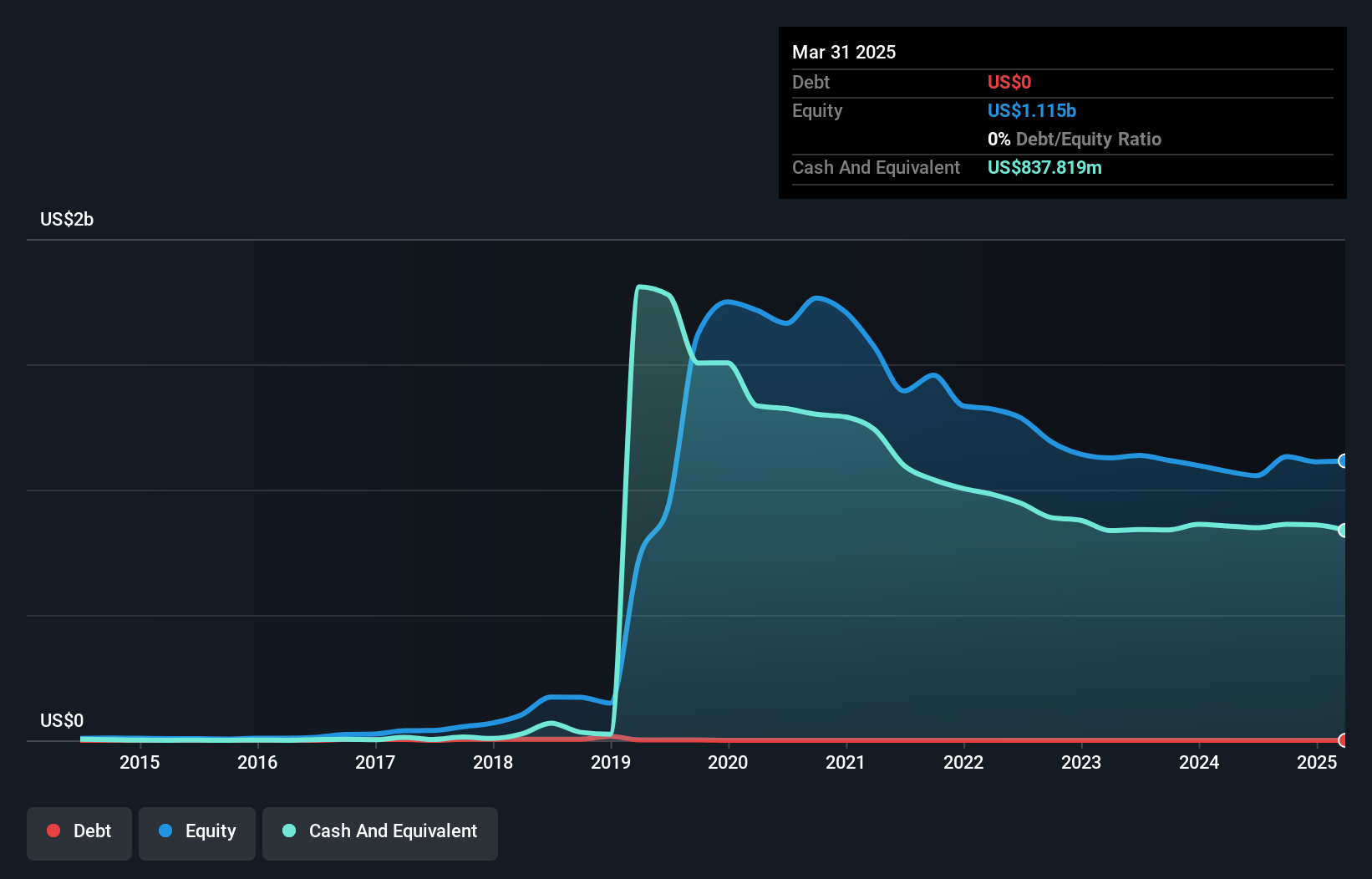

Cronos Group Inc., with a market cap of CA$1.33 billion, has shown financial stability by maintaining short-term assets of $922.2 million, which comfortably cover its liabilities. The company recently reported third-quarter earnings with net income rising to US$25.96 million from US$8.35 million the previous year, reflecting improved profitability despite a large one-off loss impacting results over the past 12 months. Cronos remains debt-free and has not diluted shareholders in the past year, though its return on equity is low at 3.7%. Recent product launches include seasonal edibles that may enhance revenue streams across Canada.

- Click here to discover the nuances of Cronos Group with our detailed analytical financial health report.

- Evaluate Cronos Group's prospects by accessing our earnings growth report.

EnWave (TSXV:ENW)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: EnWave Corporation designs, constructs, markets, and sells vacuum-microwave dehydration machinery for the food, cannabis, and biomaterial industries in Canada, the United States, and internationally with a market cap of CA$42.14 million.

Operations: No specific revenue segments are reported for the company.

