- Canada

- /

- Trade Distributors

- /

- TSX:TIH

Toromont Industries (TSX:TIH) Explores M&A Opportunities and Reports Q3 Earnings Decline

Reviewed by Simply Wall St

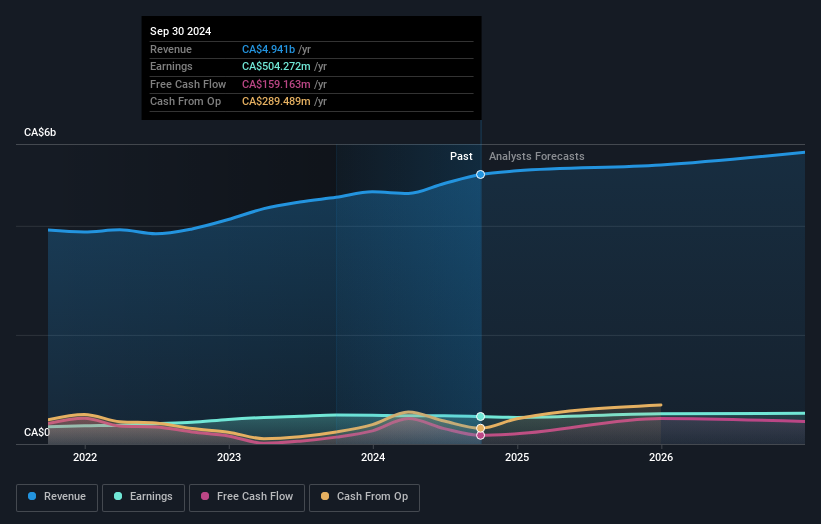

Toromont Industries (TSX:TIH) is actively seeking acquisition and investment opportunities to bolster its growth, particularly in the U.S. and Canadian markets, as emphasized by CFO John Doolittle during the recent earnings call. Despite reporting a decrease in net income for Q3 2024, the company maintains a strong financial position with stable dividends and a strategic focus on organic and inorganic expansion. In the following discussion, we will explore Toromont's competitive advantages, growth strategies, challenges, and the impact of its financial health on future prospects.

Take a closer look at Toromont Industries's potential here.

Competitive Advantages That Elevate Toromont Industries

High-quality past earnings and a solid financial health position underscore the company's competitive edge. With more cash than total debt and earning more interest than it pays, Toromont Industries maintains a strong financial footing. Dividends have remained stable over the past decade, supported by a low payout ratio of 30.5%, ensuring shareholder confidence. The leadership's focus on product innovation and strategic partnerships has bolstered market presence, as highlighted by John Doolittle, CEO, during the latest earnings call. Furthermore, the company's Price-To-Earnings Ratio of 19.4x, though above the SWS fair ratio, reflects its market strength and growth potential. Learn about Toromont Industries's dividend strategy and how it impacts shareholder returns and financial stability.

Critical Issues Affecting the Performance of Toromont Industries and Areas for Growth

Current challenges include lower net profit margins at 10.2%, down from 11.8% last year, and a 5.4% decline in earnings growth over the past year. Return on equity is 17.4%, falling short of the 20% benchmark, and revenue growth of 3.1% lags behind the Canadian market's 6.9%. These financial metrics indicate areas needing improvement. The company's trading above its estimated fair value of CA$86.34 suggests a potential misalignment with industry standards. Explore the current health of Toromont Industries and how it reflects on its financial stability and growth potential.

Potential Strategies for Leveraging Growth and Competitive Advantage

Opportunities abound with potential revenue and profit growth aligning more closely with market averages. The company's cash runway supports future expansion, particularly in international markets, as noted by John Doolittle in the recent earnings call. Strategic alliances and digital transformation initiatives are poised to enhance operational efficiency and customer engagement. These efforts align with industry trends, presenting significant growth avenues. See what the latest analyst reports say about Toromont Industries's future prospects and potential market movements.

Key Risks and Challenges That Could Impact Toromont Industries's Success

Economic headwinds and supply chain vulnerabilities pose significant risks. The company is actively addressing these issues, as highlighted by Michael Stanley McMillan, CFO. Additionally, regulatory hurdles could impact operations, requiring careful navigation to avoid compliance pitfalls. Insider selling over the past three months may signal concerns about future performance. To gain deeper insights into Toromont Industries's historical performance, explore our detailed analysis of past performance.

See what the latest analyst reports say about Toromont Industries's future prospects and potential market movements.Conclusion

Toromont Industries stands on a solid financial foundation, with a healthy cash position and stable dividends, reflecting its ability to sustain shareholder confidence. However, the company's current performance metrics, such as declining profit margins and earnings growth, indicate areas that require strategic focus to align more closely with industry standards. While its Price-To-Earnings Ratio of 19.4x suggests a premium valuation, this could be justified by its potential for growth through international expansion and digital transformation initiatives. Nonetheless, economic and regulatory challenges, alongside insider selling, highlight the need for cautious optimism regarding future performance, as these factors could impact the company's ability to achieve its growth objectives.

Summing It All Up

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

Valuation is complex, but we're here to simplify it.

Discover if Toromont Industries might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Simply Wall St and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

About TSX:TIH

Toromont Industries

Provides specialized capital equipment in Canada, the United States, and internationally.

Flawless balance sheet second-rate dividend payer.