- Canada

- /

- Industrials

- /

- TSXV:DE

Decisive Dividend (TSXV:DE): One-Off CA$3.3M Loss Renews Dividend Stability Concerns

Reviewed by Simply Wall St

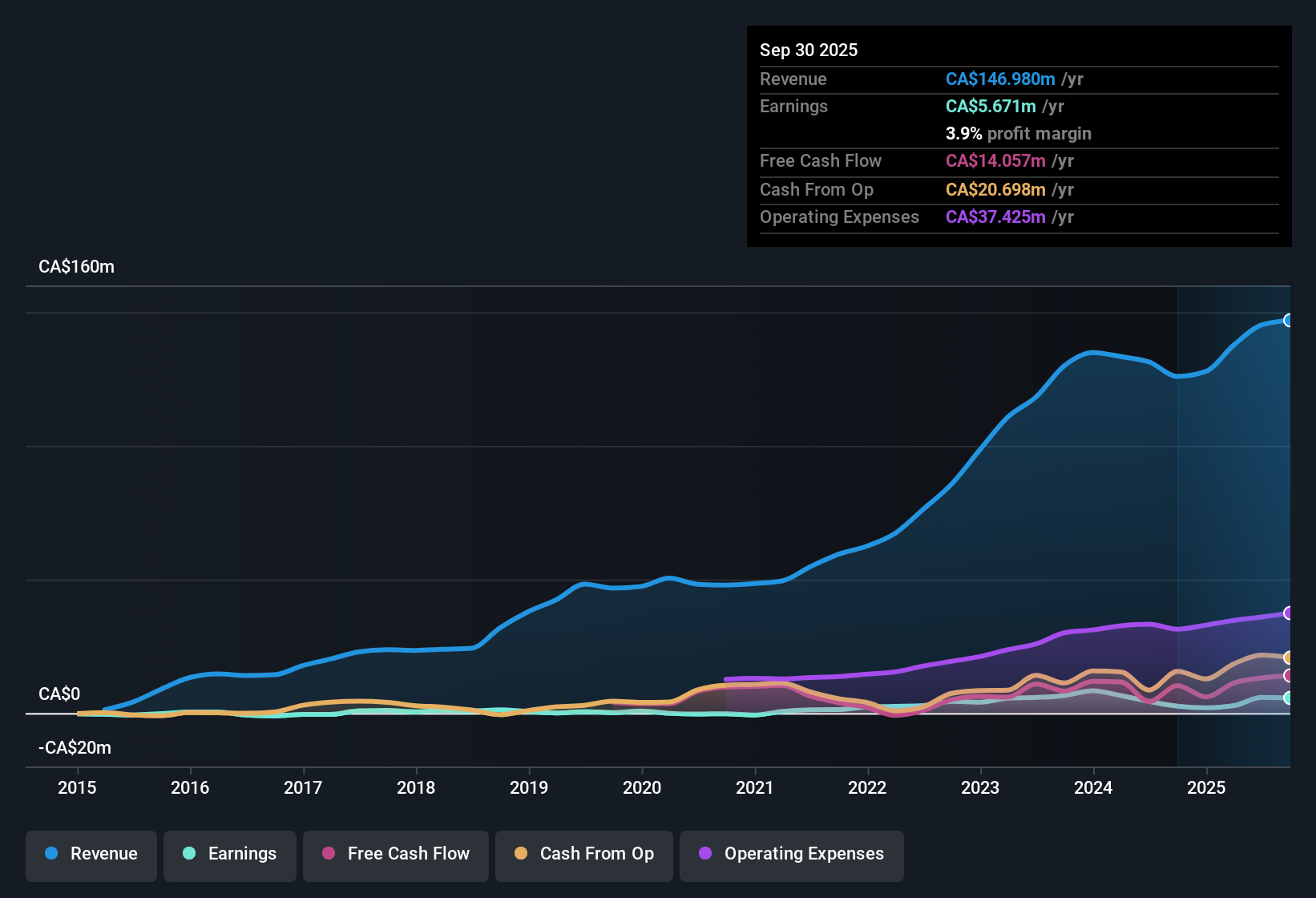

Decisive Dividend (TSXV:DE) posted revenue forecast growth of 6.38% per year, outpacing the Canadian market’s expected 5.1% rate. EPS surged with a 34% increase in earnings over the past year, and the company’s five-year annual earnings growth stands at 29.9%. Net profit margins moved up to 4% from 3.3%, despite a one-off loss of CA$3.3 million weighing on the latest results. For investors, the consistent profit growth and improving margins set up a nuanced picture as the market now weighs whether these trends can outlast recent setbacks.

See our full analysis for Decisive Dividend.The next section puts these numbers side by side with some of the most widely held market narratives, digging into where sentiment matches up and where the story could shift.

See what the community is saying about Decisive Dividend

Margin Expansion: Analysts See 4.0% Rising to 9.7%

- Consensus forecasts show net profit margins climbing substantially from today’s 4.0% to 9.7% in three years, suggesting core operations are expected to become markedly more profitable if these expectations are met.

- Analysts' consensus view points to several levers driving this margin boost:

- Growing demand for modernization and skilled labor shortages are expected to push more customers toward Decisive Dividend’s higher-margin outsourced manufacturing, supporting these optimistic projections.

- Cross-selling and product innovation, especially in sectors aiming for energy efficiency, are anticipated to shift the sales mix toward higher-margin offerings and accelerate consolidated profitability.

- To see why analysts think margins can nearly double, and which numbers justify their optimism, check out the latest consensus narrative for Decisive Dividend. 📊 Read the full Decisive Dividend Consensus Narrative.

Share Price Lags 20% Below Analyst Target

- At CA$7.51, Decisive Dividend trades about 20% below the analyst consensus price target of CA$9.81. This raises the question of whether the market is discounting its future upside or pricing in real risks.

- Analysts' consensus view weighs both sides of the value gap:

- The stock’s discount to target hinges on analysts’ expectation that revenues will rise to CA$186.4 million and earnings to CA$18.1 million by 2028. These are ambitious numbers that the company will need to deliver on to justify the gap.

- Still, the price-to-earnings ratio sits well above both the global industrials average (25.7x vs 13.6x). This indicates that despite the headline discount, investors may already be factoring in rich future performance and see some risk in the outlook.

One-off CA$3.3 Million Loss Clouds Dividend Reliability

- An exceptional loss of CA$3.3 million weighed on recent results, casting fresh attention on dividend sustainability after payout reliability was flagged as a potential risk in the latest analysis.

- Analysts' consensus view cautions that:

- Dependency on acquisition-led growth, exposure to U.S. market swings, and rising wage pressures could compound the negative impact of irregular losses, tightening free cash flow and making future dividend stability less certain.

- The market will be watching whether integration of recent acquisitions and execution on margin expansion can offset these risks, helping reinforce or undermine confidence in steady dividend payouts.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Decisive Dividend on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Got your own take on the numbers? In just a few minutes, you can shape your unique viewpoint and share your narrative. Do it your way

A great starting point for your Decisive Dividend research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

See What Else Is Out There

While Decisive Dividend shows solid top-line growth, concerns remain about dividend reliability due to one-off losses and variable cash flows. These factors could threaten payout stability.

Looking for stronger income security? Check out these 1979 dividend stocks with yields > 3% to discover companies delivering consistent, reliable yields backed by healthier financials.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:DE

Decisive Dividend

Through its subsidiaries, manufactures and sells wood burning stoves, fireplace inserts, and fireplaces in Canada, the United States, and internationally.

Proven track record average dividend payer.

Market Insights

Community Narratives