Market Cap: CA$42.14M

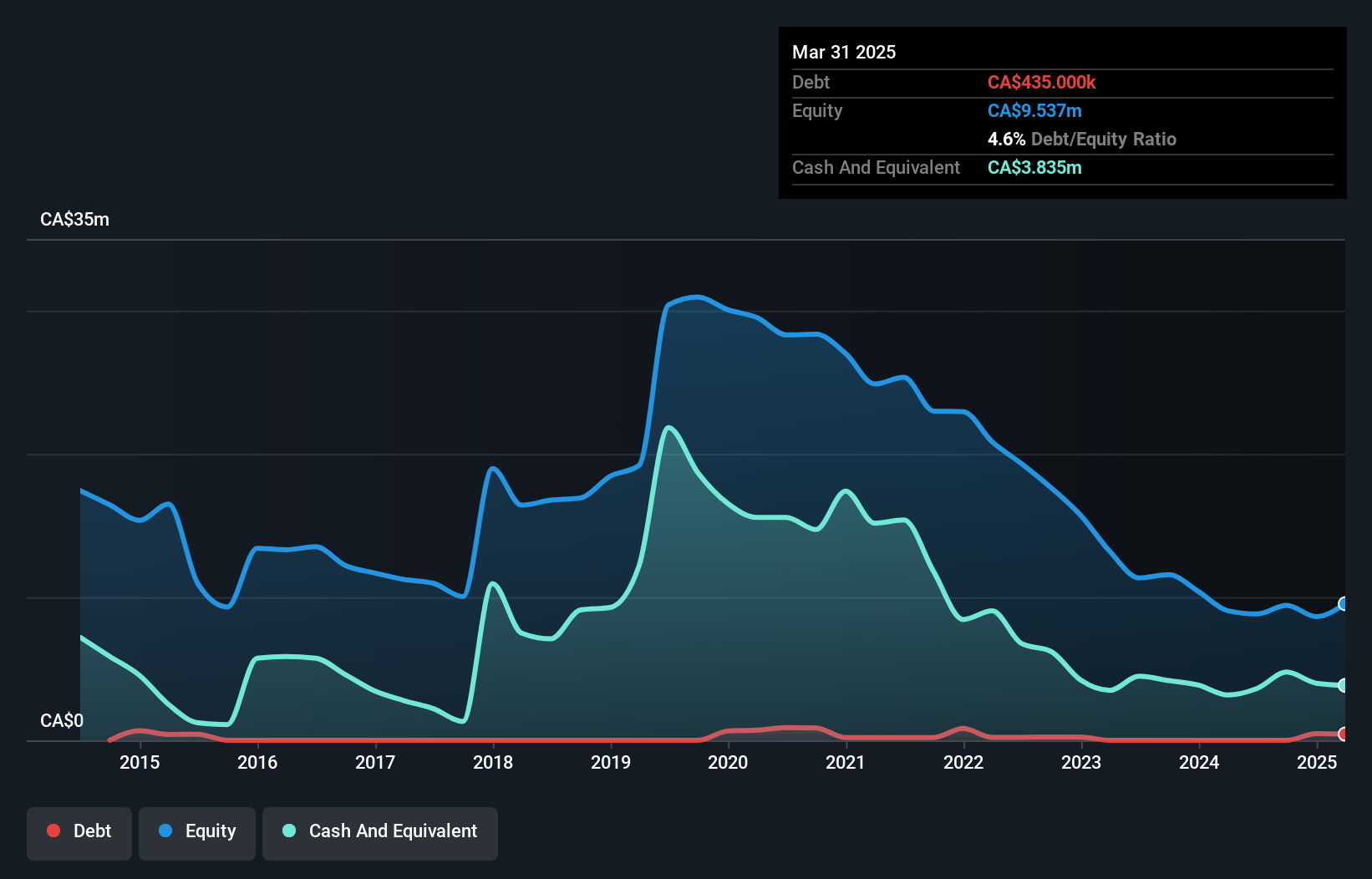

EnWave Corporation, with a market cap of CA$42.14 million, has been actively expanding its commercial reach through strategic licensing agreements and equipment sales. Recent collaborations include a royalty-bearing license with Solve Solutions Ltda in Brazil and an exclusive global dragon fruit production license with BranchOut Food Inc. Despite being unprofitable, EnWave has reduced losses by 18% annually over the past five years and maintains a robust cash position exceeding its debt, ensuring more than three years of operational runway. The management team is experienced, further bolstering investor confidence in navigating the company's growth trajectory.

- Unlock comprehensive insights into our analysis of EnWave stock in this financial health report.

- Review our growth performance report to gain insights into EnWave's future.

Key Takeaways

- Click this link to deep-dive into the 412 companies within our TSX Penny Stocks screener.

- Seeking Other Investments? Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About CNSX:LEO

Lion Copper and Gold

A mineral exploration company, engages in the acquisition, exploration, and development of copper projects in the United States.

Adequate balance sheet with low risk.

Market Insights

Community Narratives