- Canada

- /

- Aerospace & Defense

- /

- TSX:MDA

MDA Space (TSX:MDA) Valuation in Focus After Leadership Change and Echostar Contract Update

Reviewed by Simply Wall St

Most Popular Narrative: 25.2% Undervalued

According to the most widely followed investor narrative, MDA Space is currently trading at a significant discount to its calculated fair value. This perspective sees the company's future cash flows and growth potential as setting the stage for further upside.

- The space industry is currently experiencing strong growth and is expected to grow by an average of 9% per year until 2035. MDA Space can benefit greatly from the tailwind of the industry because they offer a wide product range that includes LEO and MEO satellites, space robots, and space rovers.

Curious what puts MDA Space in the spotlight as a standout value? The most compelling part of this narrative is a set of bold financial forecasts and profit assumptions that hint at a future more ambitious than what most expect. Interested in discovering the disruptive drivers and the growth factors behind such a large gap to fair value? This is the story that has investors buzzing.

Result: Fair Value of $44.08 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, risks such as heavy reliance on government contracts and potential delays to the Artemis mission could quickly shift the trajectory of MDA Space’s valuation.

Find out about the key risks to this MDA Space narrative.Another View: What About Its Market Valuation?

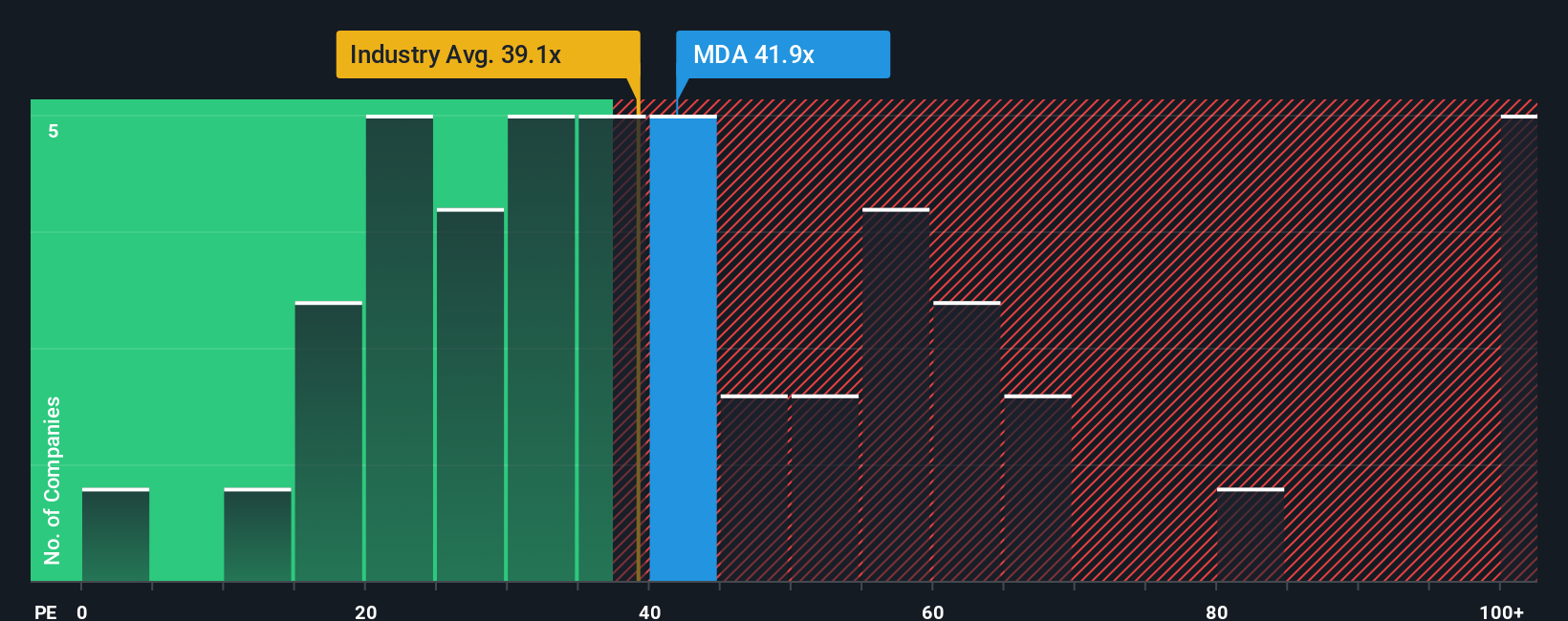

While some see MDA Space as undervalued based on fair value estimates, a look at its market valuation tells a different story. Compared to the broader industry, the stock trades at a richer valuation, which raises questions.

See what the numbers say about this price — find out in our valuation breakdown.

Stay updated when valuation signals shift by adding MDA Space to your watchlist or portfolio. Alternatively, explore our screener to discover other companies that fit your criteria.

Build Your Own MDA Space Narrative

If you have a different outlook or prefer to dig into the numbers on your own, you can easily shape your own perspective in just a few minutes with Do it your way.

A great starting point for your MDA Space research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors broaden their horizons, and you have the chance to uncover standout opportunities across the market. Don’t sit back while others spot tomorrow’s winners first.

- Tap into growth potential by targeting small-caps with momentum using our penny stocks with strong financials.

- Capture future-defining innovation by connecting with leading-edge technology firms through our AI penny stocks.

- Unlock consistent returns by evaluating income-focused opportunities in our curated list of dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About TSX:MDA

MDA Space

Provides space technology solutions and in Canada, the United States, Europe, Asia, the Middle East, and internationally.

Solid track record and good value.

Similar Companies

Market Insights

Community Narratives