- Canada

- /

- Trade Distributors

- /

- TSX:TIH

Does Toromont Industries' (TSX:TIH) Dividend Steadiness Reflect Enduring Financial Strength?

Reviewed by Sasha Jovanovic

- Toromont Industries Ltd. recently announced its third quarter 2025 results, reporting net income of C$140.62 million and diluted earnings per share of C$1.72, even as sales experienced a slight year-over-year decrease to C$1.31 billion.

- Alongside profitability gains, the company's Board affirmed its regular quarterly dividend of C$0.52 per share, highlighting ongoing confidence in Toromont's financial resilience.

- We’ll explore how Toromont’s robust earnings growth and sustained dividend reinforce its investment narrative and outlook for stable returns.

AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Toromont Industries Investment Narrative Recap

To be a Toromont Industries shareholder, you need to believe in the company's ability to benefit from the capital equipment demand cycle, harness its strong market presence in construction and data center infrastructure, and maintain resilient profitability through economic swings. The recent Q3 2025 results show improved earnings on stable sales, which does little to change the core short-term catalyst, sustained data center expansion and backlog execution, or the main risk coming from ongoing margin pressures caused by higher operating costs and potential volatility in customer demand.

Of the recent announcements, the Board’s reaffirmation of the regular quarterly dividend stands out in the context of these results. This decision reinforces management's confidence, even amidst sales softness and persistent inflation, by signalling the business's capacity to generate stable cash flows and provide consistent shareholder returns.

Yet, investors should be alert: despite these positives, pressures on margins and inflation-driven costs may still weigh heavily if...

Read the full narrative on Toromont Industries (it's free!)

Toromont Industries' narrative projects CA$5.9 billion in revenue and CA$626.8 million in earnings by 2028. This requires 4.8% yearly revenue growth and a CA$140.8 million earnings increase from the current CA$486.0 million.

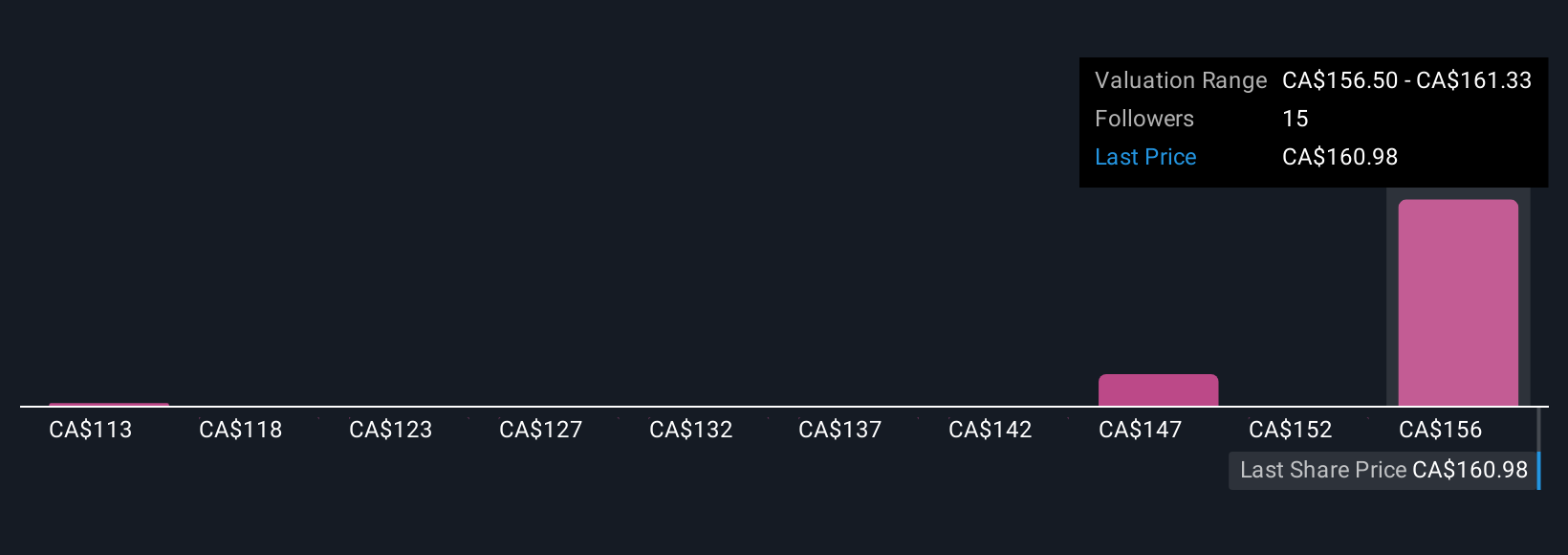

Uncover how Toromont Industries' forecasts yield a CA$161.33 fair value, a 4% downside to its current price.

Exploring Other Perspectives

Three Simply Wall St Community members estimate Toromont’s fair value between C$113 and C$161.33 per share. Opinions vary, and with margin pressure an ongoing risk for profitability, consider how different assumptions can lead to widely different outlooks on the company’s path.

Explore 3 other fair value estimates on Toromont Industries - why the stock might be worth 33% less than the current price!

Build Your Own Toromont Industries Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Toromont Industries research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

- Our free Toromont Industries research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Toromont Industries' overall financial health at a glance.

Searching For A Fresh Perspective?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Find companies with promising cash flow potential yet trading below their fair value.

- We've found 23 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Rare earth metals are the new gold rush. Find out which 37 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Toromont Industries might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:TIH

Toromont Industries

Provides specialized capital equipment in Canada, the United States, and internationally.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives